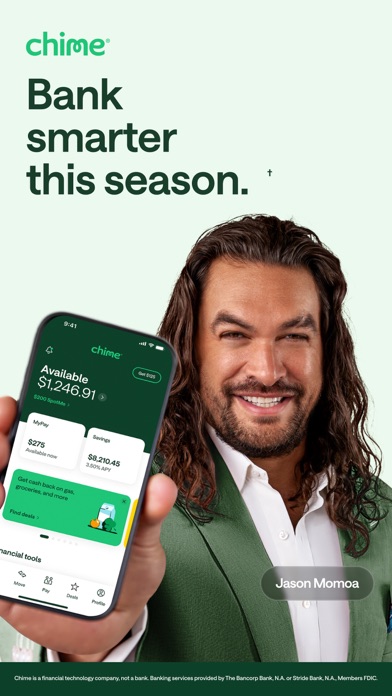

Chime – Mobile Banking

Better banking starts here. Unlock financial progress™ with Chime—credit tools, access to early pay, and no monthly fees. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

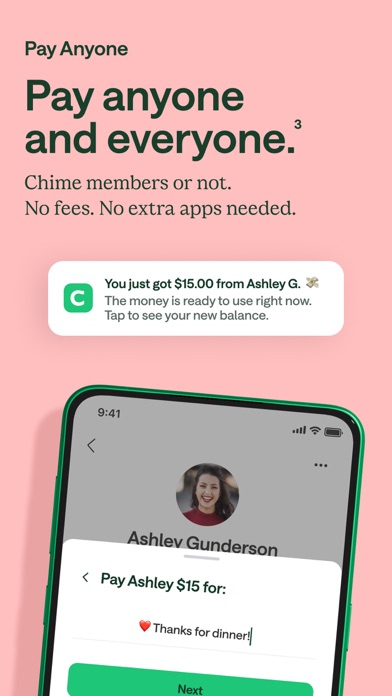

Features of Chime Mobile Banking

Better Banking

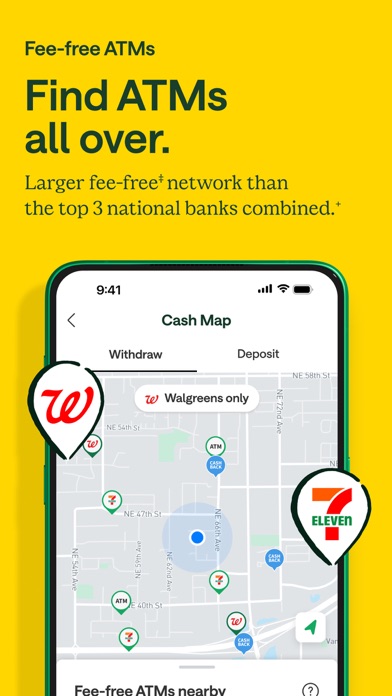

A high-powered checking account with fee-free in-network cash deposits§§, spending, overdraft coverage, free in-network ATMs‡, and more. Enjoy a seamless banking experience without the typical fees associated with traditional banks.

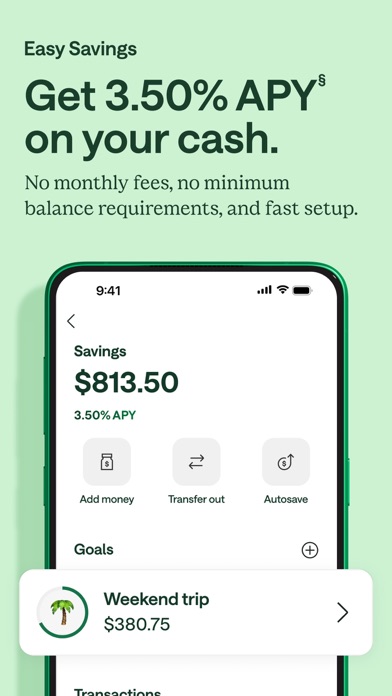

Easy Savings

Utilize automatic savings tools and a high-yield savings account¹, making it effortless to grow your savings through small but consistent habits with Chime.

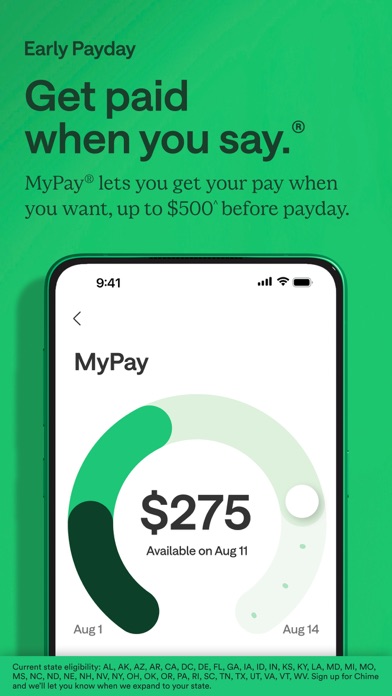

Get Paid When You Say™

Receive your paycheck up to two days early by setting up direct deposit. You can get early access to your funds, up to $500^, with no interest~, no credit check, and no mandatory fees, helping you stay financially prepared.

