Introduction to Brigit: Cash Advance & Credit

Are you searching for a reliable financial app that helps you manage your money effectively? Brigit: Cash Advance & Credit is designed to be your personal financial assistant, offering convenient solutions like instant cash advances, credit building, and budgeting tools. With over 9 million users, this app combines technology and financial knowledge to support you in achieving a brighter financial future.

Key Features of Brigit

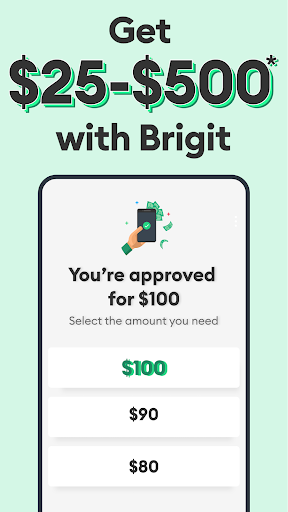

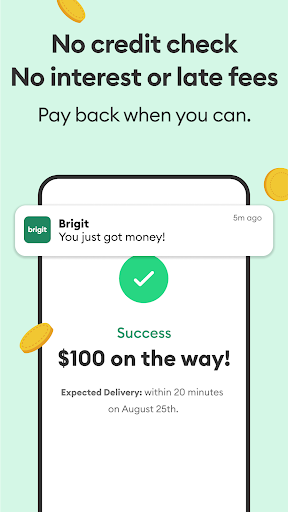

Instant Cash Advances

Need quick access to funds? Brigit offers instant cash advances ranging from $25 to $250 with no credit check, interest fees, late fees, or tips. These advances can be used for emergencies or unplanned expenses, helping you avoid costly overdraft charges. The process is straightforward:

- Download Brigit

- Connect your bank account

- Request an Instant Cash advance

- Receive funds directly deposited into your bank account

The repayment is flexible, allowing you to pay back when you get paid or at a time that suits your financial situation. This feature is especially helpful for handling unexpected costs without the burden of interest or hidden fees.

Fast Personal Loan Offers

Looking to borrow more? Brigit provides personal loan offers from lending partners for amounts of $500 or more. You can compare these options to find a loan that fits your current needs, making borrowing flexible and accessible.

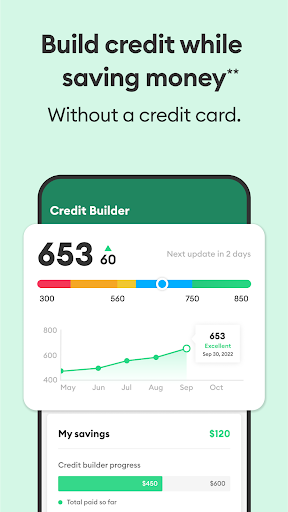

Build Credit & Save Money

Brigit empowers you to build your credit without needing a credit card. Its Credit Builder feature reports on-time payments to all three major credit bureaus—Experian, Equifax, and TransUnion—helping you improve your credit score over time. Some key aspects include:

- No hard credit pull or credit score check required

- No interest or security deposit needed

- Start building credit with as little as $1 per month

- Remaining payments are returned to your account upon loan completion

This feature is ideal for those aiming to enhance their credit profile and increase financial stability.

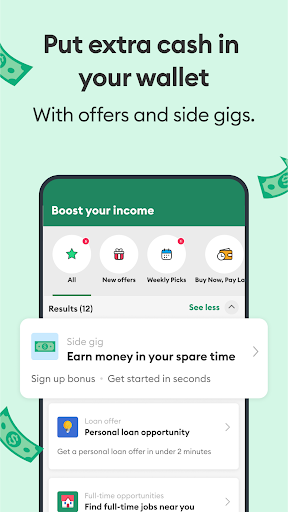

Earn & Save Money

Brigit also encourages earning extra cash and saving with various tools:

- Participate in surveys to earn additional income

- Find part-time, full-time, gig, and remote jobs

- Take advantage of cashback offers, discounts, and insurance savings

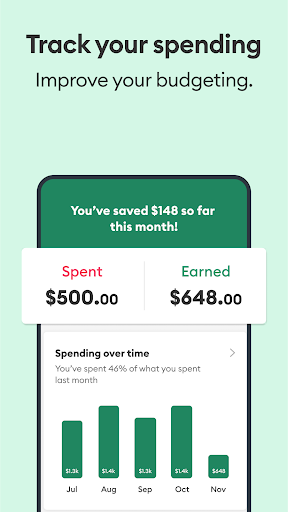

Budget Better

Stay on top of your finances with Brigit’s budgeting tools:

- Connect your bank account for personalized budgeting tips

- Track your income and expenses effortlessly

- Get insights into bill and spending breakdowns

- Identify and cancel unused subscriptions

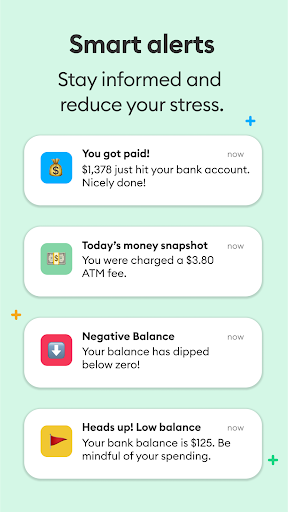

Protect Your Money

Ensure the safety of your financial data with features that monitor your credit, spending, and identity:

- View your credit score and credit reports

- Receive bank balance alerts to prevent overdraft

- Access identity theft protection tools

Easy Sign Up and Membership Plans

Joining Brigit is quick and hassle-free. Simply download the app, sign up for free, and start accessing essential financial tools. The app integrates with major banks like Chime, Bank of America, Wells Fargo, Chase, and thousands of others.

Brigit offers a Basic Plan that includes free account alerts and insights, along with exclusive earn & save offers. For enhanced features like cash advances and credit building tools, paid plans are available at $8.99 to $14.99/month. You can cancel anytime, making it flexible to your needs.

Support and Disclosures

Brigit is designed to be transparent and secure, with detailed disclosures about its services. It is not affiliated with other loan apps or banking services but partners with reputable financial institutions to provide its credit builder loans. Fees and eligibility vary, and some features may require a paid plan. The app is available across many states, with certain restrictions.

Conclusion

Brigit: Cash Advance & Credit stands out as a comprehensive financial wellness platform. Whether you need a quick cash advance, want to build or improve your credit score, or simply aim to budget smarter, Brigit offers a suite of tools designed for everyday financial management. Its user-friendly interface, combined with flexible features and no hidden costs, makes it an excellent choice for those looking to gain control over their financial future. Download Brigit today and take the first step toward financial empowerment.

Pros

- User-friendly interface for easy navigation.

- Quick and simple sign-up process.

- Provides financial advice and tips.

- Assists in improving credit scores over time.

- No late fees or hidden charges.

Cons

- Only available to residents in the United States.

- Requires access to a bank account.

- Needs a monthly subscription fee.

- Offers relatively small loan amounts.

- Not suitable as a long-term financial solution.