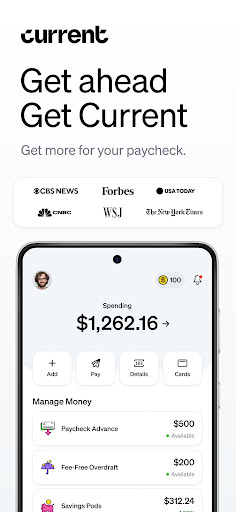

Current: The Future of Banking

Current is shaping the future of banking by providing a modern, innovative mobile banking experience tailored for today’s tech-savvy users. Designed to simplify how you spend, save, and manage your money, the Current app offers a comprehensive suite of features that make financial management easier and more convenient than ever before.

Seamless and User-Friendly Banking Experience

From the moment you download the Current app, you'll notice its intuitive user interface. Setting up an account is quick and straightforward, allowing you to start exploring its features within minutes. The app’s design focuses on making banking as seamless as possible, ensuring you stay connected to your finances at all times. One of the most appreciated features is real-time notifications. Whether it’s a paycheck deposit or a debit transaction, you receive instant updates, empowering you to stay on top of your spending habits effortlessly.

Innovative Features Tailored for Modern Banking

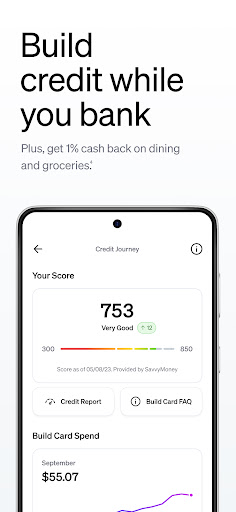

Build Credit

Using the Build Card, you can build your credit profile without any credit checks. This innovative feature enables you to improve your credit score while managing your everyday banking needs, making it ideal for those looking to establish or enhance their credit history.

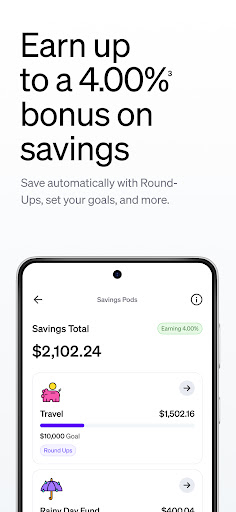

Savings Pods

Save smarter with Savings Pods, which act like digital piggy banks. You can set aside money for specific goals such as vacations, emergencies, or big purchases. The app allows you to earn an annual bonus of up to 4.00% on your savings, encouraging consistent saving habits and helping your money grow more efficiently.

Rewards Program

Earn points for every dollar spent at grocery stores or restaurants, adding a rewarding element to your everyday purchases. These points can be redeemed for various rewards, making shopping more beneficial while you continue to manage your finances effectively.

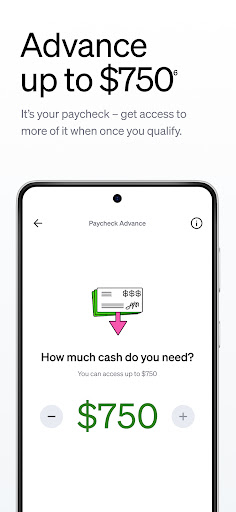

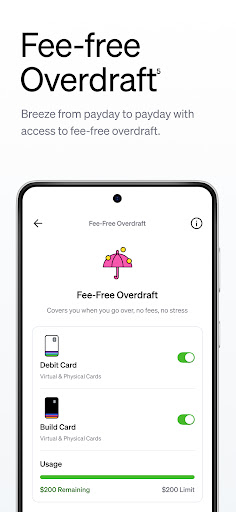

Overdraft and Paycheck Advances

It provides fee-free overdraft protection up to $200 and the option to qualify for a Paycheck Advance of up to $750 with no mandatory fees. These features offer peace of mind for unexpected expenses and faster access to funds when you need them the most, all without hidden charges.

Fee-Free ATM Withdrawals

Enjoy fee-free cash withdrawals from over 40,000 Allpoint ATMs across the U.S., saving you money on ATM fees. While out-of-network ATM transactions may incur a small fee, the convenience remains unmatched for everyday banking needs.

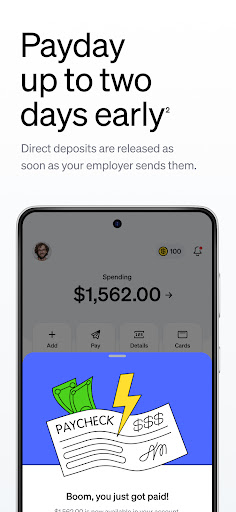

Faster Direct Deposits

With faster access to direct deposits, your paycheck can arrive up to two days earlier compared to traditional banks, thanks to electronic deposit processing. This feature ensures you have access to your funds promptly, helping you plan your finances better.

24/7 Support

Customer support is available around the clock, ready to assist you via the app. Whether you need help with your account or have questions about features, support is just a message away, ensuring you always have the assistance you need.

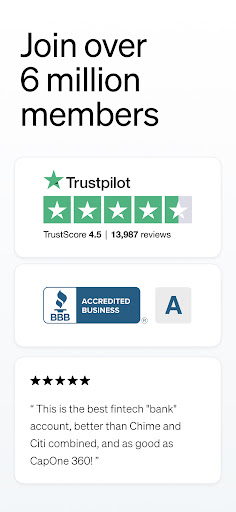

Security and Trustworthiness

Security is a top priority for Current. The app utilizes advanced encryption and security protocols to safeguard your personal and financial information. While Current is a financial technology company and not an FDIC-insured bank, your funds are protected up to certain limits through relationships with FDIC-member banks like Choice Financial Group and Cross River Bank. This combination ensures your money is kept safe while enjoying the benefits of innovative digital banking services.

Why Choose Current?

In summary, Current: The Future of Banking offers a comprehensive, user-friendly platform designed for the digital age. Its blend of innovative features—from credit-building tools and savings goals to rewards and secure transactions—makes it an attractive option for those seeking modern banking solutions. Whether you're looking to build credit, save toward specific goals, or enjoy fee-free banking perks, Current provides a streamlined, secure, and rewarding experience that's perfect for today's fast-paced lifestyle.

Pros

- User-friendly interface for easy navigation

- Real-time notifications for all transactions

- Enhanced security features to safeguard data

- Supports multiple currencies and accounts

- Round-the-clock customer support

Cons

- Limited functionality in the free version

- Occasional bugs impacting performance

- Requires a stable internet connection

- High fees for international transfers

- Complicated registration process