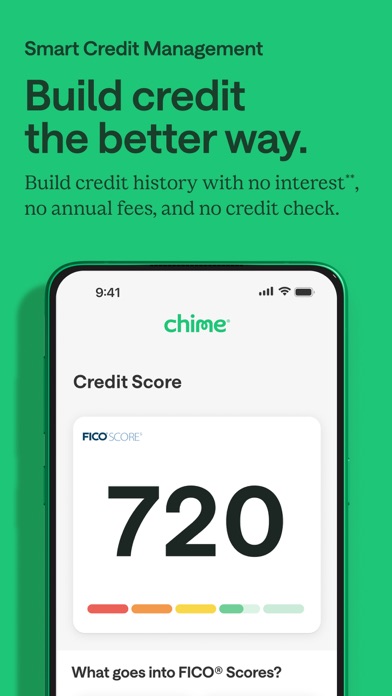

Smart Credit Management

Protect and grow your credit profile through your everyday purchases and regular on-time payments‡‡. This feature enables users to maintain a healthy credit score effortlessly.

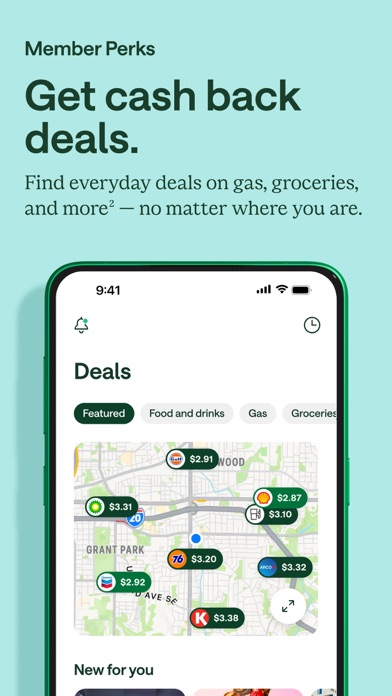

Member Perks

Access exclusive deals on your everyday purchases2, right from the app, making it easier to save money wherever you go.

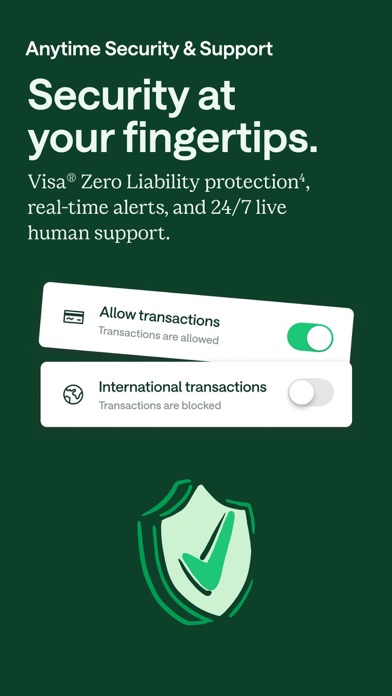

Anytime Security and Support

Keep your money safe with modern security features and 24/7 live customer support. Features like real-time transaction alerts and instant card blocking ensure your finances remain protected.

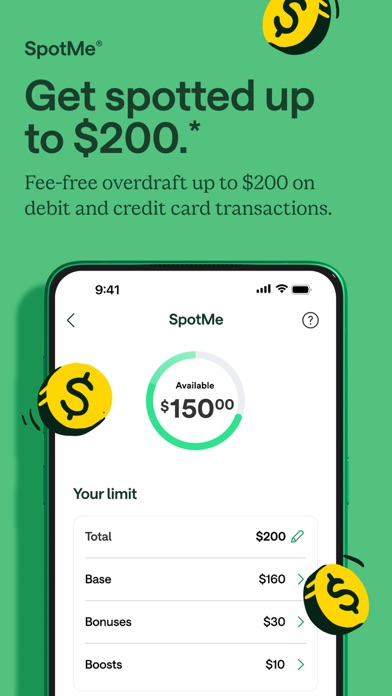

SpotMe®

Get fee-free overdraft coverage up to $200* on transactions and ATM withdrawals within in-network ATMs, providing peace of mind during emergencies or unexpected expenses.

Banking Service Details

Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A.. The Chime Visa® Debit Card and Chime Credit Builder Visa® Credit Card are issued pursuant to licenses from Visa U.S.A. Inc. and can be used wherever Visa debit or credit cards are accepted.

The MyPay® line of credit is provided by the same banking partners. Chime has been highly recommended by users, earning a top spot as the #1 most loved banking app per the 2024 Qualtrics® NPS score.

Additional Highlights

Chime emphasizes a simple, user-friendly experience. Even if you’re new to digital banking, the app’s clean layout and straightforward navigation ensure that managing your finances is effortless. Its focus on no hidden fees, a broad network of fee-free ATMs, and innovative features like automatic savings make it stand out in the crowded fintech market.

The app also prioritizes security with bank-level protocols, instant transaction notifications, and password protection. Features like mobile check deposit and instant fund transfers help you handle your finances conveniently, without the need to visit a bank branch.

Whether you're aiming to build credit, save more efficiently, or simply manage daily expenses better, Chime – Mobile Banking provides a comprehensive digital banking solution tailored to fit seamlessly into your lifestyle. Its modern approach to banking makes it an ideal choice for anyone seeking a trustworthy, cost-effective, and feature-rich financial companion.

Pros

- No monthly fees or overdraft charges

- Early access to direct deposits

- Overdraft protection without fees

- Easy-to-use mobile application

- Instant transaction alerts

Cons

- Limited options for cash deposits

- Absence of physical branch locations

- ATM withdrawal limits

- Lack of joint account features

- Limited customer support availability