Albert: Budgeting and Banking – Your All-in-One Personal Finance App

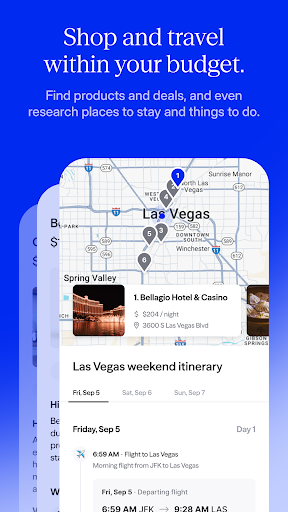

Managing personal finances can often feel overwhelming, especially with the plethora of banking and budgeting tools available today. Albert: Budgeting and Banking aims to simplify this process by offering a comprehensive, innovative app that combines budgeting, banking, saving, investing, and financial monitoring all in one platform. Whether you're looking to track your expenses, boost your savings, or invest intelligently, Albert provides a user-friendly experience designed to meet the needs of both beginners and experienced financial users.

Core Features and Functionality of Albert

Budgeting and Personal Finance Management

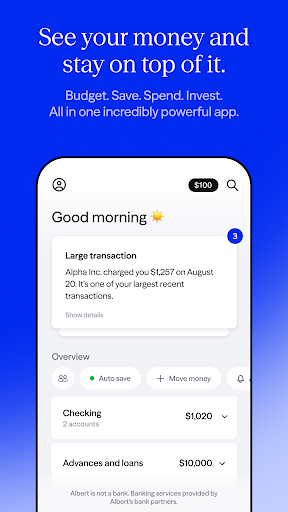

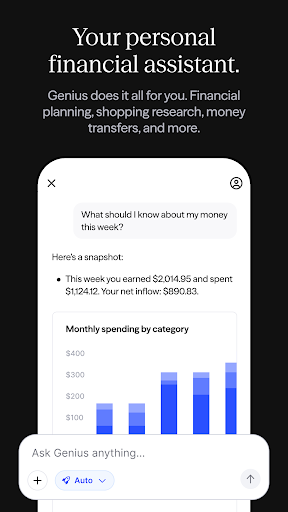

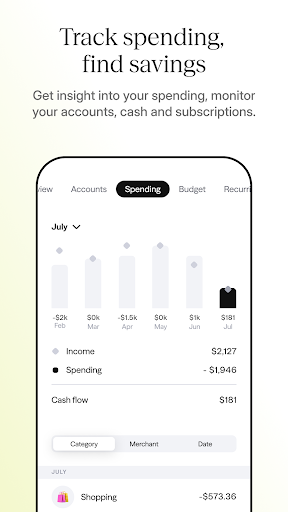

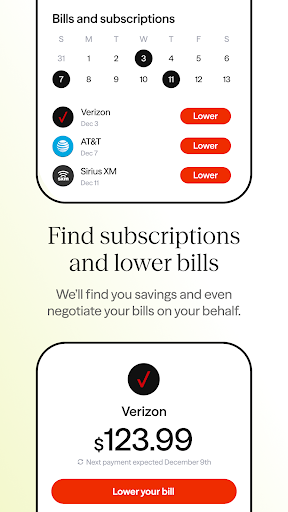

At its core, Albert excels at budget management and expense tracking. The app provides a clear, intuitive interface that makes setting up your monthly budget straightforward. Once you link your bank accounts, Albert analyzes your income and spending patterns to help you create a personalized spending plan. It also offers tools to monitor recurring bills and identify subscriptions you may no longer need, helping you lower unnecessary expenses. This feature simplifies personal finance management by giving you a consolidated view of all your accounts in one place, making it easier to stay on top of your financial goals.

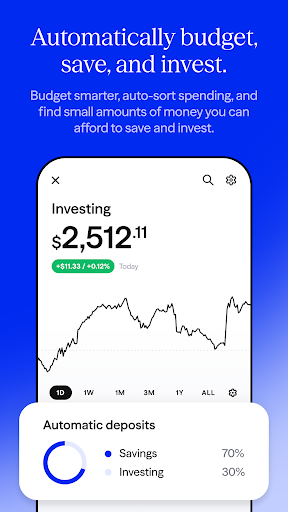

Automatic Saving and Smart Investing

One of the standout features of Albert is its automatic savings tool. Using intelligent algorithms, the app subtly transfers small amounts of money from your checking account into savings, helping you build an emergency fund or reach specific savings goals without the hassle. You can choose to open a high-yield savings account to earn a competitive Annual Percentage Yield (APY), which is over 9 times the national average, maximizing your deposit growth over time. Additionally, Albert enables you to invest in a variety of stocks, ETFs, and managed portfolios, opening avenues for wealth building tailored to your risk appetite.

