Introduction to B9: Cash Advance・Banking・Earn

Main Features of the B9 App

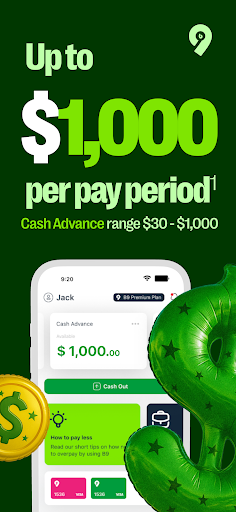

Cash Advances Up to $750

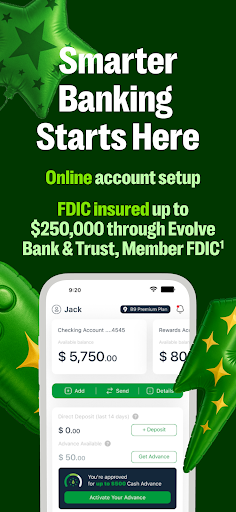

Everyday Mobile Banking

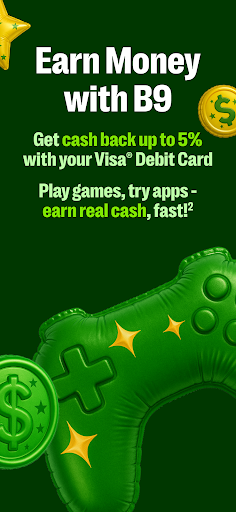

Earn Rewards and Make Extra Money

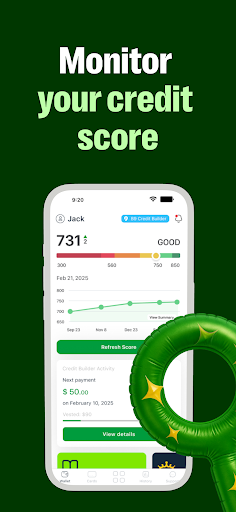

Build and Track Your Credit Smarter

How to Get Started with B9

- Download the B9 app and open an account.

- Set up a direct deposit from your job, gig work, or benefits. Income from W2, SSI, or similar sources qualifies.

- Receive your first $50 cash advance after depositing $300+ within two weeks and linking your debit card.

- Check your available advance limit and use the app’s tools to plan your next cash advance.

- Spend using your B9 Visa® Debit Card.

- Repayments are automatically deducted from your next paycheck, making repayments hassle-free.

Flexible Plans to Fit Your Needs

- Cash advance up to $100 per pay period

- Up to 5% cashback

- Instant B9-to-B9 transfers

- No-fee ACH withdrawals

- Cash advance up to $750 per pay period

- Up to 5% cashback

- Credit monitoring & score simulator

- Loan access (California only)

- Instant transfers and no-fee ACH withdrawals

*Subscription fee waived for the first 30 days. Maintain direct deposits of $5,000+ monthly to stay free.

Why Choose B9?

With its user-friendly interface, transparent fee structure, and comprehensive features—like early paycheck access, rewards earning, and credit building—the B9 app makes managing your finances more convenient than ever. Whether you want to avoid payday anxieties, earn extra cash, or improve your credit, B9 provides tools to help you succeed. It’s more than a banking app; it’s your financial sidekick designed to support your everyday money needs.

Are you ready to stop waiting for payday and start getting paid early? Curious about how to boost your savings or earn rewards effortlessly? Give B9 a try and discover a smarter way to handle your finances. Managing money has never been this straightforward and rewarding.

Important Notes

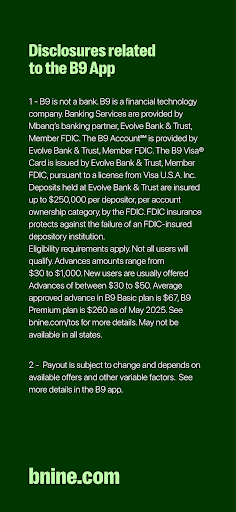

B9 Advance is an optional, no-fee service that requires setting up regular direct deposits. Your advance amount depends on various factors and may change over time. All repayment obligations are clearly outlined, and users are encouraged to understand the terms of service. B9 is not a bank, but banking services are provided through Evolve Bank & Trust, Member FDIC.

Pros

- Instant cash advances are available

- No requirement for a credit check

- User-friendly interface design

- Lower fees compared to competitors

- Real-time alerts for spending

Cons

- Limited to certain income sources

- Cash advance limits can be low

- Bank account linking is necessary

- No investment options offered

- High fees for late repayment