Introducing Flex - Rent On Your Schedule

Are you tired of the stress that comes with making your monthly rent payments all at once? Do fluctuating income or unexpected expenses make paying rent a daunting task? Look no further—Flex - Rent On Your Schedule is here to transform how you manage your rental payments. This innovative app provides a flexible solution that allows tenants to split their rent into smaller, more manageable installments, giving you control and peace of mind every month.

What is Flex?

Flex - Rent On Your Schedule is a cutting-edge financial technology app designed to help renters pay their rent in a way that aligns with their personal financial situation. Unlike traditional rent payments, which often require a lump sum upfront, Flex offers a pay-as-you-go model that can be tailored to your income flow. Whether you are a freelancer, gig worker, or someone seeking more flexibility, Flex empowers you to handle rent payments on your own terms. The app functions seamlessly by integrating with your bank account, providing a secure platform to manage your rent effortlessly.

How Does Flex Work?

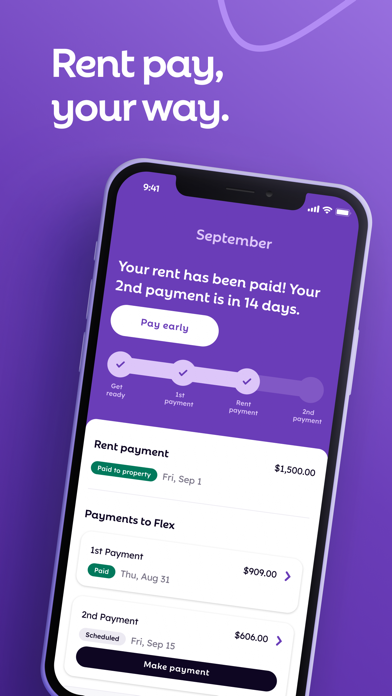

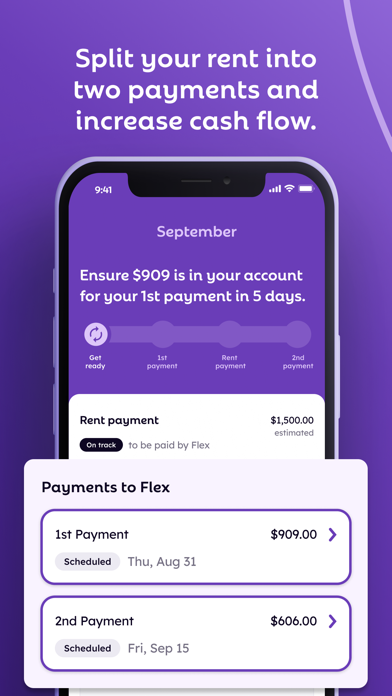

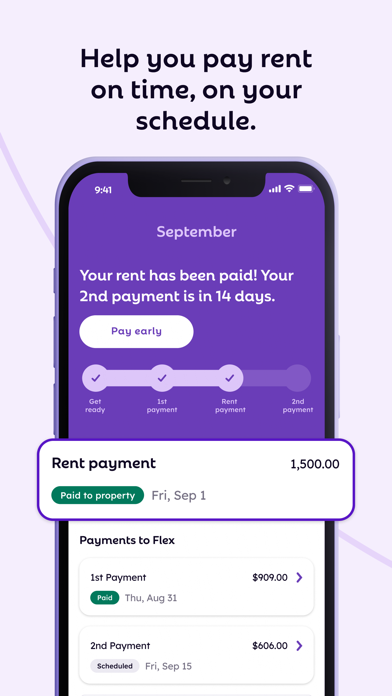

Getting started with Flex is simple. After downloading the app, you link your bank account to ensure secure transactions. Once connected, you can choose how to split your monthly rent. For example, if you get paid bi-weekly, Flex allows you to align your rent payments accordingly, breaking down your total rent into smaller, manageable amounts. Each month, Flex provides access to a credit line that you can draw from to cover your rent if needed.

