Introduction to Possible: Fast Cash & Credit

Are you searching for a reliable financial app that offers quick access to cash and helps improve your credit? Possible is designed to be your personal financial partner, providing fast, simple, and transparent credit solutions tailored for hardworking Americans. Whether you're facing an unexpected expense or looking to build your credit profile, this app delivers fast approvals and flexible repayment options, all while avoiding traditional long-term debt traps.

Key Features of Possible: Fast Cash & Credit

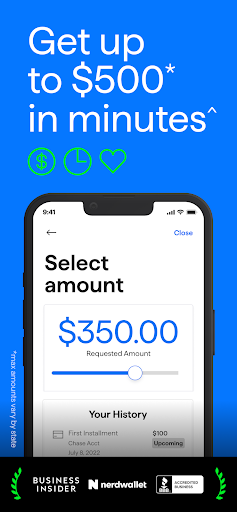

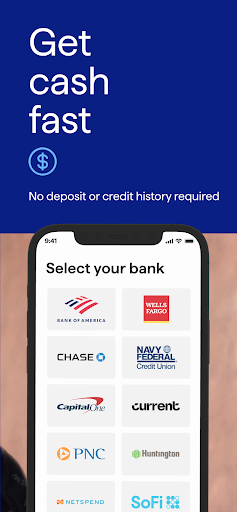

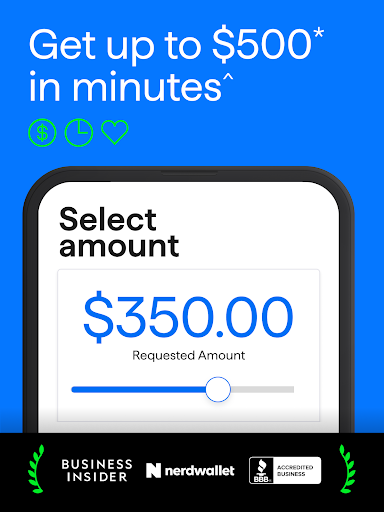

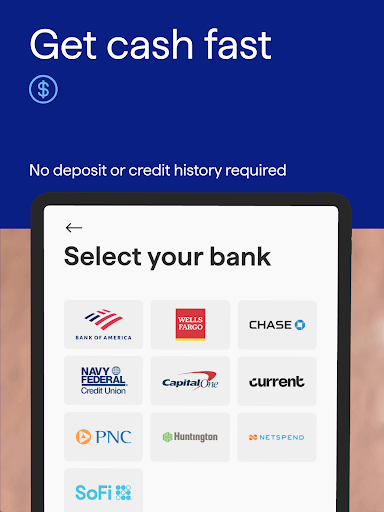

Seamless Access to Cash

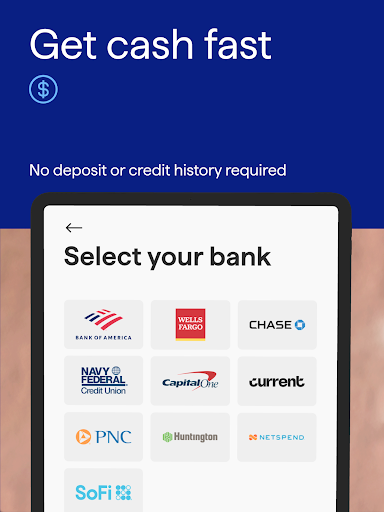

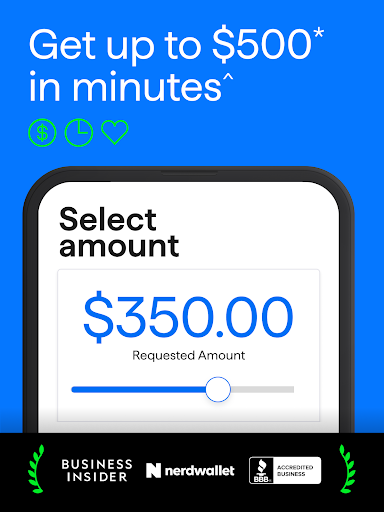

One of the standout features of Possible is its ability to provide instant •Fast Cash:cash advances. If you're caught in a financial pinch—say, your card gets declined at the store—this app enables you to request a cash advance and receive funds within minutes. The process is straightforward: just a few taps, and your cash is on its way. This quick disbursement makes it a dependable financial safety net, helping you cover urgent expenses without the hassle of traditional bank procedures.

