Rain Instant Pay: Empower Your Financial Flexibility

Rain Instant Pay is a revolutionary financial app designed to put you in control of your earnings and benefits. Whether you're facing unexpected expenses or simply want more freedom with your cash flow, Rain offers a seamless experience that allows you to access your hard-earned wages instantly and securely. This innovative application is perfect for individuals who want to manage their finances more effectively, avoid overdraft fees, and reduce financial stress.

Key Features and Benefits of Rain Instant Pay

Your benefits, on your terms

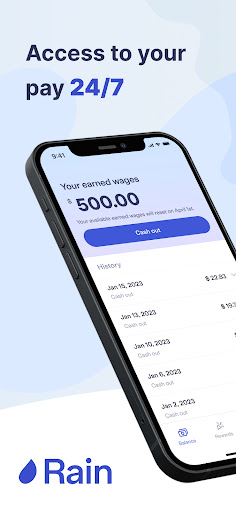

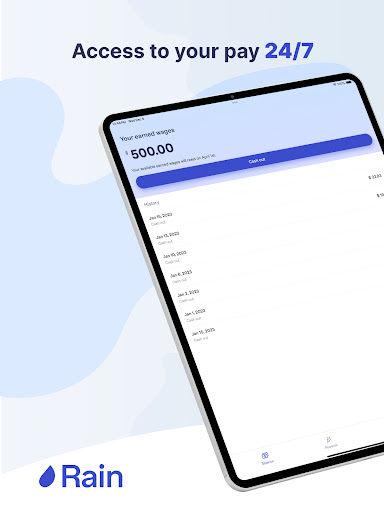

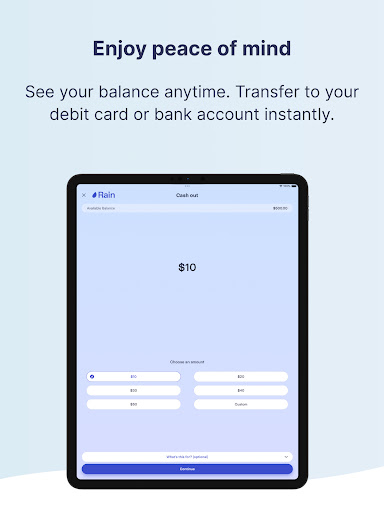

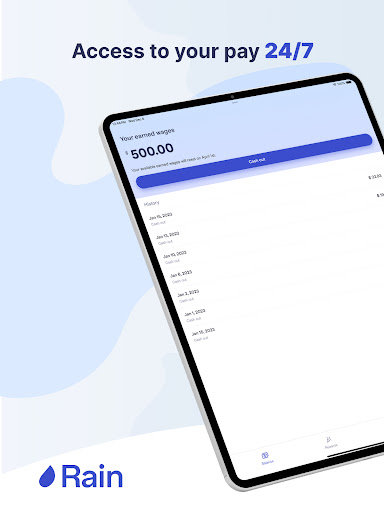

With Rain, you are in the driver’s seat—tracking your earnings and maximizing your benefits becomes effortless. The app provides a straightforward way to see your earnings grow after every shift, giving you real-time insights into your income. You can access your benefits anytime, including weekends and holidays, without waiting for traditional pay schedules.

Rain also guides you toward smarter financial decisions. From spending analytics to auto-balance transactions, the app offers a comprehensive suite of tools to enhance your financial literacy and stability. Whether you need to check your current balance, receive alerts, or explore additional financial benefits, Rain makes it simple and stress-free.

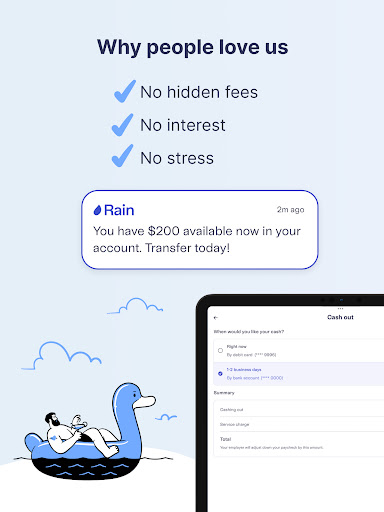

Why You’ll Love Rain

- Fast & Flexible: Access your earned wages instantly whenever you need them—no more waiting until payday.

- Stay Informed: Real-time updates and insights keep you aware of your financial status at all times.

- Safe & Secure: Robust bank-level encryption ensures your data and funds are protected, backed by 24/7 customer support.

- Full Suite of Financial Benefits: From spending analytics, rewards, and tax filing to financial coaching and education, Rain offers a holistic approach to managing your money.

Discover the convenience of having your wages available at your fingertips and enjoy a no-hassle experience that prioritizes your financial well-being.

