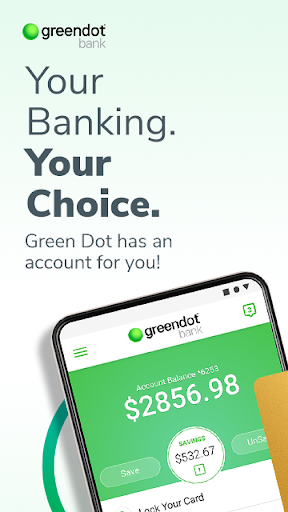

Green Dot - Mobile Banking

Green Dot is a financial technology and bank holding company dedicated to empowering individuals and businesses to bank seamlessly, affordably, and confidently. With over 80 million accounts managed to date, Green Dot offers a comprehensive suite of features across its range of Green Dot cards. These cards provide numerous benefits designed to enhance your financial experience without traditional banking hurdles.

Key Features of Green Dot Cards

Users can enjoy a variety of advantages, including:

- Get your pay up to 2 days early and government benefits up to 4 days early with early direct deposit¹

- Overdraft protection up to $200 with eligible direct deposits and opt-in²

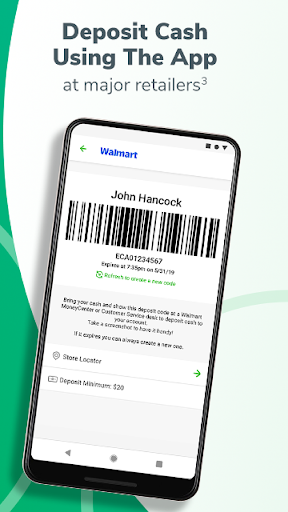

- Deposit cash using the app³

- Enjoy no minimum balance requirement

Additional features available on select Green Dot cards include:

- Earn 2% cash back on online and mobile purchases⁴

- Save money in the Green Dot High-Yield Savings Account with an APY of 2.00% on balances up to $10,000⁵

- Access a free ATM network with certain limits⁶

Managing Your Account with the Green Dot App

The Green Dot mobile app is the most convenient tool for account management, offering a user-friendly experience packed with powerful features:

- Activate a new card

- View account balance and transaction history

- Lock or unlock your account as needed

- Deposit checks directly from your mobile device⁷

- Works seamlessly with mobile payment options like Google Pay

- Set up account alerts to stay informed

- Access chat customer support for assistance

Additional Information and Requirements

To learn more, visit GreenDot.com. Please note, the service is not a gift card, and you must be 18 years or older to purchase. Activation requires online access, a mobile number, and identity verification (including SSN). Some features may require an activated, personalized card. The name and Social Security number on file with your employer or benefits provider must match your Green Dot account to prevent fraud restrictions.

¹ Early direct deposit relies on various factors such as payor type and banking procedures, which may delay availability.

² Fees, terms, and conditions apply; find out more at GreenDot.com/benefits/overdraft-protection.

³ Cash deposits are subject to a retail service fee of $4.95 and certain limits. Keep the receipt as proof of transaction.

⁴ Cash back on eligible purchases using the Green Dot Cash Back Visa® Debit Card; claim every 12 months while the account is in good standing.

⁵ The APY of 2.00% is effective as of 5/01/2025 and may change.

⁶ Free ATM locations and terms are accessible via the app. Limits include 4 free withdrawals per month, then $3.00 per withdrawal afterwards. ATM fees outside the network may apply.

⁷ Check deposit feature involving Ingo Money has specific limitations and eligibility requirements. This service is not available in New York.

⁸ Message and data rates may apply.

Cards are issued by Green Dot Bank, Member FDIC, under a license from Visa and Mastercard. Green Dot Corporation reserves all rights.

Why Choose the Green Dot Mobile Banking App?

Introducing the Green Dot - Mobile Banking app, a user-centric platform designed for individuals who need a straightforward yet powerful banking solution. Whether you’re managing multiple accounts or on the go, this app simplifies your financial interactions. Downloading and setting up the app is effortless, with availability on both Android and iOS devices, ensuring accessibility for a broad user base.

The app’s intuitive interface guides you through each step seamlessly, making it suitable for both tech-savvy users and those less familiar with digital banking. Once set up, you'll have access to an array of features that bring banking directly to your fingertips.

From managing your balance and tracking transactions to paying bills and depositing checks, the Green Dot app covers all essential banking needs. Real-time alerts keep you informed of your spending, while integrated budgeting tools help you control your finances more effectively. Plus, donating or paying via Apple Pay and Google Pay makes transactions even more convenient.

Security features such as fingerprint login and advanced encryption provide peace of mind, ensuring your personal and financial data remains protected. With additional perks like cash rewards for eligible purchases, the Green Dot mobile app not only simplifies banking but also rewards savvy spenders.

Whether you're just starting out or looking for a reliable mobile banking solution, this app combines ease of use, security, and added value—making it a smart choice to manage your finances smarter and more efficiently. Give it a try and discover how seamless modern banking can be!

Pros

- User-friendly interface for easy navigation

- No monthly fees with qualifying direct deposits

- Instant transaction alerts for security

- Overdraft protection up to $200

- Wide network of free ATMs nationwide

Cons

- High fees for cash deposits at retail locations

- Limited customer service availability

- Absence of physical bank branches

- Charges for paper statements

- Mobile check deposits can be slow