Introduction to the Capital One Mobile App

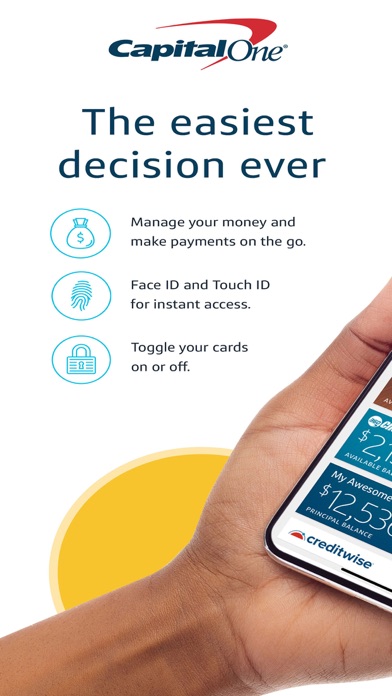

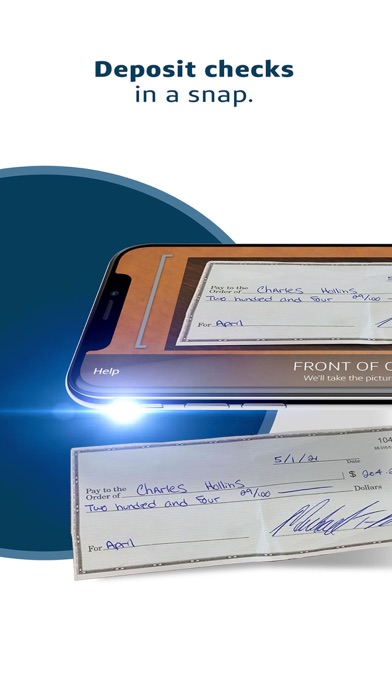

Are you searching for a smarter, more streamlined way to manage your finances on the go? The Capital One Mobile app offers a comprehensive banking experience right at your fingertips. Designed with user convenience and security in mind, this app consolidates all your banking needs into a single, easy-to-navigate interface. Whether you're at home or out in the world, managing your money has never been easier or more secure.

Key Features of the Capital One Mobile App

The Capital One Mobile app packs a variety of powerful features to help you stay in control of your financial life:

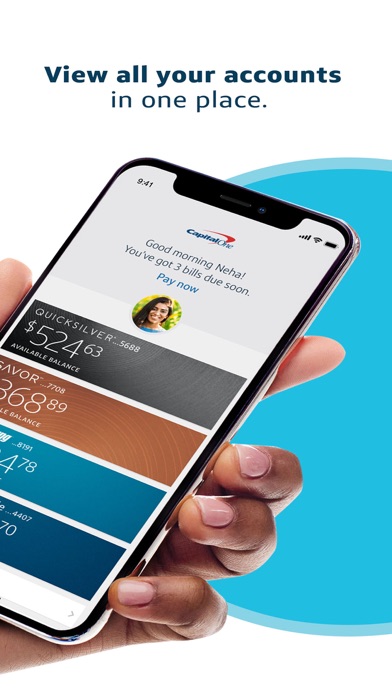

Account Management

Easily view your balances and export account statements, giving you quick access to your financial information. Whether you're checking your savings or checking account, the app provides a clear and organized display of your account details.

Bill Payments & Loan Management

Pay bills seamlessly and stay on top of your loan payments without needing to visit multiple websites or branches. The app makes it simple to handle these tasks directly from your device.

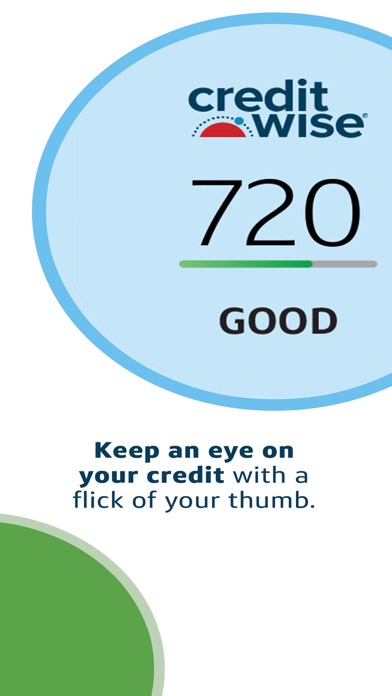

Credit Monitoring with CreditWise

Stay informed about your credit health by using CreditWise. Monitor your credit score and receive alerts about changes, helping you take proactive steps toward improving your financial standing.

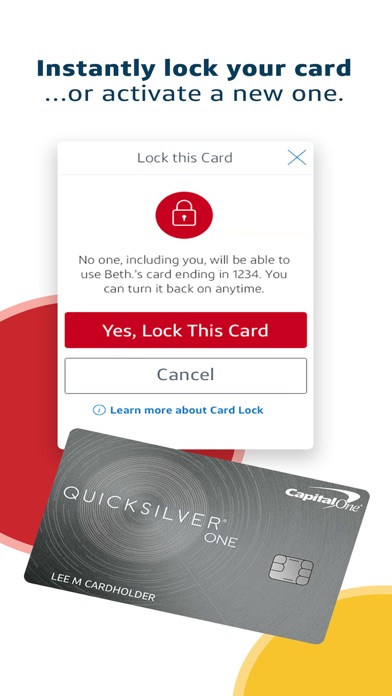

Card Activation & Security

Activate your credit or debit card instantly when needed, and quickly lock your card in case of loss or suspected fraud—all from within the app. This instant control enhances your security and peace of mind.

