TurboTax: File Your Tax Return

Are you tired of the stress and complexity that often come with tax season? TurboTax: File Your Tax Return offers a seamless and user-friendly solution to make filing your taxes easier, faster, and more accurate. Whether you're a beginner or an experienced taxpayer, this app is designed to fit various tax situations and help you maximize your refund with confidence.

Key Features and Benefits

File with Confidence and Expert Support

With TurboTax, you can file your taxes with 100% confidence, backed by the assistance of experienced TurboTax Live experts. No lines, no waiting—just expert support right on your phone who can either prepare your taxes for you or assist as you file yourself. The tax return lifetime guarantee ensures that, whether you choose expert help or file independently, you’ll receive your maximum refund with guaranteed 100% accuracy and audit support for up to 7 years.(1)

Behind the scenes, specialized tax analysts work to ensure your return includes all the latest deductions and credits. Additionally, a dedicated quality review team proactively scans your return for accuracy, giving you peace of mind that your filings are correct and compliant with current tax laws.

Speedy Refunds and Financial Benefits

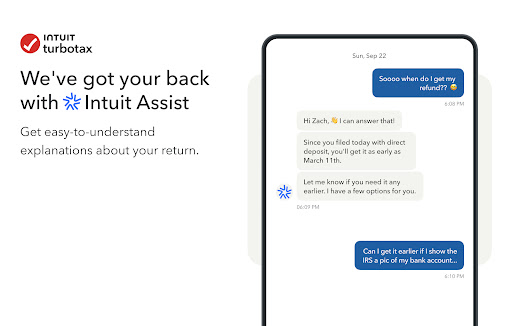

Get Money Fast: With TurboTax, you can receive your federal tax refund up to 5 days early before the IRS processes it, directly into your bank account for a small fee. This feature helps you access your refund quicker, giving you financial relief sooner during tax season.(2)

Choose the service that best suits your needs—whether you want a professional to handle your taxes from start to finish or prefer to do it yourself with expert guidance. TurboTax offers a variety of options, allowing you to file confidently while taking advantage of built-in features designed to optimize your refund.

Different Tax Filing Options

TurboTax Live Full Service

Let a tax expert do your taxes from start to finish. After being matched with an expert tailored to your unique situation, they will handle everything real-time, ensuring your return is 100% accurate before signing and filing. You can rest assured that you’re getting the best possible outcome.

TurboTax Live Assisted

File your taxes with professional help at your side. An expert will walk you through the process, explain your taxes, and help fix any errors. Once finished, they will perform a final review, guaranteeing your return is done right.

File Your Own Taxes

If you prefer to handle your taxes independently, you can add your forms, answer a few simple questions, and let TurboTax guide you. The CompleteCheckTM review feature then guarantees your return's accuracy before submission.

TurboTax Free Edition

For those with simple filings, the Free Edition allows you to file federal and state returns at no cost. It’s ideal for straightforward Form 1040 filings and excludes most schedules except for certain credits like Earned Income Tax Credit, Child Tax Credit, and Student Loan Interest. Approximately 37% of taxpayers qualify for this free option.

Convenient Features to Make Filing Easier

Speed and Ease of Use

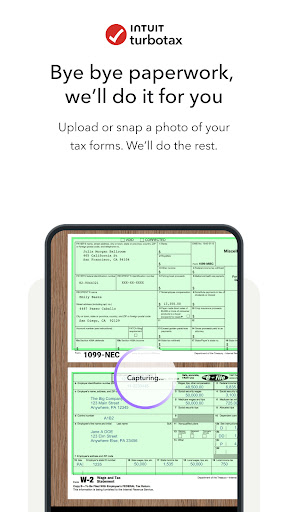

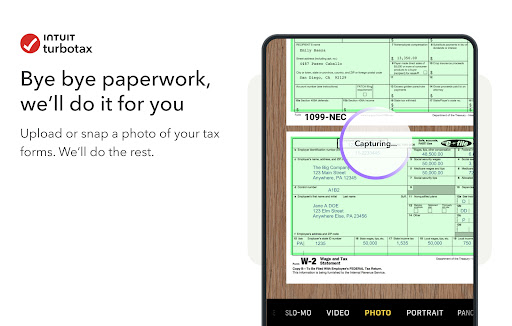

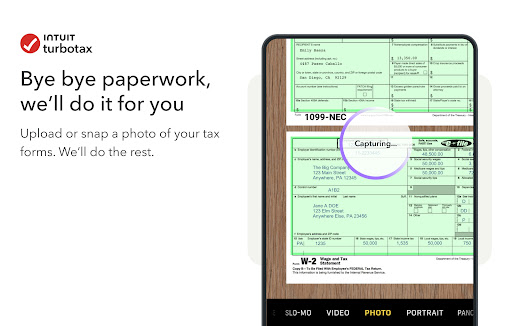

TurboTax’s app enables you to file 30% faster* compared to the website by simplifying the process. You can quickly upload your documents through photos or import your forms directly from your employer or financial institutions, with auto-fill features that save time and reduce manual errors.

Language Support and Accessibility

The app offers bilingual support with options to toggle between English and Spanish. Bilingual experts are available to assist you in your preferred language, ensuring a smooth filing experience for everyone.

Why Choose TurboTax for Your Tax Filing Needs?

TurboTax has revolutionized the way Americans approach tax season, transforming it from a daunting chore into a streamlined process. Its combination of intelligent automation, expert assistance, and user-friendly design makes it one of the top choices for tax filers nationwide. Whether you’re a self-employed freelancer, a small business owner, or someone with a simple tax situation, TurboTax can adapt to your needs, helping you claim all eligible deductions and credits to maximize your refund.

Moreover, the app prioritizes security, adhering to top-notch data protection standards to keep your personal information safe. Its integration with numerous financial institutions means you can import data effortlessly, significantly reducing the chance of errors.

Incorporating variations of keywords like tax filing app, online tax software, file taxes easily, and maximize tax refund naturally throughout the content, TurboTax ensures enhanced visibility and SEO performance. Its comprehensive features, reliability, and ease of use make it a highly recommended solution for stress-free tax season management.

Disclaimer: Guarantees and features are subject to terms of service. Please review the official TurboTax website for full details.

Pros

- User-friendly interface facilitating easy navigation.

- Complete coverage and accurate calculations for taxes.

- Integrates seamlessly with QuickBooks for business users.

- Provides step-by-step guidance for first-time filers.

- Guarantees maximum refund for users.

Cons

- Premium features are accessible only through subscription.

- Limited support from human agents without additional payment.

- Users have reported occasional software bugs.

- Complex tax situations may require professional assistance.

- Additional fees apply for state tax returns.