Introduction to Rocket Money - Bills & Budgets

Key Features of Rocket Money

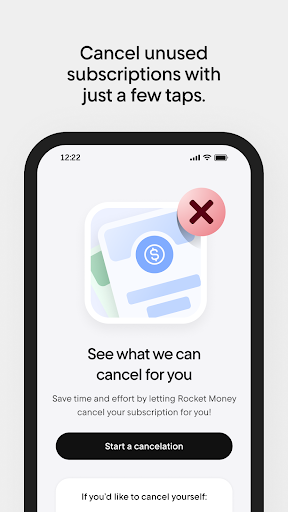

Find and Cancel Forgotten Subscriptions

One of the standout features of Rocket Money is its ability to automatically identify your subscriptions. The app tracks all your recurring payments and helps you cancel unused or forgotten subscriptions with just a few taps. This feature can save you significant money each month and eliminates the hassle of manually searching through bank statements.

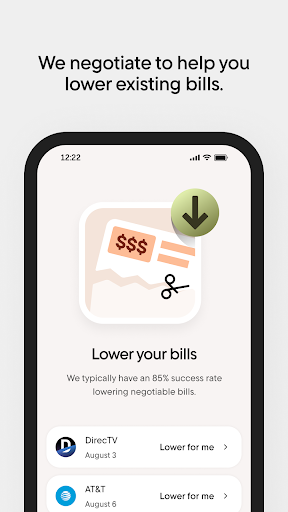

Lower Your Bills and Negotiation

Rocket Money’s concierge service actively helps you lower your bills. By analyzing your current bills, the app can identify opportunities for savings and even negotiate on your behalf to secure better rates. This proactive approach ensures you're not overpaying for services like cable, internet, or insurance.

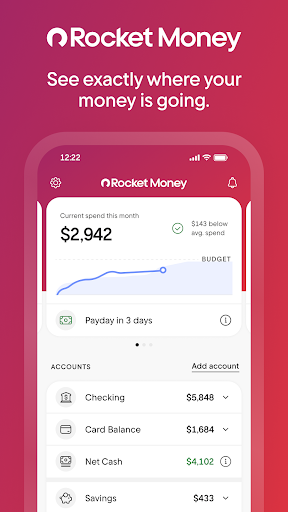

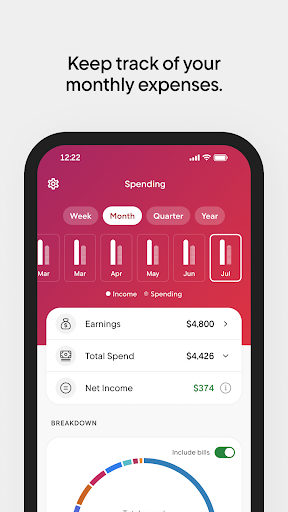

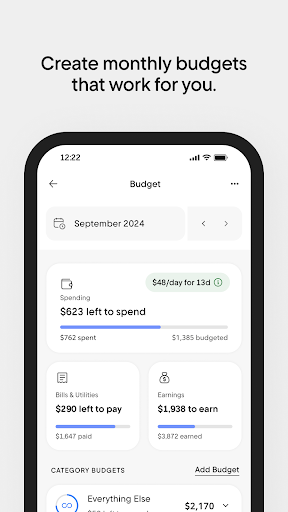

Expense Tracking and Budgeting

The app seamlessly connects to your bank accounts and credit cards, automatically categorizing your transactions. This allows you to monitor your monthly expenses in real-time, avoid overdrafts, and set personalized budgets. Alerts notify you as you approach your spending limits, aiding you in staying on target.

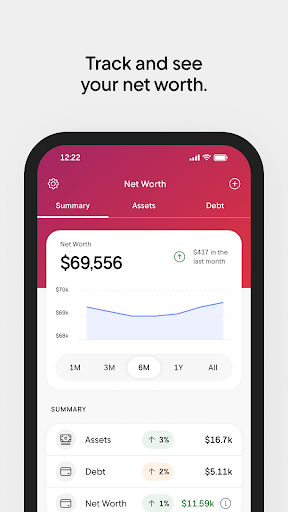

Automated Savings and Net Worth Monitoring

Put your savings on autopilot by setting your savings goals, choosing a preferred frequency and amount, and letting the app do the rest. Rocket Money also helps you track and grow your net worth by providing a clear overview of your assets, debts, and investments. This holistic view enables you to measure your financial progress over time.

Additional Benefits

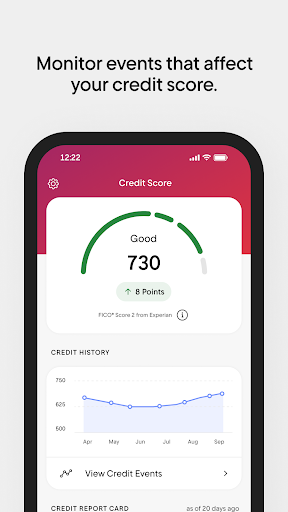

Security is a top priority, and Rocket Money employs bank-level encryption to protect your data. The app also helps you monitor your credit score so you can stay informed about your financial health and work toward improving it. Overall, Rocket Money integrates multiple essential financial management tools into a single, easy-to-use platform, making it a must-have personal finance app.

User Experience and Personal Insights

Pros

- Intuitive user interface

- Comprehensive budgeting tools

- Bill tracking feature

- Real-time spending alerts

- Secure data encryption

Cons

- Limited free features

- Occasional syncing issues

- Ads in the free version

- No support for joint accounts

- Customer support response time