Discover the Features and Benefits of MyMoney Pro - Expense & Budget

Today, I want to introduce you to MyMoney Pro - Expense & Budget, a personal finance management app that seamlessly integrates into your daily life. Whether you're looking to track your expenses, set budget goals, or gain clearer insights into your financial habits, this app is designed to be your trusted financial companion. From its user-friendly interface to advanced features like visual analytics and secure data handling, MyMoney Pro makes money management effortless and engaging, helping you take control of your financial future.

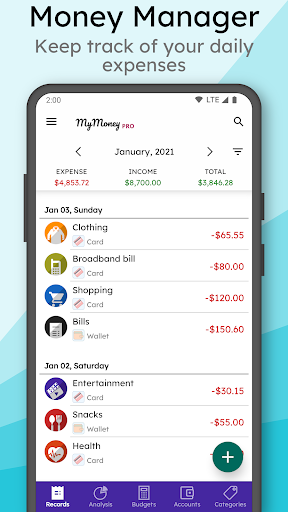

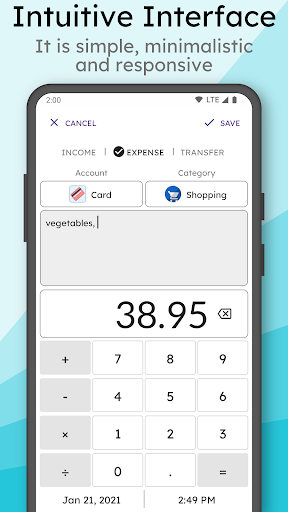

Intuitive Design for Easy Expense Tracking

One of the standout aspects of MyMoney Pro is its straightforward and intuitive interface. You don’t need to be a finance expert to navigate this app; it’s crafted for users of all levels. The main dashboard provides quick access to add your income and expense records—simply input your earnings or spending, and the app automatically categorizes each entry, such as •Categories like Cars, Foods, or Clothing. This organized approach makes tracking your daily spending a breeze without any complicated procedures.

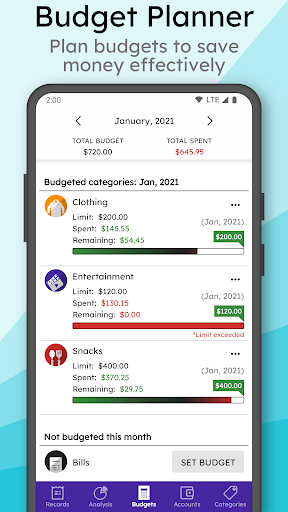

Comprehensive Budget Planning

Setting and maintaining a budget is at the core of financial discipline, and MyMoney Pro excels in this area. The app enables you to plan monthly budgets across various categories and receive gentle reminders when you’re nearing your set limits. For example, if you want to keep your coffee expenses under control, just set a •Budget for Coffee, and the app will help ensure you don’t overspend. This proactive approach encourages responsible spending behavior and supports your savings goals.

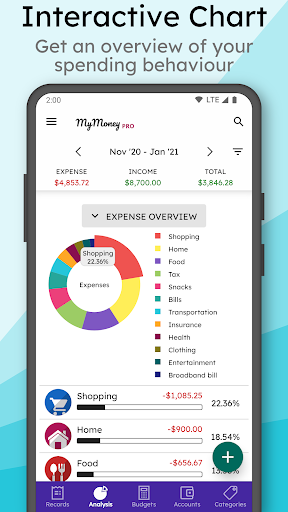

Visual Financial Insights

A picture is worth a thousand words, especially when it comes to finances. MyMoney Pro offers colorful pie charts and bar graphs that present a clear snapshot of your financial health. See exactly where your money is going—whether it’s dining out, shopping, or other categories. These visual analytics help you understand your spending habits, identify areas to cut back, and make informed decisions. It’s like having a financial advisor that visualizes your personal money story.

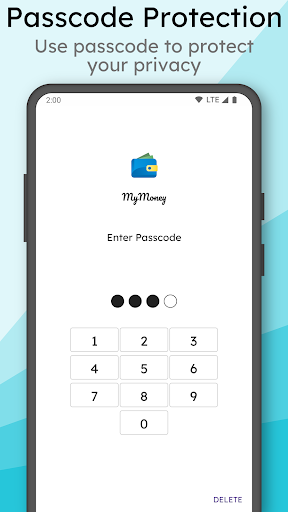

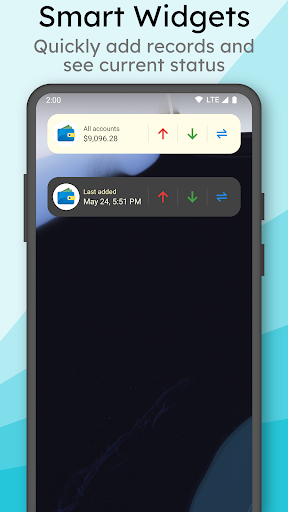

Robust Data Security and Cross-Device Synchronization

Concerned about privacy? Rest assured, MyMoney Pro prioritizes the security of your data. The app encrypts your financial records and supports secure cloud syncing, ensuring your information stays safe whether you access it from your phone or tablet. The seamless synchronization feature guarantees your financial data is always up-to-date across devices, giving you peace of mind and easy access whenever needed.

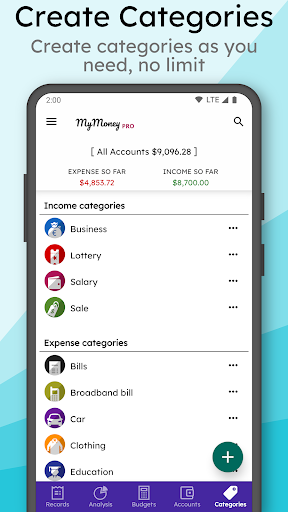

Customizable and Personal-Friendly Settings

Personalization enhances user experience, and MyMoney Pro offers numerous options to tailor the app to your preferences. Choose your preferred currency, decimal precision, and customize categories and icons to match your spending habits. These small details make tracking more intuitive and remind you of a dedicated financial dashboard designed just for you.

Privacy and Backup Control

Your financial privacy is protected with options for data backups and restoration. Export your records for printing or safekeeping, and restore data whenever necessary, so your spending history is preserved securely. This ensures your financial data remains confidential and under your control at all times.

Why Choose MyMoney Pro - Expense & Budget?

If you're searching for a comprehensive yet easy-to-use app to manage your expenses, set budgets, and analyze your financial health, MyMoney Pro ticks all the boxes. It transforms complex money management tasks into simple, enjoyable activities. The app’s visual tools make understanding your finances straightforward, while security features keep your data safe. Plus, with its customizable options and seamless synchronization, you can confidently rely on MyMoney Pro to support your goals of saving more, spending wisely, and gaining financial clarity. Start your journey toward better money management today and see tangible improvements in your financial habits!

Pros

- User-friendly interface

- Easy navigation

- Comprehensive budgeting tools available

- Supports multiple currencies

- Detailed expense tracking features

- Customizable categories for expenses

Cons

- Limited features in the free version

- Lacks integration with banking applications

- Occasional synchronization problems

- Limited customer support options

- Requires frequent updates