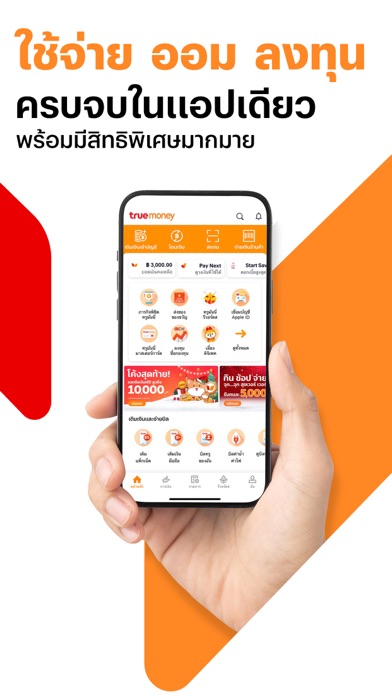

TrueMoney: Thailand’s Leading Digital Payment App

TrueMoney is a comprehensive payment application that has established itself as Thailand’s leading digital wallet for all mobile network users. This all-in-one app offers a secure platform to make cashless payments for a wide range of everyday transactions. Whether it's mobile top-ups, bill payments, or online and offline purchases, TrueMoney simplifies your financial dealings with just a few taps. Its user-friendly interface and robust security features make it a trusted choice for Thais looking to manage their finances conveniently and safely.

Instant Mobile Top-Up Convenience

One of the standout features of TrueMoney is its instant mobile top-up service. Users can top-up their TrueMove H and Dtac prepaid numbers anytime and anywhere. This instant recharge capability eliminates the need to visit stores or use complicated procedures, making sure your mobile balance is always topped-up and ready to go. It's perfect for busy individuals who need quick and reliable mobile credit refills on the go.

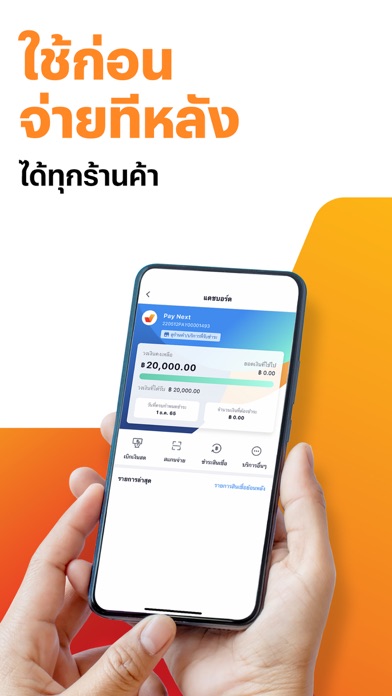

Digital Lending Made Effortless

TrueMoney offers digital lending services that are both secure and legal. Collaborating with two trusted financial institutions, the app provides users with three distinct loan products, featuring rapid approval processes supervised by the Bank of Thailand. These loan options include personal revolving credit lines with flexible terms, suitable for quick financial needs without the hassle of traditional banking procedures.

Loan Products Overview

Ascend Nano (Pay Next Extra) by TrueMoney

- Type: Revolving credit

- Credit limit: Up to 5x of monthly income

- Interest rate: 0% - 25% APR

- Repayment period: Up to 48 months

Digital Personal Loan (Pay Next)

- Type: Revolving credit

- Credit limit: Up to 20,000 THB

- Interest rate: 0% - 25% APR

- Repayment period: Up to 5 months

Kiatnakin Phatra Bank Loan (KKP Cash Now)

- Type: Term loan

- Credit limit: Up to 5x of monthly income

- Interest rate: 8.99% - 25% APR

- Repayment period: 24 to 60 months

Example of Loan Calculation

Suppose a user borrows 10,000 THB with a repayment plan of 5 installments at a 24% annual interest rate. The interest is calculated proportionally for each period, and the installment amounts include both principal and interest. For example, the first installment on April 1 would be approximately 530.40 THB, which covers interest and principal repayment.

Additional fees for cash disbursement vary depending on the amount, ranging from 30 THB to 300 THB. For instance, disbursing amounts less than or equal to 3,000 THB incurs a fee of 30 THB per transaction.

Secure and Trustworthy Transactions

Security is a key priority for TrueMoney. Users can pay with full confidence, knowing their personal and financial information is protected through multi-layered security systems. Features include 24/7 real-time monitoring, face verification, and state-of-the-art data encryption standards. These measures ensure that your transactions are safe from unauthorized access or cyber threats.

Seamless Money Transfers & Payments

TrueMoney makes sending and receiving money effortless and instant, with no transaction fees. Enjoy features like gift envelopes and options to link your account to pay quickly at stores. You can even shop at major Thai retailers such as 7-Eleven, Lotus's, 7Delivery, and thousands of other merchants—both domestically and internationally—without cash. Paying abroad at over 40 destinations becomes just as simple as a few taps on your phone, removing the need for currency exchange or carrying cash.

Shop and Make Digital Purchases Effortlessly

Connect your TrueMoney Wallet to the Google Play Store to buy apps, music, and stickers. You can also purchase in-game items, making it a versatile tool for entertainment and leisure. This integration ensures a seamless shopping experience with no additional fees, further enhancing the convenience of managing your digital life through TrueMoney.

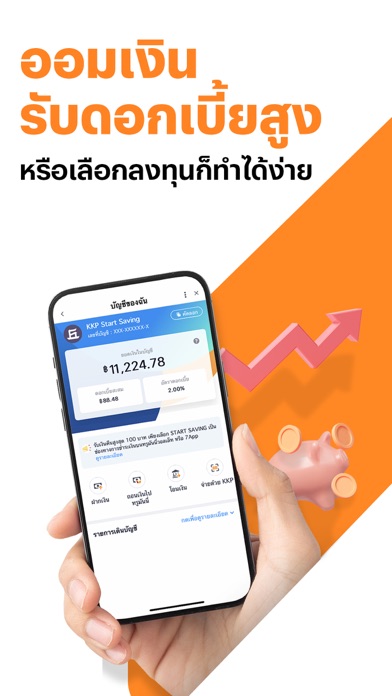

Final Thoughts: Why Choose TrueMoney?

TrueMoney is more than just a digital wallet; it is a comprehensive financial solution tailored to meet the needs of modern users. Whether you're paying utility bills, topping up mobile credits, transferring money internationally, or earning rewards, TrueMoney streamlines each process. Its combination of ease-of-use, security, and diverse features makes it a game-changer in the digital finance landscape in Thailand. Download TrueMoney today and experience a new level of financial freedom and convenience.

Pros

- User-friendly interface for easy navigation.

- Secure transactions with advanced encryption.

- Extensive network of partnered merchants.

- Fast and straightforward bill payments.

- Customer support available 24/7.

Cons

- Limited availability in certain countries.

- Transaction fees may be high.

- Requires a stable internet connection.

- Sometimes experiences app slowdowns or crashes.

- Fewer features compared to competitors.