Introducing Zelle®: A Fast and Secure Way to Send Money

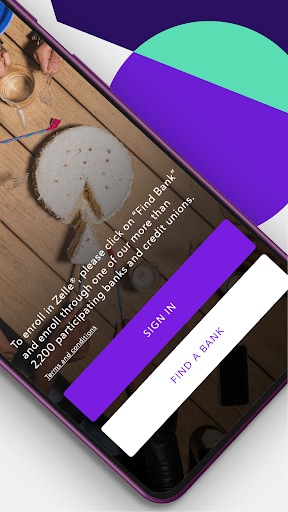

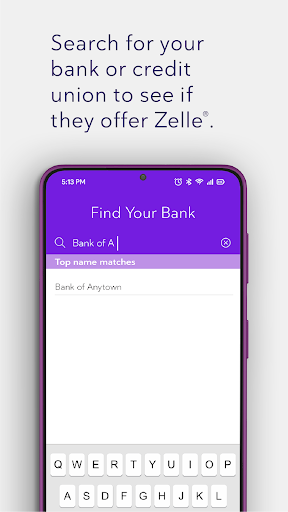

Zelle® is an innovative peer-to-peer payment service that simplifies transferring money between bank accounts. Whether you want to send cash to friends and family or settle payments quickly, Zelle® offers a seamless experience integrated directly into your banking app or online banking platform. With over 2,200 banks and credit unions across the United States supporting Zelle®, it has become a popular choice for effortless financial transactions. The service’s wide acceptance means you can easily locate participating banks or credit unions through the Zelle® app or your bank's digital platform.

The Benefits of Using Zelle®

Convenience and Speed

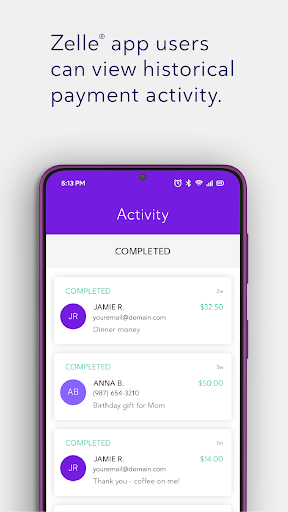

Zelle® makes sending money as simple as sending a text message. Once you've linked your bank account, you can transfer funds almost instantly—often within minutes. This rapid transfer capability surpasses many other payment methods, making it ideal for urgent situations like splitting bills, paying rent, or reimbursing friends for shared expenses.

Ease of Setup

Getting started with Zelle® is straightforward. If your bank supports Zelle®, simply find the Zelle® option within your banking app or website and follow the enrollment prompts. If your bank hasn't partnered with Zelle® yet, you can still use the service by downloading the standalone Zelle® app and signing up with your debit card. After setup, sending money involves selecting a contact, entering an amount, and confirming the transaction—all in a matter of moments.

Security and Reliability

Security is a top priority with Zelle®. The platform leverages your bank’s existing security measures to protect transactions. Because funds are transferred directly between bank accounts and are not stored in a separate account, the risk of fraud or theft is minimized. Nonetheless, users should double-check recipient details such as phone numbers or email addresses before sending money, as Zelle® transactions are instant and cannot be canceled once initiated.

Why Choose Zelle® for Your Payments?

One of the main reasons people prefer Zelle® is its convenience and speed. Unlike third-party payment services that may charge fees or require additional steps, Zelle® is often integrated directly into your bank's existing mobile or online banking platform, resulting in a streamlined experience. Also, since the service does not hold your funds—transferring money directly from your account—users benefit from added security and simplicity.

Whether you need to split and settle bills, make quick online purchases, or send money to family members, Zelle® offers a reliable solution. Its quick transfer times and no-fee structure make it an attractive choice for many users seeking fast, secure, and hassle-free transactions. In today’s fast-paced world, having a tool like Zelle® in your digital banking arsenal means you can handle financial needs swiftly and confidently—truly a financial superhero in your pocket.

Pros

- Instantly transfer money between users.

- No fees for sending or receiving funds.

- Compatible with major U.S. banks.

- User-friendly interface suitable for all ages.

- Secure transactions with encryption.

Cons

- Limited to U.S. bank accounts.

- Lacks buyer protection features.

- Restricted to personal use only.

- Not intended for business transactions.

- Requires both users to have Zelle accounts.

- Payments cannot be canceled once sent.