Introduction to Experian: Your Personal Financial Powerhouse

Getting Started: Easy Setup and User-Friendly Experience

Key Features that Empower Your Financial Journey

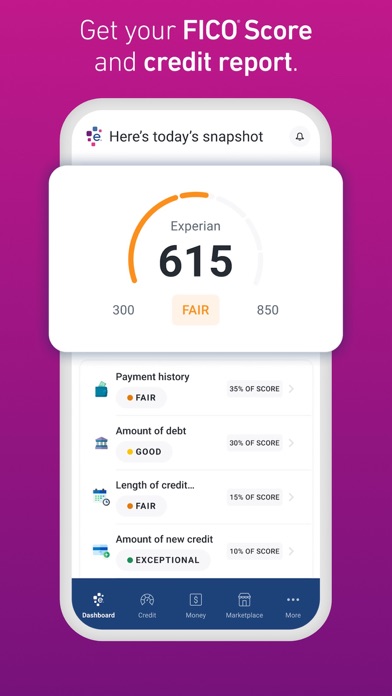

One of the standout features of Experian is its ability to provide a free credit score check. Yes, absolutely free! This feature allows you to monitor your FICO® Score and credit report regularly—up to once every 30 days—without impacting your credit score. It’s an invaluable tool for keeping tabs on your financial health and understanding what factors influence your credit standing.

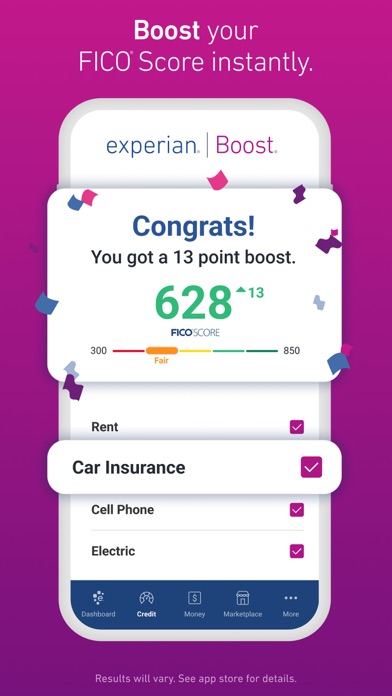

But that’s not all. Experian Boost® is a revolutionary tool that enables you to enhance your FICO® Score by including your on-time payments for bills you’re probably already paying, such as your cell phone, utilities, video streaming services, and eligible rent payments. This feature can help raise your score, opening doors to better loan and credit card offers.

Additionally, the app offers personalized insights and recommendations based on your credit profile. It guides you on how to improve your credit score, alerts you about potential fraud, and helps you understand the factors that help or hurt your financial standing. For example, if a new inquiry appears or an account is opened in your name, you’ll receive timely notifications through push alerts, keeping you informed of any suspicious activity.

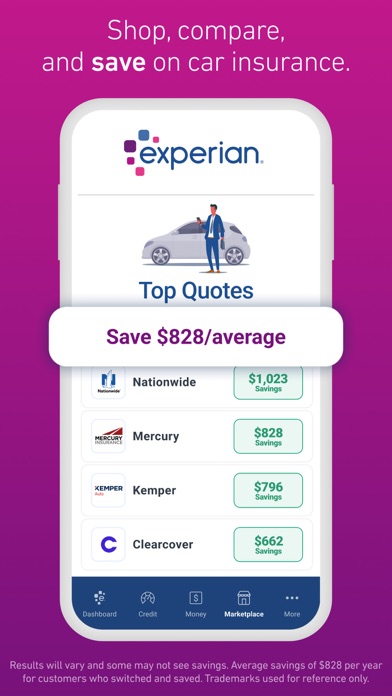

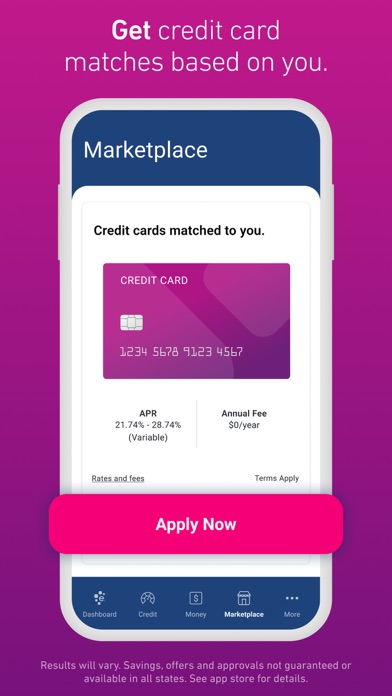

For those looking to compare insurance options, the Marketplace feature allows you to evaluate credit card, loan, and auto insurance quotes tailored to your credit profile—all within minutes.

Premium Benefits: Enhancing Your Financial Power

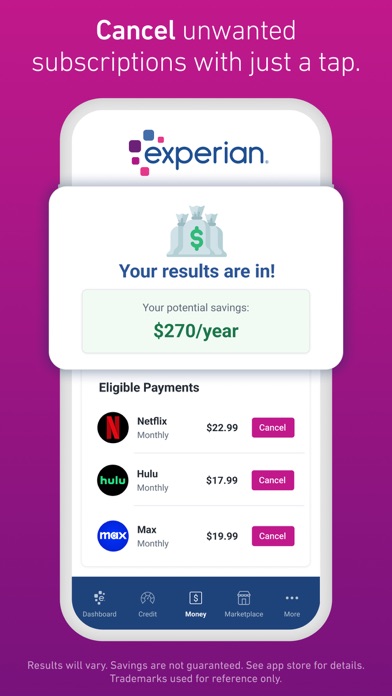

The app also offers premium services like bill negotiation and subscription cancellation. Our team of experts can help you negotiate lower bills—from cable to internet, insurance, and more—and cancel unwanted subscriptions, saving you time and money. Note that results vary, and not all bills are eligible, but the potential savings make this a valuable addition for those aiming to optimize their expenses.

Furthermore, Experian Smart Money™ introduces a digital checking account that helps build credit without incurring debt. This account connects seamlessly with Experian Boostø, enabling a comprehensive approach to improving your credit and financial health.

Terms and conditions apply, and the app’s features are designed to provide users with practical tools to boost their creditworthiness and manage their finances better. Whether it’s checking your credit report, improving your score, or comparing financial products, Experian supports your journey toward financial empowerment.

Why Choose Experian? The Benefits and Impact

In a world where financial stability is key, Experian acts as your personal financial assistant, offering detailed insights and actionable advice to help you take control of your credit and financial future. The app’s ability to track your spending habits over time provides a clear picture of your financial behavior, making budgeting less of a chore and more of a strategic game plan.

By offering real-time updates and personalized alerts, Experian helps you stay proactive about your financial health. Whether it’s checking your credit report, understanding the factors impacting your score, or getting notified about suspicious activity, this app empowers you with knowledge and tools necessary for financial success.

Overall, Experian is a powerful all-in-one platform that combines convenience, valuable insights, and practical features. It’s like having a personal financial advisor in your pocket—minus the hefty fees. For anyone dedicated to maintaining good credit, improving their score, or exploring new financial products, Experian is an essential app to keep on your device. Take control of your finances today and see how this innovative app can help you achieve your financial goals.

Pros

- Access to detailed credit reports.

- Intuitive and easy-to-use interface.

- Credit scores updated in real-time.

- Provides tailored financial advice.

- Includes protection against identity theft.

Cons

- Requires submitting personal information during setup.

- Some functionalities require a paid subscription.

- App may occasionally experience slowdowns.

- Customer support is available only during limited hours.

- Notifications can become excessive.