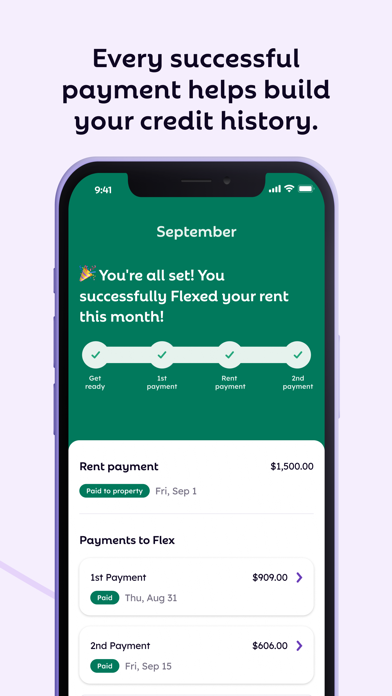

The process involves paying a part of your rent upfront while borrowing the remainder through Flex's credit line. When your rent is due, Flex settles the full amount directly with your landlord or property management company. Subsequently, you pay Flex back on a schedule that makes sense for your finances—whether that's weekly, bi-weekly, or monthly. This flexibility helps reduce financial strain, prevent late payments, and even helps you build or improve your credit history through positive rent reporting.

The process involves paying a part of your rent upfront while borrowing the remainder through Flex's credit line. When your rent is due, Flex settles the full amount directly with your landlord or property management company. Subsequently, you pay Flex back on a schedule that makes sense for your finances—whether that's weekly, bi-weekly, or monthly. This flexibility helps reduce financial strain, prevent late payments, and even helps you build or improve your credit history through positive rent reporting.

Key Features and Benefits of Flex

- Flexible Payment Schedules: Customize your repayment timeline to match your income flow, making rent payments less stressful.

- Manageable Installments: Split your rent into smaller payments to improve your budgeting and avoid large upfront costs.

- Build Credit History: Positive rent payment history can be reported to credit bureaus, helping you improve your credit score over time.

- Secure and Easy to Use: The app uses bank-level security, ensuring your financial information remains safe.

- Transparent Fees: Be aware of small fees, such as a 1% bill payment fee or optional membership fees, which are clearly disclosed within the app.

Why Choose Flex?

Flex stands out as a practical solution for renters seeking greater financial flexibility. Its user-friendly interface makes managing rent payments simple, even for those who aren’t tech-savvy. Whether you’re a freelancer, gig worker, or someone navigating irregular income streams, Flex provides the breathing room you need to stay on top of your financial obligations without stress.

The app's adaptive payment options help avoid late fees and can foster a more responsible payment history—benefits that can positively impact your credit report. Moreover, Flex's ongoing updates and customer-centric approach mean it continually improves to serve its users better, making rent payments a more manageable and less burdensome task.

The app's adaptive payment options help avoid late fees and can foster a more responsible payment history—benefits that can positively impact your credit report. Moreover, Flex's ongoing updates and customer-centric approach mean it continually improves to serve its users better, making rent payments a more manageable and less burdensome task.

Is Flex Right for You?

While Flex offers numerous advantages, it’s essential to understand the potential costs involved. Small fees apply depending on your chosen plan, but many users find that these costs are justified by the peace of mind and financial flexibility they gain. Keep in mind that eligibility for certain features, such as term loans, may vary based on your state of residence and creditworthiness. Flex is committed to transparent and fair service, so reviewing the terms and conditions before signing up is recommended.

Final Thoughts

If you’re searching for a way to make rent payments less stressful and more adaptable to your financial situation, Flex - Rent On Your Schedule could be the perfect solution. Its innovative approach to rent management offers flexibility, simplicity, and potential credit-building benefits—all in one app. Give Flex a try, and discover how managing your rent payment game can become easier, smarter, and more aligned with your lifestyle.

Pros

- Flexible rental periods for convenience.

- Wide variety of car models available.

- User-friendly interface enhances experience.

- Competitive pricing compared to others.

- Reliable customer support team.

Cons

- Limited availability in smaller cities.

- Requires a credit card for booking.

- High fees for last-minute cancellations.

- Occasional app crashes reported.

- No loyalty rewards program.