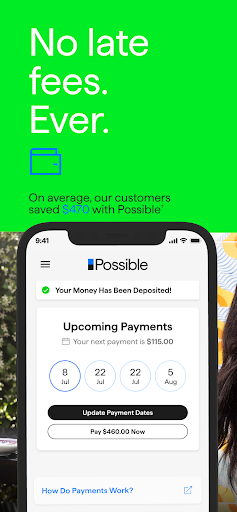

Transparent and Honest Pricing

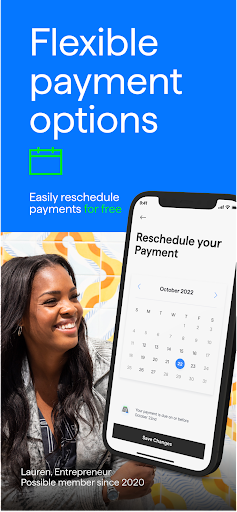

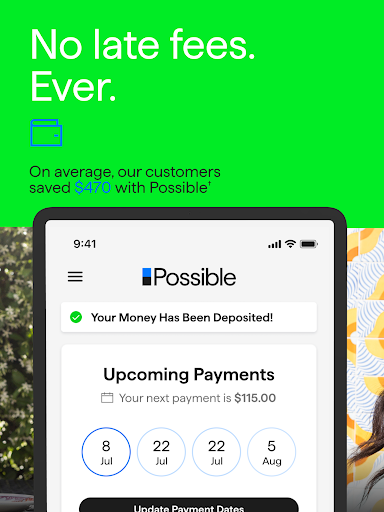

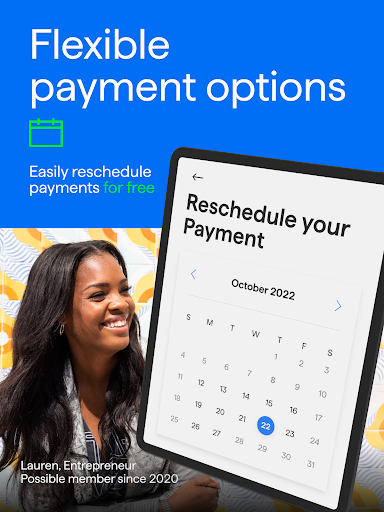

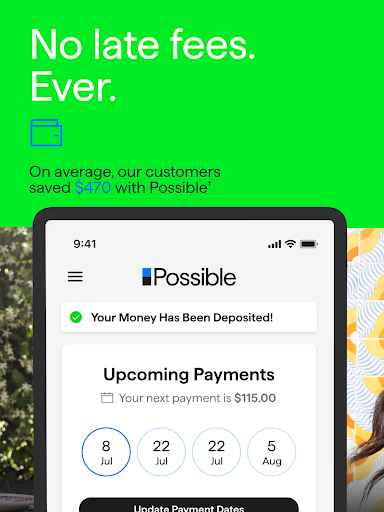

Possible prides itself on clear, upfront pricing with no hidden fees. Unlike some lenders that surprise you with late fees or penalty charges, this app ensures you understand all costs from the start. There are No late fees or surprise fees—ever, giving you peace of mind and control over your finances. Plus, flexible payment schedules allow you to choose a repayment plan that suits your financial situation, avoiding the debt cycle often associated with payday loans.

Build Your Credit Effortlessly

Beyond providing quick cash, Possible emphasizes •Content•: Credit Building. The app reports your on-time payments to major credit bureaus, which can help enhance your credit score over time. This means you can build or rebuild your credit history simply by making regular, timely payments through the app. Additionally, it offers helpful insights and educational resources to guide you in managing your finances more effectively, acting as a virtual financial advisor in your pocket.

Flexible and User-Friendly Experience

The app features an intuitive interface that makes navigating its features a breeze. Whether you're applying for a quick loan, setting up automated payments, or viewing your credit progress, everything is organized clearly. You can also customize payment dates according to your schedule, ensuring your repayments are manageable. Support is readily available if any issues arise—friendly, responsive customer service helps you resolve concerns swiftly.

Additional Benefits

With over 100,000+ 5-star reviews and more than 3 million members, Possible has demonstrated its value among users. Customers have reported saving over $470 on average by choosing this app over traditional lenders, thanks to lower fees and flexible repayment terms. The Maximum 0% APR for qualified customers on the Possible Card further enhances its appeal—though availability varies by state.

Why Choose Possible: Fast Cash & Credit?

If you need quick access to funds without the worries of hidden charges and want to improve your financial health over time, Possible offers an effective solution. Its focus on transparency, responsible lending, and credit building makes it stand out in the crowded financial app marketplace. Whether you're dealing with an emergency or aiming to boost your credit score, this app equips you with the tools, support, and flexibility to manage your money better.

Pros

- Quick approval process

- User-friendly interface

- No hidden fees

- Multiple loan options

- Secure transaction handling

Cons

- High interest rates

- Limited customer support

- Strict eligibility criteria

- Frequent app updates

- In-app ads