Introduction to Venmo

Venmo is the fast, safe, and social way to pay and get paid. With over 90+ million users worldwide, Venmo has established itself as a leading mobile payment platform that seamlessly connects friends and helps manage shared expenses. Whether you're splitting rent, paying for a gift, or settling a dinner bill, Venmo offers a convenient solution for everyday money transactions.

Key Features of Venmo

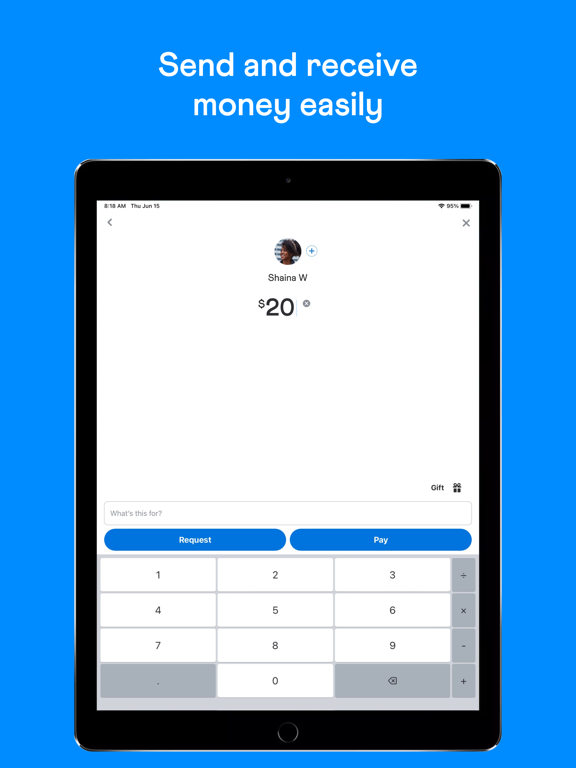

Send and Receive Money

Venmo allows users to quickly pay and get paid for any amount. You can add a note to each transaction to share the purpose or simply connect with friends in a fun and personal way.

Split a Request Among Multiple Friends

Need to divide a bill? Venmo enables you to send a payment request to multiple friends simultaneously and customize the amounts each person owes, making group expenses hassle-free.

Venmo Credit Card & Rewards

Earn up to 3% cash back on your top spending categories with the Venmo Credit Card. Use it for purchases everywhere Visa® is accepted, split card purchases with friends, and enjoy rewards in your daily transactions.

Buy Crypto with as Little as $1

Venmo provides a platform to buy, hold, and sell cryptocurrency directly within the app. For those exploring digital assets, in-app resources are available to learn more, but users should be aware of crypto's volatile nature.

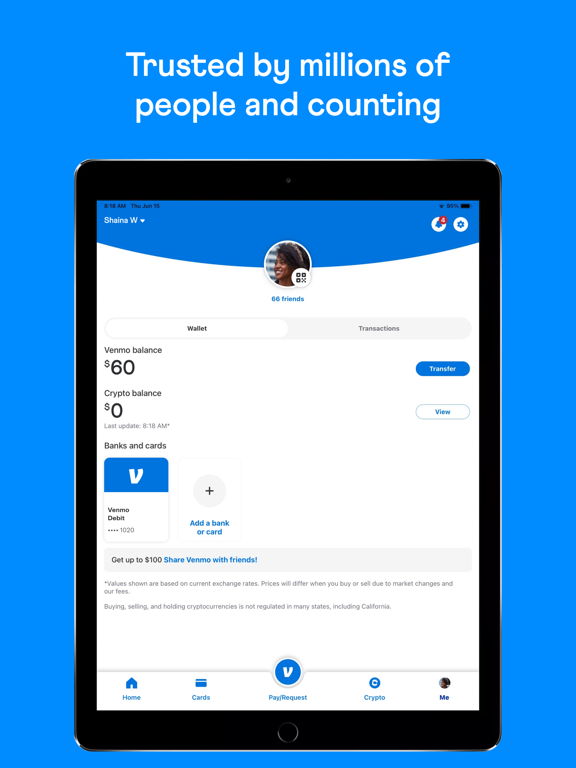

Venmo Debit Card & Shopping

The Venmo Debit Card allows you to spend your Venmo balance everywhere Mastercard® is accepted worldwide, earning cashback at select merchants. Terms apply, and more details can be found on their official site.

Venmo Teen Accounts

For users aged 13-17, Venmo offers Teen Accounts with a debit card and the ability to send money to trusted friends and family—all without minimum balances or monthly fees.

Business & Online Payments

Create a business profile to manage side gigs or small businesses within the same Venmo account. Plus, make payments in apps and online at services like Uber Eats, StockX, and Grubhub.

Manage Your Money Efficiently

Instant Transfer allows you to move money to your bank account in minutes. You can also set up Direct Deposit to receive your paycheck up to two days early, enhancing your financial flexibility.

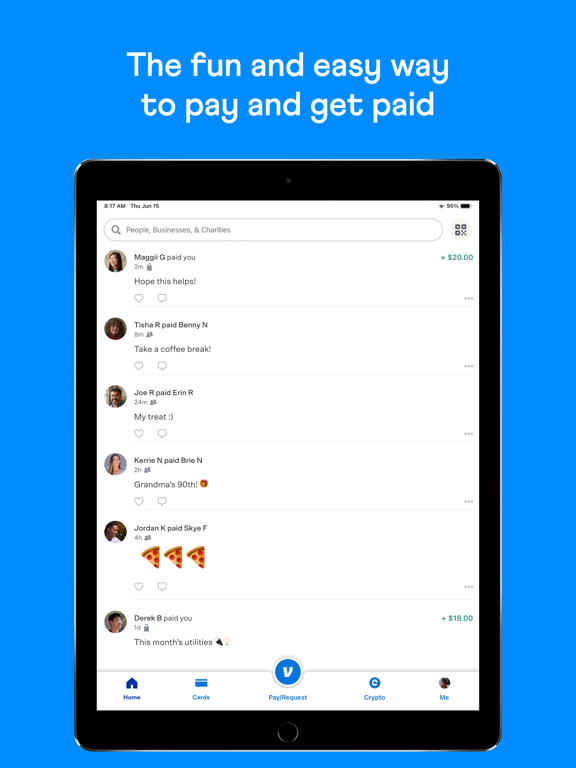

The Social Side of Venmo

One of Venmo's standout features is its social feed. It’s akin to a social media platform where you can see your friends’ transactions and notes—often decorated with emojis—adding a fun and personal touch to financial interactions. This social aspect makes managing shared expenses more engaging and transparent.

The app’s user-friendly interface ensures easy navigation. Setting up your account, linking bank accounts or cards, and sending money can all be done in just a few simple steps, making Venmo accessible even for those new to digital payments.

Security is a top priority. Venmo employs robust encryption and security measures, including options like PIN or fingerprint authentication, to keep your account safe. Users are encouraged to keep their app updated to benefit from the latest security enhancements.

Overall, Venmo combines convenience with a social twist, transforming routine money transactions into an effortless and sometimes entertaining experience. Whether you’re splitting bills, earning rewards, or exploring cryptocurrencies, Venmo has become an essential app for modern financial management.

Pros

- User-friendly interface

- Fast and efficient money transfers

- Robust security features

- Widely accepted payment options

- Integration with social media platforms

Cons

- Limited international functionality

- Transaction fees are applicable

- Concerns regarding user privacy

- Customer support challenges

- Periodic app functionality issues