Introduction to IRS2Go: Your Ultimate Tax Companion App

The IRS2Go app is the official mobile application of the Internal Revenue Service (IRS), designed to make your tax experience more manageable and less stressful. Available for both Android and iOS devices, this user-friendly app provides a convenient way to check your refund status, make payments, access free tax help, and stay updated with the latest IRS news. Whether you're a seasoned taxpayer or a first-timer, IRS2Go acts as your personal digital assistant during tax season and beyond, ensuring you have quick and secure access to essential tax services anytime and anywhere.

Core Features of IRS2Go

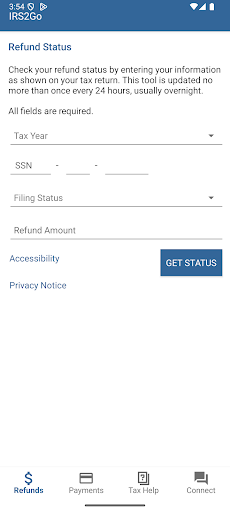

Check Your Refund Status

One of the most valuable features of IRS2Go is the ability to track your refund. After you file your taxes, waiting for the IRS to process your refund can be nerve-wracking. With this app, you can easily check the status of your refund by entering your Social Security Number, filing status, and the exact amount of your expected refund. This saves you time and eliminates unnecessary phone calls or website navigation, letting you stay informed effortlessly.

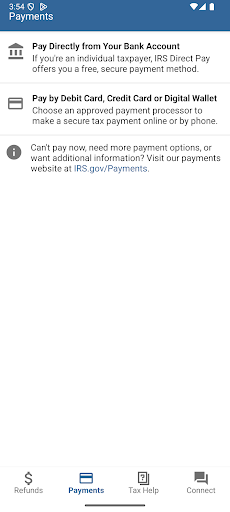

Make Secure Tax Payments

The app simplifies the payment process by allowing you to pay your taxes directly through your device. Support for multiple payment options — including bank transfers, credit card payments, and IRS Direct Pay — ensures flexibility and convenience. The secure handling of your payment information gives you peace of mind, removing worries associated with traditional check payments or mailing delays.

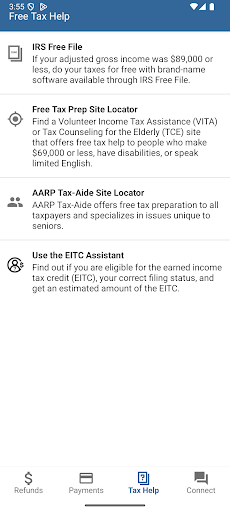

Access Helpful Tax Tips

During tax season, every little bit of advice counts. IRS2Go offers regularly updated tax tips that can help you better understand the complex tax process, identify potential deductions, and optimize your tax return. Think of it as having a mini tax advisor on your smartphone, guiding you to make smarter financial decisions.

Find Free Tax Assistance Locations

The app includes features to locate nearby Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) sites that provide free tax preparation help for eligible taxpayers. Using your device's location data, IRS2Go helps you find the most convenient assistance centers, making tax help accessible even during busy times.

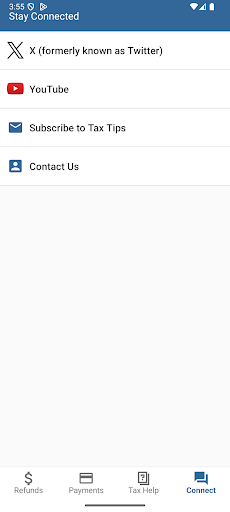

Stay Updated with IRS News

Keeping current with IRS announcements, tax law changes, and important deadlines is crucial. IRS2Go provides the latest news updates from the IRS, helping you stay informed and plan accordingly throughout the year.

Permissions and Security

When installing IRS2Go, you might notice permissions such as location, phone, and Photos/Media/Files. These are utilized to offer features like finding nearby assistance centers and saving map data to your device for offline access. Rest assured, the app employs industry-standard security protocols to protect your sensitive data during all transactions and interactions. The privacy and security measures underpinning IRS2Go ensure that your information remains safe while you use the app for essential tax-related activities.

Conclusion: Why IRS2Go Should Be Part of Your Digital Tax Toolkit

Tax season can often feel overwhelming, but with the IRS2Go app in your pocket, handling your taxes becomes more straightforward and less stressful. Its intuitive design, combined with powerful features like refund tracking, payment processing, and access to free tax help, make IRS2Go an indispensable tool for modern taxpayers. By offering timely updates, easy navigation, and secure services, this app helps you stay on top of your tax obligations and potentially saves you both time and money. Incorporating IRS2Go into your financial routine ensures you are well-prepared to tackle tax season with confidence, anytime and anywhere.

Pros

- User-friendly and straightforward interface.

- Real-time updates on refund status.

- Secure and encrypted data transfer.

- Free to use without advertisements.

- Quick access to tax records and payment history.

Cons

- Fewer features compared to the desktop version.

- Needs internet connection for updates.

- No option for in-app tax filing.

- Occasional server outages.

- Limited customer support within the app.