Varo Bank: Online Banking

In today’s digital age, managing your finances is easier than ever with Varo Bank. Unlike traditional banks or many third-party money apps, Varo isn’t just an online banking app—it’s a fully licensed real bank built for the modern world. With a focus on accessibility, security, and innovative financial tools, Varo provides a comprehensive banking experience that fits right in your pocket.

Key Features of Varo Bank

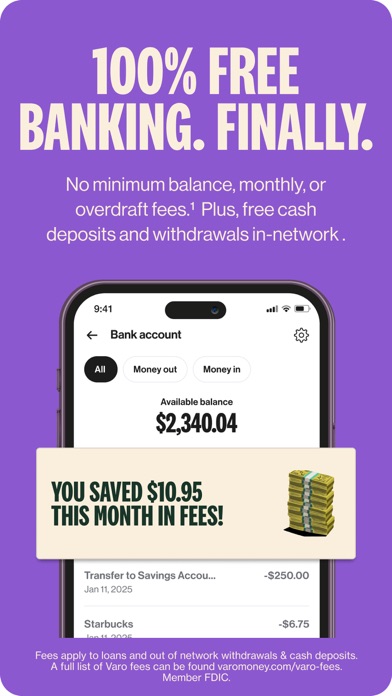

Accessible and Cost-Effective Banking

Varo offers free online banking with no minimum balance requirements or hidden fees. You get a free debit card, and can deposit or withdraw cash at over 40,000 in-network ATMs across the country, including locations like CVS® —free cash deposits at CVS® and withdrawals at partner ATMs. Plus, account holders can monitor their credit score for free, making it easier to stay on top of their financial health.

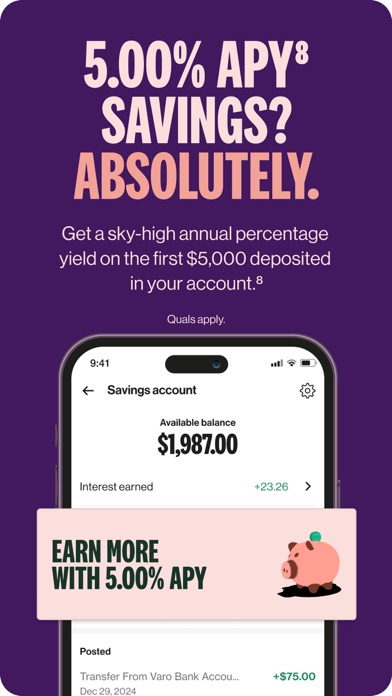

High-Yield Savings Accounts

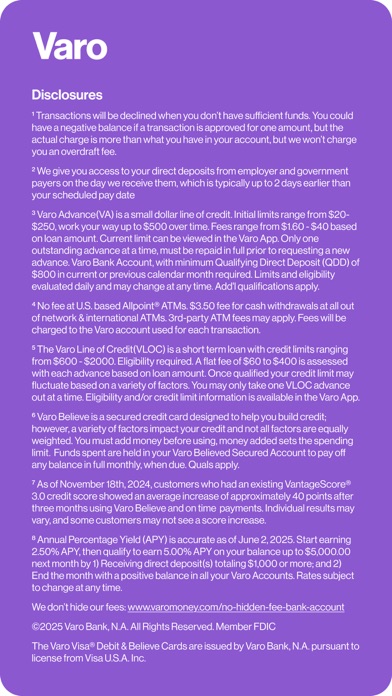

Save smarter with Varo’s high-yield savings account offering up to 5.00% APY on balances up to $5,000—qualifications apply. Remaining balances earn a competitive 2.50% APY. Automated savings features help you grow your money faster by rounding up purchases or setting up automatic transfers, encouraging disciplined saving habits.

Credit Building Made Easy

Build or improve your credit score with Varo’s free secured credit card. There’s no credit check, no annual fees, interest charges, or security deposit requirements. Spend only what you have available, and track your expenses by category. With automatic payments via Safe Pay, your credit history can see a significant boost—often a 40+ point increase after just three months of on-time payments.

