Walmart MoneyCard: Your Convenient Financial Companion

Are you searching for a smarter and more flexible way to manage your finances without the hassle of traditional banking? The Walmart MoneyCard app offers a user-friendly solution that simplifies money management, helping you stay on top of your financial goals with ease. Whether you want to access your pay early, earn cash back, or enjoy secure and versatile spending options, the Walmart MoneyCard is designed to meet your needs seamlessly.

Key Features and Benefits of the Walmart MoneyCard

Easy Management and Accessibility

The Walmart MoneyCard app prioritizes simplicity and accessibility, making financial management straightforward for everyone. Setting up your account is quick and effortless through the Google Play Store or Apple App Store. Once registered, you can link your existing bank accounts, load funds directly, or deposit checks using your smartphone camera—no trips to the bank required.

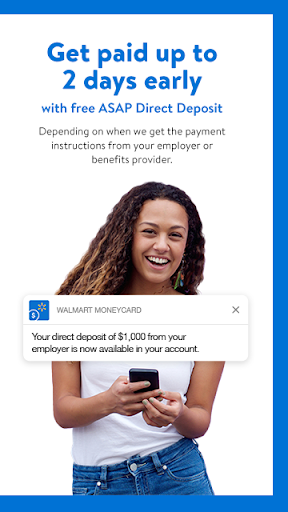

Enhanced Payment Features

Enjoy the convenience of early access to your pay—up to 2 days before your scheduled payday with direct deposit. Additionally, the app offers comprehensive tools for managing your money, such as detailed transaction history and real-time alerts that keep you updated on your account activity, preventing unexpected surprises.

Rewarding Shopping Experience

One of the app’s highlights is the ability to earn cash back on select purchases. Earn 3% cash back at Walmart.com, 2% at Walmart fuel stations, and 1% at Walmart stores—up to $75 per year. This incentive turns everyday shopping into an opportunity to save, making your spending more rewarding.

Security and Control

The Walmart MoneyCard app comes equipped with lock protection features—simply press the lock button within the app if your card is misplaced to prevent unauthorized purchases. You can quickly unlock it when needed. The app also incorporates security measures like fraud alerts and easy-to-use login features to safeguard your financial information effectively.

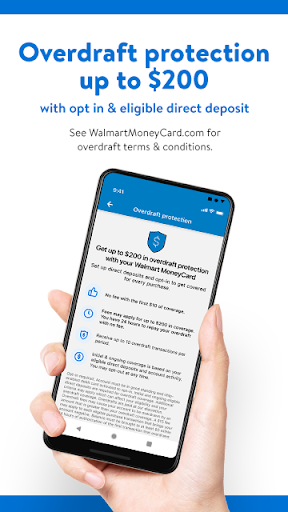

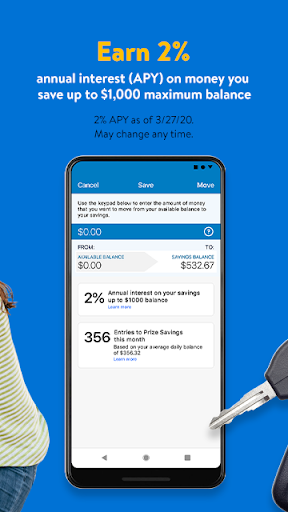

Additional Financial Advantages

The app offers options like overdraft protection of up to $200, provided you opt-in and meet certain requirements, and a competitive interest rate of 2% on savings. Plus, there’s no minimum balance or credit check needed to get started, making it accessible for many users.

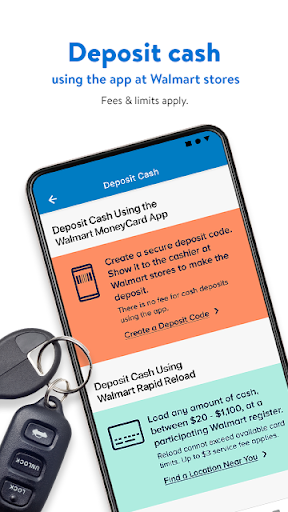

Versatile Deposit Options

Funding your account is simple—get your pay or government benefits deposited via direct deposit, or transfer money from your existing bank account. You can also load cash for free at Walmart stores nationwide or deposit checks instantly using your smartphone app, providing maximum convenience for your everyday financial needs.

Summary: Is Walmart MoneyCard Right for You?

The Walmart MoneyCard app is an excellent choice for anyone seeking an easy-to-use financial tool that blends the benefits of prepaid cards with digital banking features. Its focus on security, rewards, and flexible deposit methods makes it ideal for frequent Walmart shoppers or individuals looking to streamline their finances without the complexities of traditional banks. With features like early pay access, cash back rewards, mobile check deposits, and robust security controls, this app provides a comprehensive solution for managing your money efficiently. Take control of your finances today with Walmart MoneyCard and enjoy a smarter, simpler way to handle your money!

Pros

- Simplifies fund management through mobile access.

- Offers cashback rewards on purchases.

- Provides free cash reloads at Walmart.

- FDIC insured for safety and security.

- No credit check needed to open an account.

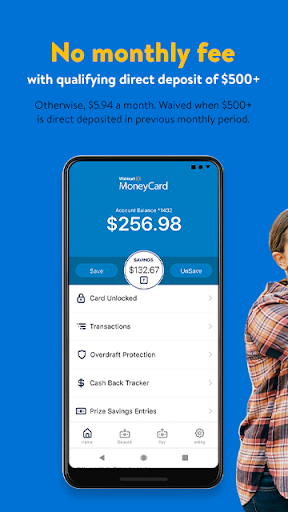

Cons

- Monthly fee applicable unless certain conditions are met.

- Charges for ATM withdrawals.

- Limited functionalities without using the app.

- Lacks traditional bank branch presence.

- Deposit limits may be enforced.