Introduction to the Classic Netspend App

Let’s dive into the world of financial management with the Classic Netspend app, a powerful tool designed to make handling your finances easier, quicker, and more efficient. If you’re like me, always on the lookout for ways to simplify life, then you might just find this app to be a trustworthy companion for managing your money seamlessly.

Getting Started with Ease

First things first, the setup process with Classic Netspend is as smooth as butter. After downloading the app, which is available for both Android and iOS, I found the registration process pretty straightforward. You simply enter your basic details, link your bank account, and you’re good to go. The app does a great job of guiding you through each step, making sure you don’t get lost in the process. It feels like having a financial advisor right in your pocket, helping you set up and manage your account with ease.

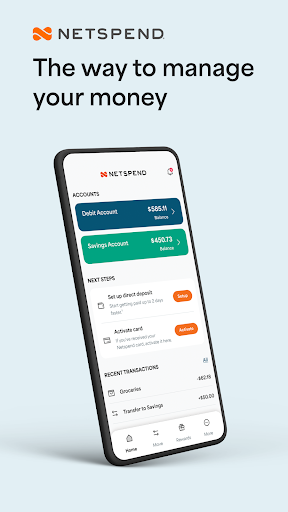

User-Friendly Interface

One of the standout features of the app is its user-friendly interface. Everything is laid out in a manner that makes navigation intuitive. Whether you’re checking your balance, reviewing recent transactions, or managing your savings goals, everything is just a tap away. The design is clean and uncluttered, which is perfect for those who prefer a minimalist** approach to app interfaces. This simplicity enhances the user experience, making financial management less intimidating and more accessible.

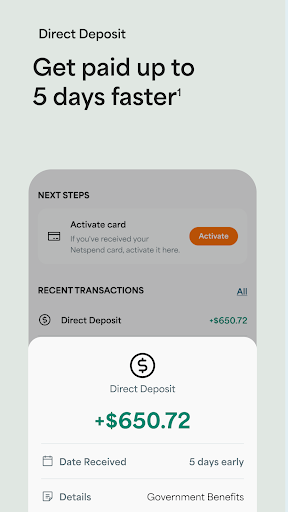

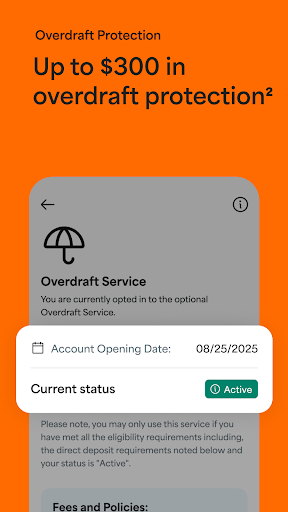

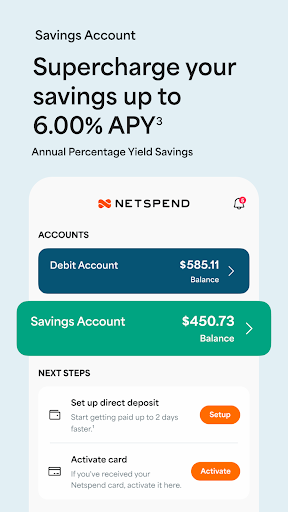

Features That Make a Difference

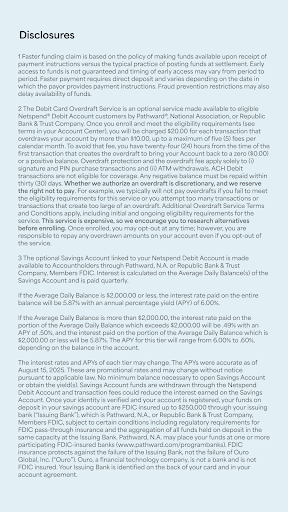

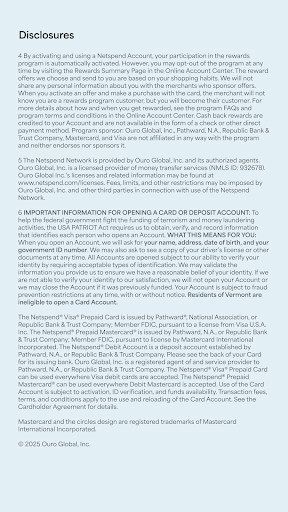

The Classic Netspend app is loaded with features catering to various financial needs. One of my favorites is the ability to receive direct deposits up to two days earlier than most banks—this faster funding feature is a game-changer for budgeting and bill payments. Additionally, the app offers robust budgeting tools that allow you to set spending limits and monitor expenses in real-time, functioning like a personal financial assistant. For travelers, the app supports international transactions, simplifying finances while abroad. Plus, it allows you to send money to family and friends, making it a versatile tool for both personal and shared financial management.

Security and Customer Support

When it comes to handling money, security is a top priority. The Classic Netspend app employs advanced security measures, including biometric login options and instant alerts for any suspicious activity. This ensures your financial information remains protected at all times. Additionally, the customer service team is known for being responsive and helpful. Should any issues arise, prompt assistance provides peace of mind, making the overall experience smooth and reliable.

Conclusion

In summary, if you’re searching for a reliable and comprehensive financial management app, Classic Netspend is worth considering. Its user-friendly design, robust features, and strong security measures make it a standout choice in the crowded field of financial apps. Whether you’re managing everyday expenses, saving for special goals, or handling international transactions, this app adapts to your needs. Give it a try and discover how it can transform your financial management experience into a simpler, more efficient process.

Pros

- User-friendly interface that makes navigation simple.

- Immediate notifications for transactions.

- Tools available for customizable budgeting.

- Secure login options, including biometric authentication.

- No hidden fees or charges.

Cons

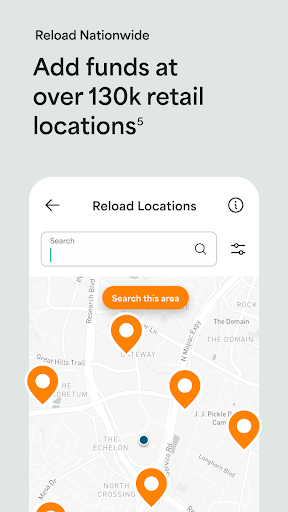

- Limited locations for ATM access.

- Monthly maintenance fee is charged.

- Customer service response can be slow.

- Limited compatibility with other applications.

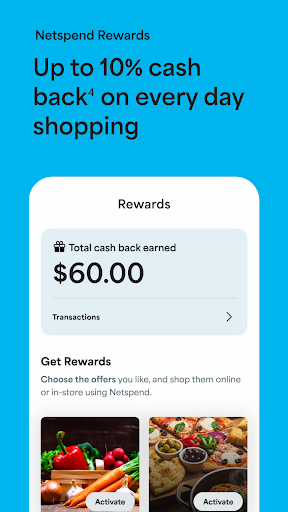

- Absence of cash-back rewards program.