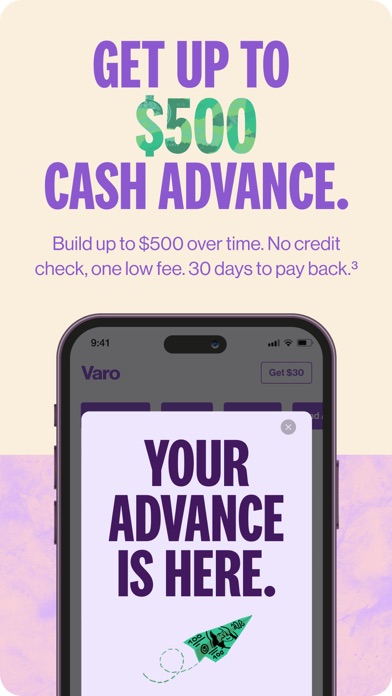

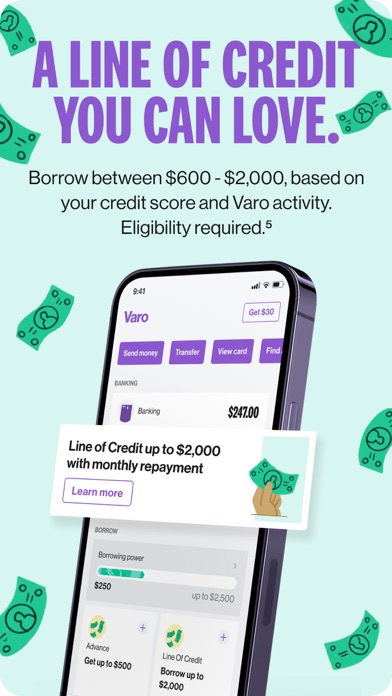

Instant Cash Advances and Personal Loans

Need quick access to cash? Varo offers instant cash advances ranging from $20 to $250 (qualified users can increase this to $500 over time). These advances are funded directly into your account, and you have 30 days to repay with a flat fee—avoiding the pitfalls of traditional payday loans. Additionally, a personal line of credit ranging from $600 to $2,000 is available for qualified users, with no interest or late fees, and flexible repayment options spanning 3 to 12 months.

Benefit from Cashback and Send Money

New customers can enjoy a 50% cashback bonus within the first 30 days. The app also makes it effortless to send money to anyone—whether they’re a Varo customer or not—using just their phone number or email. Transfers are fast, secure, and free, making peer-to-peer payments simple and convenient.

Additional Benefits and Security

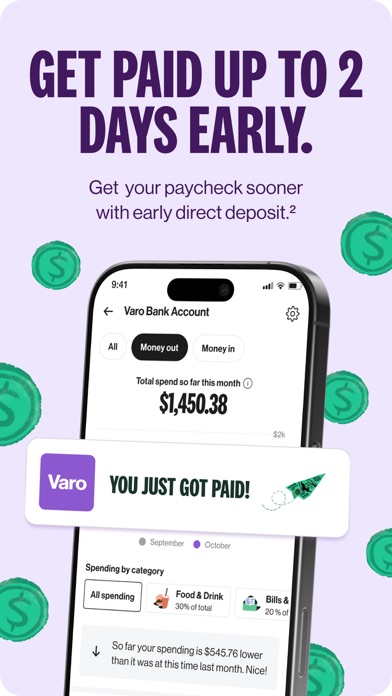

Early PaycheckAccess & Fee-Free Banking

You can receive your paycheck up to two days early, giving you more control over your finances. Varo’s banking services are free from monthly maintenance fees, overdraft charges, and foreign transaction fees, offering a truly transparent banking experience backed by the FDIC.

Modern Security Measures

Your security is a top priority. Varo employs advanced encryption and security protocols to protect your sensitive information. If your phone is lost, you can remotely disable access to your account instantly, ensuring your funds remain secure at all times.

User-Friendly Design and Experience

The app’s clean and intuitive interface makes managing your finances straightforward. You can check balances, categorize spending, set savings goals, and deposit checks—all within a few taps. The experience is seamless, even for those who aren’t tech-savvy, making Varo a perfect companion for everyday financial needs.

Whether you’re looking to boost your credit, save money with high-yield accounts, or enjoy fee-free banking, Varo provides tools tailored for a variety of financial goals. Its combination of security, accessibility, and innovative features positions it as a standout choice among digital banking options.

Pros

- No monthly fees or minimum balance requirements

- Early access to direct deposits

- Suitable for seniors over 55

- Access to over 55,000 fee-free ATMs

- User-friendly interface

- Customer support available 24/7

Cons

- Limited physical branch access

- Does not offer joint accounts

- Foreign transaction fees may apply

- Limits on mobile check deposits

- Restricted investment options