Revolut: Spend, Save, Trade — Your All-in-One Financial App

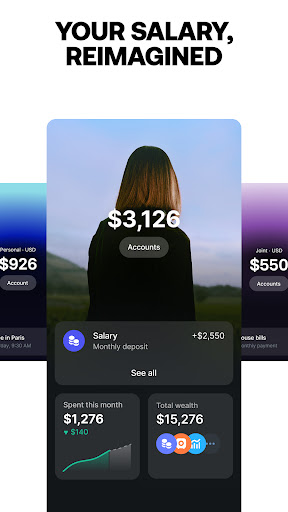

Join the 50+ million customers worldwide who rely on Revolut to spend, send, and save smarter. This innovative app offers a seamless experience that empowers you to take control of your finances, whether you're managing daily expenses, saving for the future, or investing in stocks and cryptocurrencies. Designed with user convenience in mind, Revolut combines cutting-edge features with security measures that keep your money protected.

Effortless Spending and International Freedom

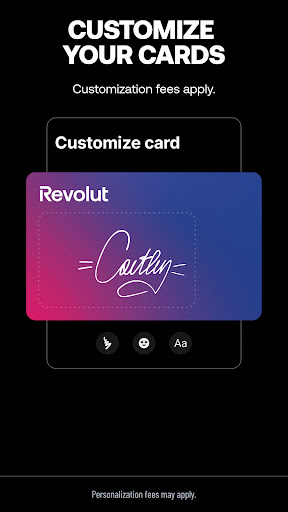

With Revolut, you can make your spend truly well-spent through multiple payment options: utilize physical cards, generate virtual cards, or opt for single-use virtual cards for an extra layer of protection. Whether shopping locally or abroad, enjoy great exchange rates when paying in different currencies (additional fees may apply). You can access over 55,000 ATMs worldwide without any fees, making cash withdrawals convenient wherever you go.

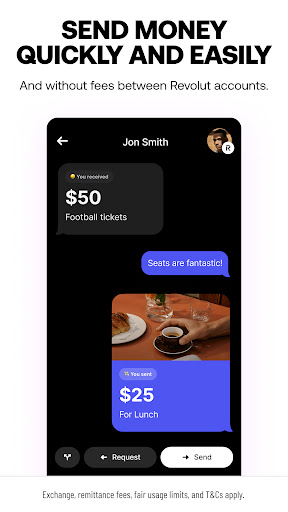

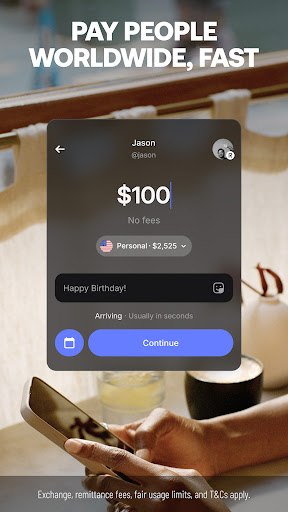

Streamlined Money Management

Link external bank accounts to stay on top of all your spending and manage your finances effortlessly. Design a physical card that matches your vibe (fees may apply), or set up a Revolut <18 account for kids to learn about money in a fun and safe way—complete with their own card. Need to send money? Quickly transfer in 25+ currencies with just a tap, wherever your recipient is. Use the chat feature to send or receive money, share GIFs, and split bills seamlessly, keeping everything organized in one place.

Smart Savings and Growing Your Money

Revolut offers Savings Vaults that let you grow your money up to 4.25% APY (*variable rate as of October 20th, 2023), with the flexibility to access your savings anytime—no penalties or fees. Set up recurring transfers or round up spare change to accelerate your savings effortlessly. Whether building an emergency fund or saving for a special goal, Revolut makes it easy to develop a healthy savings habit while enjoying peace of mind.

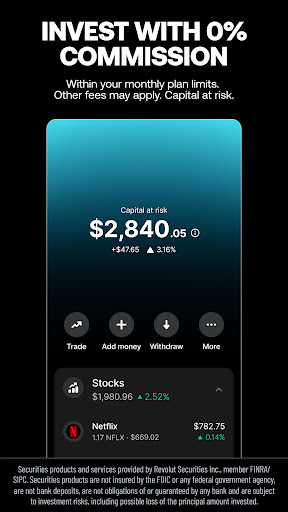

Invest Smartly with Stock Trading

Explore the world of investing with Revolut's Stock Trading feature. Start trading stocks from just $1 (fees may apply) and choose from over 2,000 well-known companies. Enjoy no-commission trading within your monthly allowance—but remember, all investments carry risks, including the potential loss of principal. For those interested in automated investing, Revolut Wealth Inc. offers SEC-registered advisory services, providing a helpful way to diversify and grow wealth over time.

Stay in Control with Advanced Spending Tools

Instant spending notifications keep you aware of every transaction, helping you stay within budget. Use smart budgeting and analytics tools to understand where your money goes, allowing you to control your finances more confidently. Set spending limits and receive notifications to help prevent overspending or missing upcoming payments or subscriptions.

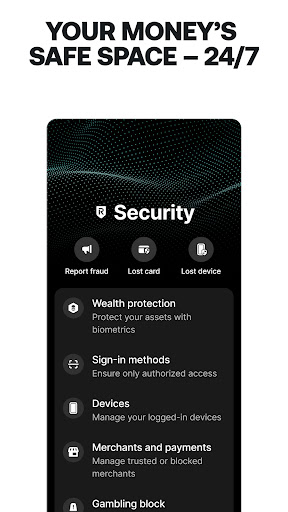

Enhanced Security for Your Peace of Mind

Revolut prioritizes your security with features like card freeze/unfreeze, single-use cards with dynamic details, and capabilities to set spending limits. Its sophisticated fraud prevention system quickly detects high-risk transactions and alerts you instantly, helping to prevent scams. Extensive verification procedures and biometric access add additional layers of protection, ensuring your account remains secure at all times.

Reliable Support and Insurance

Revolut offers 24/7 in-app customer support to assist with any issues. Funds stored on the Prepaid Card are held at or transferred to Lead Bank, a member of FDIC, up to applicable insured limits. This coverage adds an extra layer of security, protecting your money in case of bank failure, provided deposit insurance requirements are met.

Choose Your Plan and Unlock Exclusive Benefits

Upgrade to paid plans such as Premium or Metal to unlock exclusive cards, enhanced benefits, and premium perks—note that applicable fees and T&Cs apply. With these plans, you also gain access to advanced security features, better travel perks, and personalized services to elevate your financial experience.

Conclusion

Revolut: Spend, Save, Trade is more than just a financial app; it’s a comprehensive platform empowering users to manage their money smartly, securely, and effortlessly. Whether you’re spending abroad, saving for future goals, or investing in stocks, Revolut provides all the tools you need in one intuitive interface. Discover financial freedom and start taking charge of your money today—your wallet will thank you.

Pros

- User-friendly interface facilitating easy navigation.

- Offers a broad spectrum of financial services.

- Provides instant notifications for transactions.

- Features transparent pricing with no hidden fees.

- Supports multiple currencies suitable for travel.

Cons

- Limited number of free ATM withdrawals each month.

- Certain features require a premium subscription.

- Customer service responses may be slow.

- Users have reported occasional app glitches.

- Service is not available in all countries worldwide.