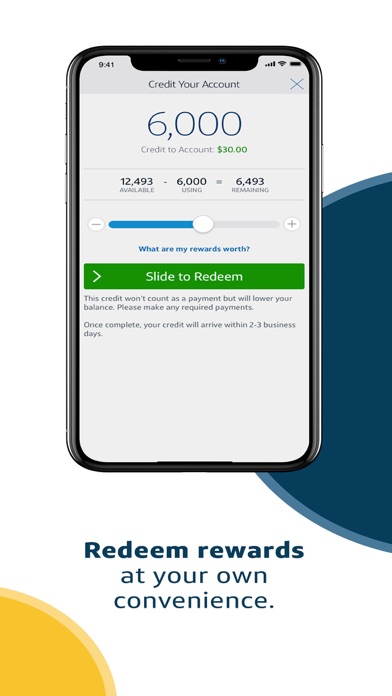

Rewards & Cashback

Redeem rewards effortlessly on the go, making it easy to enjoy the benefits of your Capital One credit cards whenever you want.

Send & Receive Money

Use Zelle® to send and receive money smoothly with friends and family. It's a fast, secure way to handle everyday transactions without the hassle of cash or checks.

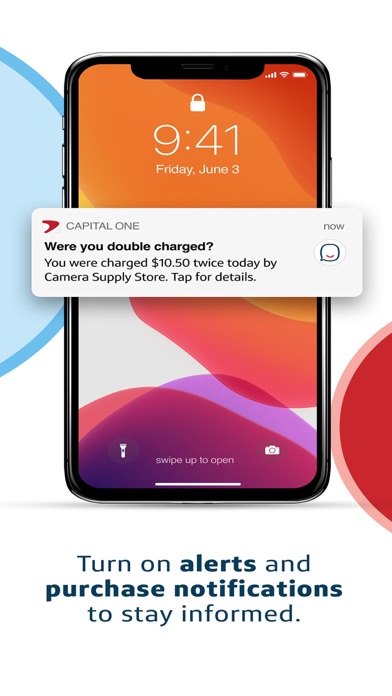

Stay Informed with Alerts

Enable push notifications, purchase alerts, and purchase notifications to stay informed of all activity related to your accounts and cards. Immediate alerts can help you spot suspicious activity quickly.

Transaction Details & Instant Card Lock

View detailed transactions for each of your cards to understand your spending habits better. In case of emergencies, you can instantly lock your card directly from the app.

Personalized Assistance with Eno

Get quick answers and support from Eno, your personal Capital One assistant, to resolve queries or get guidance without waiting on hold.

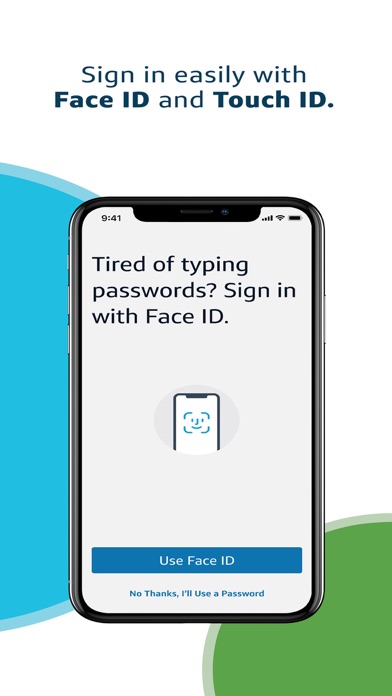

Security and Convenience

Security is a top priority when it comes to managing your finances. The Capital One Mobile app uses biometric login options, such as fingerprint and facial recognition, to provide a secure yet convenient access method. Real-time alerts notify you of suspicious activity, allowing you to respond immediately. Additionally, travel notifications can be set up, ensuring your credit card won’t be declined while you're exploring new destinations. These features make the app a reliable tool for safeguarding your finances while providing flexibility and peace of mind.

How the App Enhances Your Banking Experience

The Capital One Mobile app stands out as a versatile financial assistant that simplifies everyday banking tasks. Its intuitive design and extensive features cater to a broad user base—from tech-savvy millennials to busy professionals seeking hassle-free banking. The ability to manage multiple accounts, pay bills, monitor credit, and control card security all from one platform streamlines your financial life, saves time, and reduces stress. Whether you're tracking spending, ensuring security, or maximizing rewards, this app is your go-to resource for better banking.

Final Thoughts

If managing your finances feels overwhelming or time-consuming, the Capital One Mobile app offers an efficient alternative that keeps you in control. Its combination of robust features, security measures, and user-friendly design makes it an essential tool for modern banking. Download the app today to enjoy a more convenient, secure, and comprehensive way to handle your finances—from anywhere in the world.

Pros

- User-friendly interface

- Comprehensive account management

- Secure login features

- Real-time alerts

- Budgeting tools

Cons

- Occasional app crashes

- Limited customer support

- Slow updates

- Complex navigation for new users

- Requires internet connection for full functionality