Introduction to GO2bank: Mobile Banking

In today's fast-paced digital world, having a reliable and user-friendly banking app is essential. GO2bank stands out as a mobile banking solution designed for everyday people who value simplicity, security, and financial perks. With no hidden fees and straightforward features, this app is tailored to meet the needs of modern users seeking convenient banking on the go.

Main Features of GO2bank

No Hidden Fees and Easy Access

GO2bank™ is built with transparency in mind, offering no hidden fees and no monthly fees for eligible direct deposit users. Otherwise, a small fee of $5 per month applies. The app allows you to get paid up to 2 days early and receive government benefits up to 4 days early with direct deposit, giving you quicker access to your funds.

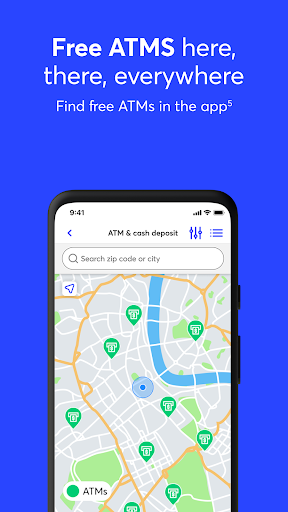

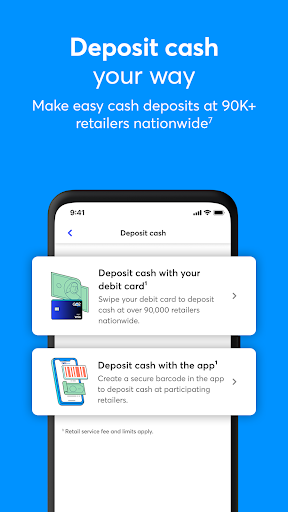

ATM and Retail Cash Deposits

Enjoy free cash withdrawals at the extensive nationwide ATM network. Additionally, you can deposit cash at retail locations across the country, making it easy to fund your account whenever needed.

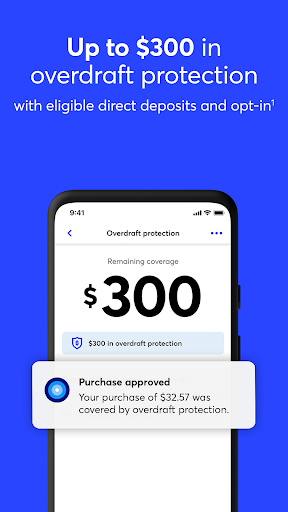

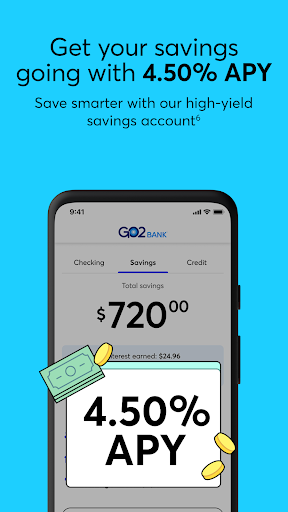

Interest Earnings and Overdraft Protection

Earn an impressive 4.50% APY on your savings, paid quarterly, helping your money grow effortlessly. The app also offers up to $300 in overdraft protection after qualifying direct deposits and opting in, providing peace of mind against unexpected expenses.

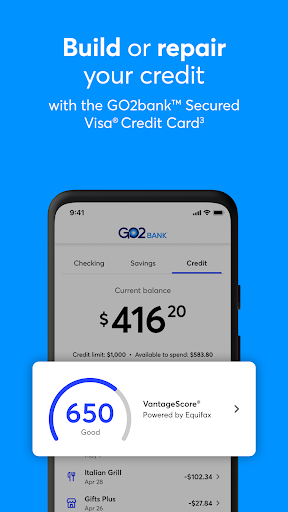

Credit Building Options

Build your credit score easily with the GO2bank Secured Visa® Credit Card. This card comes with no annual fee and requires no credit check, making it accessible for users looking to establish or improve their credit profile.

Security Measures

Your funds are protected with advanced security features such as card lock/unlock options. The app also provides fraud alerts if suspicious activity is detected. Moreover, all account funds are FDIC-insured, ensuring your money's safety up to the allowable insurance limits.

Getting Started with GO2bank

Downloading the app is simple—just open your app store and install GO2bank. To open an account, online access, mobile number verification (via text message), and identity verification (including SSN) are required. Access to all features necessitates mobile number verification and email address verification.

Terms, Conditions, and Additional Details

For detailed information about fees, terms, and conditions, you can visit GO2bank.com/daa. Fees may vary, and certain features like early direct deposit depend on factors such as payor type and bank policies. Always consult the official site for the latest terms and updates.

Why Choose GO2bank?

If you're searching for a mobile banking app that offers a blend of convenience, security, and attractive rewards, GO2bank is a compelling choice. Its user-friendly interface, helpful features like early direct deposit and cashback rewards, along with robust security measures, cater to both tech-savvy users and those seeking straightforward banking solutions. Download the app today and experience the benefits of modern digital banking tailored for your everyday financial needs.

Pros

- User-friendly interface improves navigation.

- Fast account setup with minimal requirements.

- No-fee overdraft protection available.

- Instant access to digital cards for new accounts.

- Cashback rewards on debit card transactions.

Cons

- Limited access to physical branches.

- Monthly fees apply unless specific conditions are met.

- ATM withdrawal limits may be restrictive.

- Customer service responses can be slow.

- Occasional bugs reported in the mobile app.