How Rain Instant Pay Works

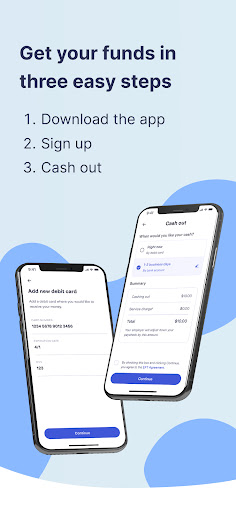

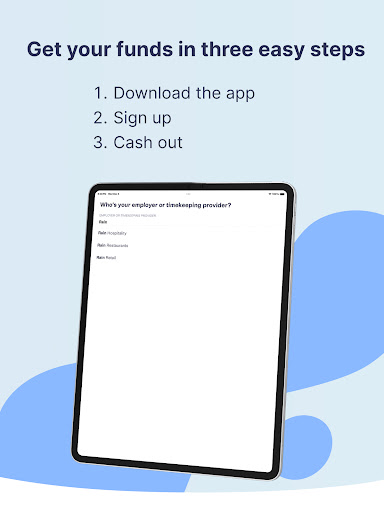

Simple and User-Friendly Process

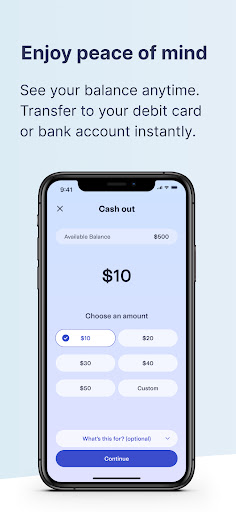

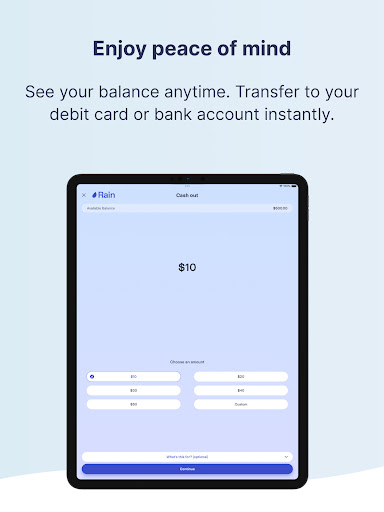

To get started, your employer needs to partner with Rain. Once set up, your earnings are tracked automatically, and you can request an advance of your wages directly through the app. When you need cash before your scheduled payday, select the amount you wish to access, and the funds typically arrive in your bank account within minutes. The intuitive interface ensures that requesting your wages is quick and straightforward.

Smart Financial Management

The app not only provides early access to your wages but also empowers you to manage your finances more effectively. Options like spending analytics and automated transactions help you stay on top of your financial goals. Plus, features such as balance alerts, rewards, and access to financial coaching foster better money habits, making Rain more than just a paycheck advance tool—it's a comprehensive financial companion.

Why Use Rain Instant Pay

Financial Security and Flexibility

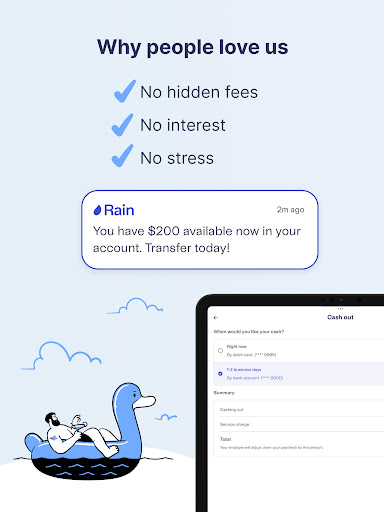

Life's uncertainties can be stressful, but Rain offers a safety net by giving you immediate access to your earnings. This flexibility can help you avoid costly overdraft fees, payday loan traps, and the embarrassment of borrowing from friends or family. It's a reliable way to bridge the gap between paychecks while maintaining control over your money.

Considerations and Tips

While Rain is highly beneficial, it’s important to be mindful of potential fees associated with accessing your wages repeatedly. Understanding your usage patterns can help you avoid unnecessary costs. Additionally, confirmation that your employer is partnered with Rain ensures you can fully utilize the app’s features.

Final Thoughts

Rain Instant Pay is a powerful tool for modern earners seeking financial flexibility and control. Its user-friendly interface, combined with real-time updates and a full suite of benefits, helps you manage your money more proactively. Whether you want quick access to cash for emergencies or wish to improve your financial literacy, Rain provides a reliable, secure, and convenient solution. Remember to use the app wisely, and it can become an essential part of your financial toolkit.

Pros

- User-friendly interface

- Instant payment processing

- Secure transactions

- 24/7 customer support

- Low transaction fees

Cons

- Limited to certain regions

- Requires stable internet connection

- Not compatible with all banks

- Occasional app glitches

- Limited currency options