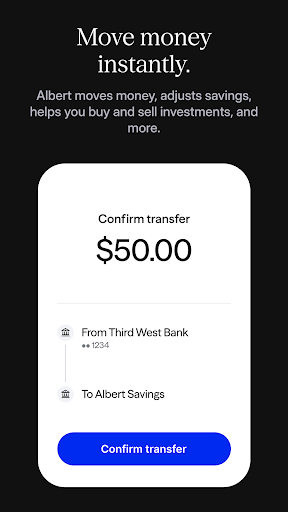

Online Banking and Rewards

Albert provides a convenient online banking experience. With features like direct deposit, you can get paid up to 2 days earlier, enhancing your cash flow management. The app also offers cash-back rewards at select stores, turning everyday spending into savings opportunities. Plus, Albert’s no-fee cash account includes a debit card, giving you quick access to your funds without hidden charges. While Albert is not a bank itself, its banking services are backed by FDIC-insured partner banks such as Sutton Bank, Stride Bank, and Wells Fargo, ensuring your funds are protected.

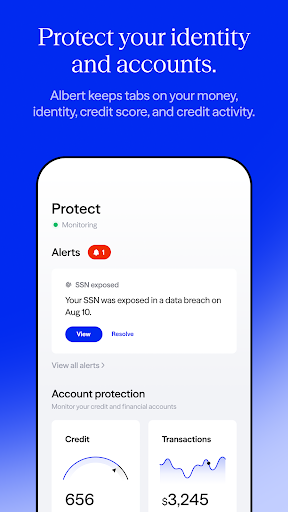

Identity and Security Monitoring

Security is a priority for Albert. The app provides 24/7 monitoring of your accounts, credit, and identity. You receive real-time alerts if potential fraud is detected and can track your credit score regularly, giving you peace of mind knowing your financial identity is safeguarded. This comprehensive security suite helps protect your assets while you focus on financial growth.

Subscription and Additional Services

Albert offers a subscription plan called Albert Genius, which grants access to real human financial advisors. These experts can assist with various financial decisions, such as refinancing loans or planning large purchases. The app plans range from $14.99 to $39.99 per month and auto-renew until canceled, which you can do directly in the app. Instant cash advances are also available, allowing quick access to funds with limits from $25 to $1,000, subject to eligibility. For those serious about their investments, brokerage services and advisory products are provided by Albert Securities and Albert Investments, respectively.

Disclaimers and Financial Details

It’s important to note that Albert is not a bank; banking services are provided by partner banks that are FDIC-insured. The app’s funds in Savings accounts are insured up to $250,000, and funds in Cash accounts are held at partner banks. The app also clearly states that investing involves risk, and accounts are not FDIC insured. Rates for high-yield savings are variable and subject to change, and all features, including fees and limits, are detailed thoroughly for transparency.

Why Choose Albert?

Whether you’re aiming to improve your budgeting skills, automate savings, or invest smarter, Albert: Budgeting and Banking offers an all-in-one platform that adapts to various financial needs. Its seamless integration of banking, investing, and budgeting tools, coupled with real-time security monitoring and personalized advice, makes it a powerful companion in your financial journey. With innovative features designed for both beginners and savvy investors, Albert truly serves as a smart financial sidekick to help you achieve your money goals efficiently and securely.

Pros

- User-friendly interface makes budgeting easier.

- All-in-one app with extensive financial tools.

- Automatic savings feature enhances savings.

- Real-time alerts improve expense monitoring.

- Customized financial guidance provided.

Cons

- Some features are behind a paid subscription.

- Limited options for customer support.

- Occasional bank account synchronization problems.

- May be overwhelming for new users.

- Fewer investment choices compared to competitors.

You May Like

Capital One Mobile

Finance

4.9

Intuit Credit Karma

Finance

4.8

Trust: Crypto & Bitcoin Wallet

Finance

4.7

Investing.com: Stock Market

Finance

4.6

Coinbase: Buy BTC, ETH, SOL

Finance

4.7

Venmo

Finance

4.9

Revolut: Spend, Save, Trade

Finance

4.7

TrueMoney

Finance

3.4

Walmart MoneyCard

Finance

4.1

Current: The Future of Banking

Finance

4.5

LifeLock Identity by Norton

Finance

4.4

PNC Mobile

Finance

4.6