Empower: Advance & Credit - Your Personal Financial Sidekick

Are you looking for a reliable way to manage your finances more effectively? Empower: Advance & Credit is an innovative app designed to help you take control of your financial life. Whether you need quick access to cash, want to build credit, or simply want to track your spending, this app offers a suite of features that make managing money simpler and more accessible. With a user-friendly interface and powerful tools, Empower aims to be your trusted companion on your financial journey.

Key Features of Empower: Advance & Credit

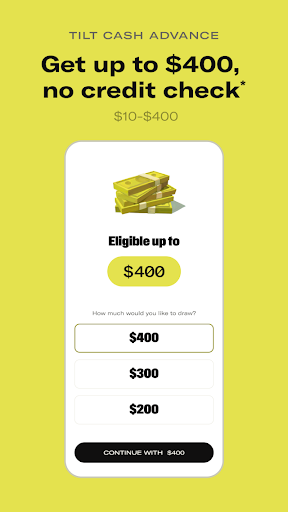

Cash Advances Made Easy

One of the standout features of Empower is its ability to provide cash advances. Imagine facing an unexpected expense—perhaps a car repair or medical bill—without having to go through lengthy loan processes. With Empower, you can request a cash advance and receive funds in your bank account almost instantly, with amounts ranging from $10–$400. The process is straightforward, with optional instant delivery, though fees may apply. Best of all, there are no credit checks, and you won’t be charged interest or late fees, making it a flexible and transparent solution for urgent financial needs.

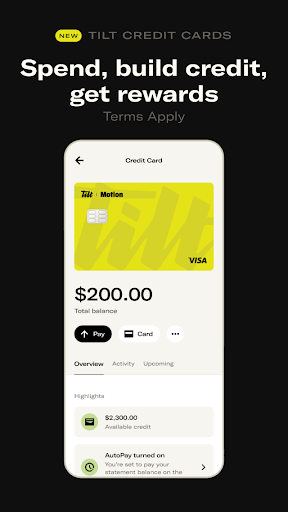

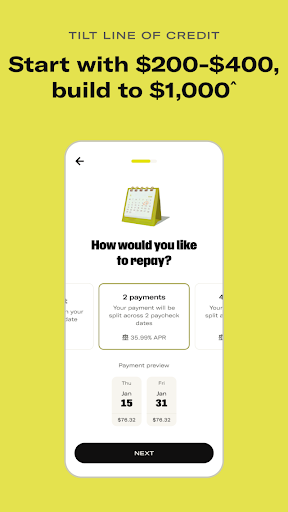

Build and Monitor Your Credit

Empower also offers credit-building tools suitable for all credit scores. Its Credit Cards are issued by WebBank—no security deposit or credit score required—making them accessible to everyone. You can earn cash back rewards (terms apply), and the app automatically considers you for limit increases as you demonstrate responsible usage. The Line of Credit feature, provided by FinWise Bank, starts at $200–$400 and can grow with timely payments. These tools are designed to help you improve your credit profile over time, giving you more financial options in the future.

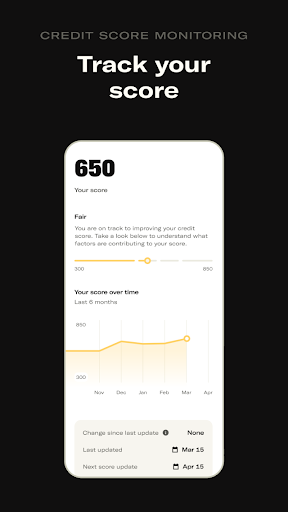

Stay on Top of Your Credit Score

Monitoring your credit score is effortless with Empower. The app allows you to check your score regularly, receive personalized tips for better credit building, and stay informed about your financial health—all within the app. This ongoing oversight helps you make smarter decisions and work towards your long-term financial goals.

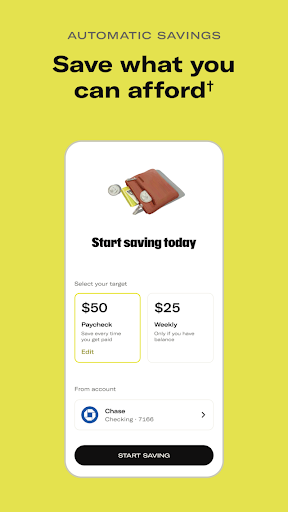

Automatic Savings for a Brighter Future

If saving money is a challenge, Empower’s Automatic Savings feature is here to help. Set your savings goals by week or pay period, and the app’s AI will automatically transfer funds from your account—based on your budget—making saving hands-free and effortless. Your data is secured with bank-level encryption, ensuring your personal information is safe at all times.

Why Choose Empower? - Benefits and Security

Empower combines convenience, security, and personalized support to provide a comprehensive financial management experience. The app is built with robust security measures, including bank-level encryption, to protect your data. Your login details are never stored, and the app only partners with regulated providers trusted by major financial institutions. If you have questions or need assistance, Empower offers responsive support through email, an in-app chatbot, and FAQs on their website.

Flexible Financial Tools for Everyday Life

Managing finances shouldn’t be stressful. Empower’s features like cash advances, credit building, and automatic savings are designed to support your financial goals without the complexities of traditional banking. Whether you’re preparing for an unexpected expense or looking to improve your credit profile, Empower offers a user-friendly platform that adapts to your needs. Plus, with no minimum credit score requirement for the credit options, it’s accessible to a wide range of users.

Final Thoughts

If managing your money feels overwhelming, Empower: Advance & Credit could be the ideal app to help you gain financial clarity and freedom. Its innovative features empower you to make smarter financial decisions, save automatically, and build credit—all in one place. Download the app today and start taking control of your financial future with confidence.

Pros

- User-friendly interface for easy navigation.

- Quick access to cash advances when needed.

- No hidden fees or surprise charges involved.

- Provides detailed financial insights and tips.

- Secure and encrypted data to protect users.

Cons

- Limited to users with stable income sources.

- Monthly subscription fee may deter some users.

- Not available in all countries or regions.

- Cash advance limits may be too low for some.

- Requires access to personal financial data.