Instant Cash Advance Loan App: Your Quick and Easy Financial Helper

Are you often caught in situations where cash is tight, and payday feels far away? If so, the Instant Cash Advance Loan App is designed to be your reliable financial assistant. This innovative app offers a fast, straightforward way to access cash advances online, making emergency expenses manageable—even if you have a bad credit score. With its user-friendly interface, quick processing, and secure platform, this app stands out as a top solution for anyone seeking instant loans or payday advance options.

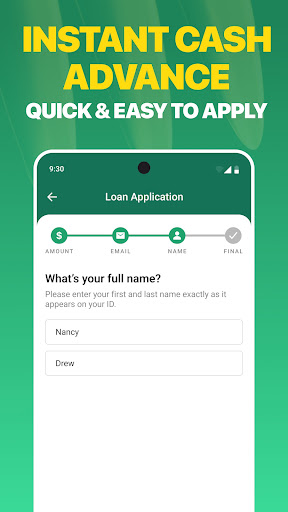

How Does the Instant Cash Advance Loan App Work?

Getting started with the instant cash advance app is effortless. First, you simply download the app from your preferred app store and set up your profile. The app’s intuitive design makes it easy for even first-time users to navigate. After installation, you connect the app to your bank account—don’t worry, it employs bank-level security to keep your sensitive information safe and protected.

Once linked, the app analyzes your income and spending habits to determine how much cash you could be eligible to borrow. The process does not involve a hard credit check, which is a huge advantage for those with poor credit or no credit history. Based on your profile, the app offers a cash advance limit that can increase over time as you build a positive borrowing record.

Fast and Convenient Service

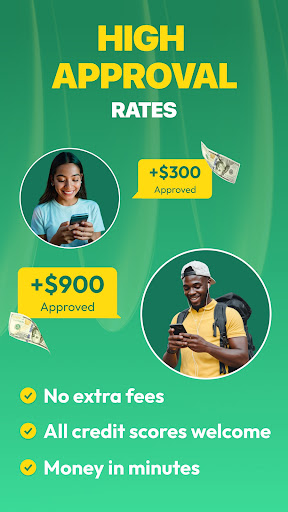

One of the most appealing features of this loan app is the speed. After submitting a quick application, you find out in just a few minutes whether you've been approved. If approved, the funds are transferred directly into your bank account—often almost instantly—so you can access the cash you need without unnecessary delay. This quick turnaround makes it an excellent solution for urgent expenses, such as medical bills, car repairs, or unexpected emergencies.

Simple Repayment Options

Repayment is designed to be hassle-free, with automatic deductions from your bank account on your scheduled pay date. This convenience ensures you avoid missed payments or late fees, helping you manage your finances effortlessly. The app also offers flexible repayment plans—ranging from a few weeks to several months—tailored to your specific needs and the loan amount.

Accessible to All Credit Types

Contrary to traditional lenders, the instant cash advance app recognizes that many individuals may have bad credit scores or past financial difficulties. Instead of automatically rejecting applicants based on credit reports, the app’s lending partners assess each application holistically. They consider employment status, total income, requested amount, and other relevant factors before making a decision. This inclusive approach offers more people the opportunity to get quick funds when needed most.

Security and Reliability

Though the app itself does not lend money directly, it acts as a secure platform connecting borrowers with regulated independent lenders. All data transmission is protected using 128-bit SSL encryption, ensuring your personal and financial information remains confidential. It's important to note that loan approval is not guaranteed; outcomes depend on individual lender policies, the requested amount, and your overall application profile.

Additional Benefits and Considerations

While instant cash advance apps provide quick access to funds, they are designed for short-term solutions. The APR rates typically range from 6.63% to 35.99%, with detailed disclosures provided before you sign any agreement. For example, borrowing $1,000 for a year at a 17% APR would result in a total repayment of approximately $1,170, including interest. It’s essential to borrow responsibly and ensure you can meet repayment terms without strain.

In summary, the Instant Cash Advance Loan App offers a fast, safe, and accessible way to cover unexpected expenses. Its simple process, minimal requirements, and considerate approach towards users with imperfect credit make it an excellent tool for managing financial emergencies. Whether you need a small payday advance or a larger amount for special plans, this app can be your go-to resource for quick cash loans in times of need.

Pros

- Fast loan approval process.

- Easy-to-use interface.

- No credit check needed.

- Flexible repayment choices.

- Available 24/7 customer support.

Cons

- High interest rates.

- Limited loan amounts.

- Needs access to personal data.

- Not offered in all regions.

- Possible hidden fees.