Introduction to the Affirm App

The Affirm app is revolutionizing the way consumers approach shopping by offering flexible buy now, pay over time options. Whether you're shopping online, in-store, or within the app itself, Affirm provides a seamless financing solution that enables you to purchase the products you love without immediate full payment. One of the standout features is the Affirm Card™, a Visa–accepting debit card available to eligible users in the United States, allowing for further convenience and versatility in your spending.

Key Features and Benefits of the Affirm App

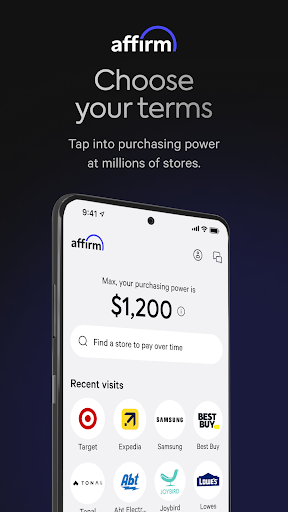

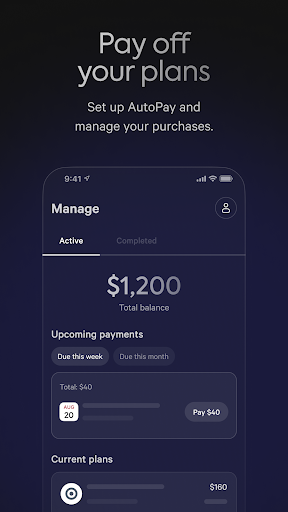

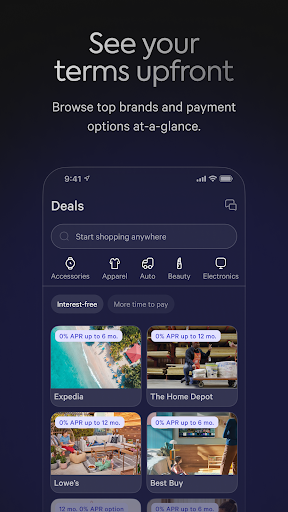

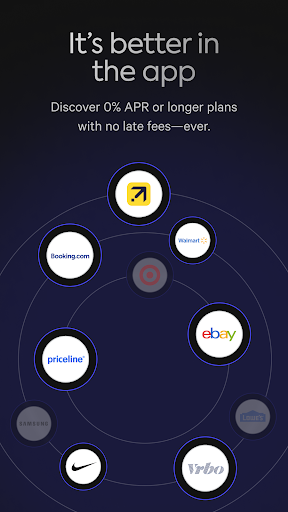

With the Affirm app, users gain access to a variety of tools designed to enhance the shopping experience. You can easily view your purchasing power upfront, which helps in planning your spend wisely. The app supports purchasing from numerous brands that offer clear, flexible payment options, including 0% APR plans and installment options spanning over 12 months. Managing your payments is straightforward—you can set up AutoPay or make early or one-time payments conveniently through the app. Additionally, if you qualify, you can request to pay over time with the Affirm Card™ online or in-store, streamlining your purchase process.

The Affirm Card™: Your Portable Payment Solution

The Affirm Card™ is designed for on-the-go shopping. It’s a physical VisaⓇ debit card issued by Evolve Bank & Trust, offering broad acceptance across the U.S. in numerous stores, both online and offline. Applying for the card does not impact your credit score, and there are no associated card or annual fees. With this card, you can access 0% APR options or choose flexible plans at top brands. Before or after checkout, you can request a payment plan directly within the app, giving you greater control and flexibility over your spending.

How Does Affirm Work?

Using Affirm is simple and transparent. When shopping at participating retailers, select Affirm during checkout and choose your preferred payment plan. The app will display your estimated purchasing power and the installment details upfront, helping you make informed decisions. In many cases, no credit impact is involved, and approval is quick, provided you meet the eligibility requirements. Keep in mind that minimum purchase amounts may apply for certain plans, and approval is not guaranteed. You can opt for plans like 4 interest-free payments or installment plans spanning over 12 months, with varying< strong> interest rates from 0% up to 36% APR depending on the plan and purchase.

Why Consumers Love Affirm

Many users appreciate how Affirm makes shopping less stressful by breaking down payments into manageable chunks. This eliminates the immediate financial burden and allows for spontaneous purchases without guilt. The app is intuitive and easy to navigate, enabling you to manage your payments effortlessly. Whether you’re buying a big-ticket item or a small gadget, Affirm offers a tailored< strong> payment plan that fits your budget. It’s an excellent tool for savvy shoppers who want to enjoy their shopping sprees without sacrificing financial stability.

Important Considerations

While Affirm is a valuable financial tool, responsible usage is essential. You should carefully review your spending limits and interest rates before committing to a plan. Sometimes, you might access 0% APR deals, but other times, applicable< strong> interest rates could be higher. Remember, the minimum purchase amounts and potential down payments vary depending on the plan and state regulations. Affirm does not guarantee approval for every purchase, so understanding your financial commitments beforehand is vital. Always shop responsibly and consider your ability to meet repayment obligations.

Conclusion: A Smarter Shopping Companion

Overall, the Affirm app is a game-changer for anyone looking to blend flexible financing with everyday shopping. Whether you want to spread payments over months or use the Affirm Card™ for in-store purchases, this platform empowers consumers with transparency, convenience, and control. It simplifies managing buy now, pay later plans and helps avoid the pitfalls of credit debt while enabling you to enjoy the products you love today. If you’re interested in making smarter, more flexible purchases, giving Affirm a try might just revolutionize your shopping experience—just shop responsibly!

Pros

- Offers flexible payment options for users.

- Does not involve hidden fees or late charges.

- Features an easy-to-use interface.

- Provides access to a broad network of partner retailers.

- Offers instant approval for applications.

Cons

- Available only at certain retailers.

- Requires a soft credit check.

- Not applicable for all types of purchases.

- Risk of overspending.

- Interest charges may be applicable.