Overview of PayPal - Pay, Send, Save

PayPal is a smart and secure digital wallet designed to make online and in-store shopping seamless, rewarding, and hassle-free. With this versatile app, users can enjoy earning cashback on favorite brands, sending and requesting money effortlessly, managing cryptocurrency, and even growing savings—all from their mobile device. Whether you're a seasoned online shopper or new to digital payments, PayPal - Pay, Send, Save offers a suite of features tailored to meet your financial needs.

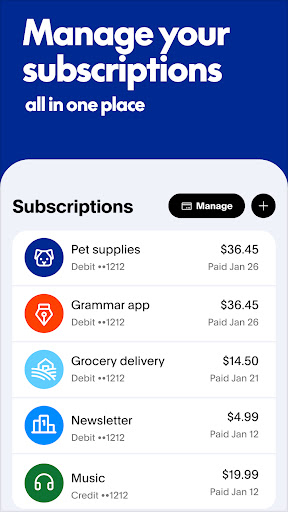

Key Features of PayPal - Pay, Send, Save

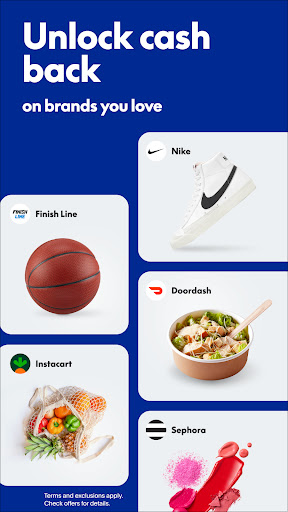

•SAVE OFFERS IN THE APP:

Within the app, you can discover exclusive cashback offers from popular brands. These offers are automatically applied at checkout, simplifying your shopping experience. Eligible items qualify for cashback rewards that you can redeem for cash or other options. Keep in mind that terms and exclusions apply, but this feature helps you save effortlessly on everyday purchases.

•SEND AND REQUEST MONEY FOR FREE:

Sending and requesting money is quick, secure, and free when you use your bank account or PayPal balance within the US for personal transactions. This makes splitting bills, paying rent, or settling expenses with friends and family simple and safe, regardless of where they are located—supporting over 120 countries worldwide.

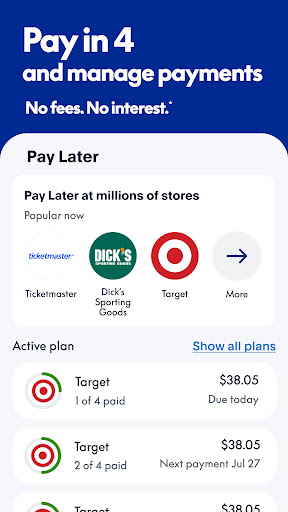

•PAY IN 4 WITH NO LATE FEES:

Enjoy the freedom of splitting purchases between 4 interest-free payments at millions of online stores. This feature is available for purchases ranging from $30 to $1500, with no late fees or impact on your credit score. You can manage your installment plans conveniently within the app, making budget-friendly shopping more accessible.

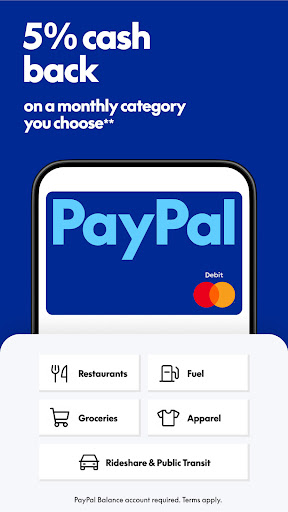

•PAYPAL DEBIT CARD AND CASH BACK:

Request your PayPal Debit Mastercard directly through the app—no credit check required. Shop anywhere Mastercard is accepted using your PayPal balance and earn 5% cash back on a category you select each month, up to $1000 spend per month. This card is issued by The Bancorp Bank, and linked directly to your PayPal Balance account, offering a flexible and rewarding shopping experience.

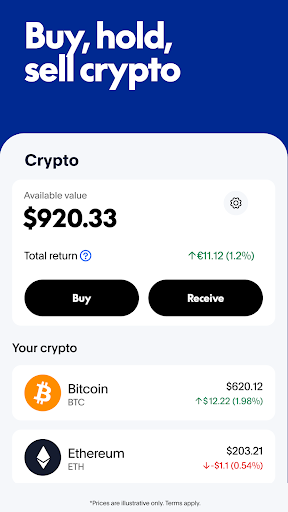

•CRYPTOCURRENCY:

Buy, sell, and hold popular cryptocurrencies such as Bitcoin, Ethereum, PayPal USD, Bitcoin Cash, and Litecoin within the app. Transactions are regulated by licensing from the NY Department of Financial Services. Keep in mind that investing in crypto involves risks, including the potential for significant losses. Always consider consulting a financial advisor before engaging in virtual currency trading.

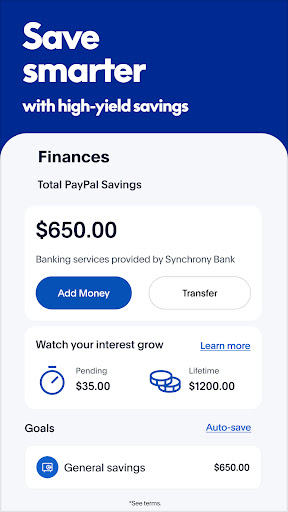

•GROW YOUR MONEY WITH PAYPAL SAVINGS:

Automatically transfer your funds into PayPal Savings and earn a competitive APY that’s variable and subject to change. You can easily manage your savings goals, transfer money, and track your progress—all from the same app. It’s an efficient way to grow your savings without the need for a traditional bank account.

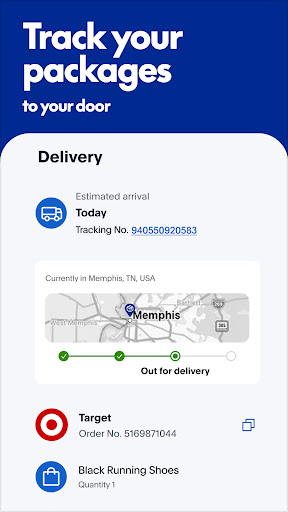

•PACKAGE TRACKING:

Link your Gmail or Outlook accounts to view real-time updates on your orders—including those not paid through PayPal. Track delivery status step-by-step and receive notifications until your package arrives safely, making online shopping more transparent and stress-free.

Final Thoughts

PayPal - Pay, Send, Save has truly revolutionized how I handle everyday financial transactions. Its intuitive interface, security features, and variety of tools—like cashback offers, crypto trading, and savings options—make managing money simpler and more rewarding. From splitting bills and online shopping to growing your savings or exploring cryptocurrencies, this app provides a comprehensive solution for modern financial needs. If you're looking for a trusted, versatile, and user-friendly digital wallet, PayPal - Pay, Send, Save is definitely worth trying. It just might become your favorite financial app for all your money matters.

Pros

- Widely accepted for online payments

- Offers strong security features

- Enables instant money transfers

- Features a user-friendly interface

- Supports multiple currencies

Cons

- High fees for currency conversion

- Account freezes can happen

- Customer support is limited

- App may crash occasionally

- Not available in all countries