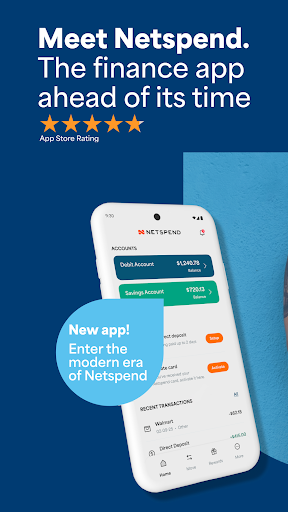

Discover the Benefits of the Netspend Wallet

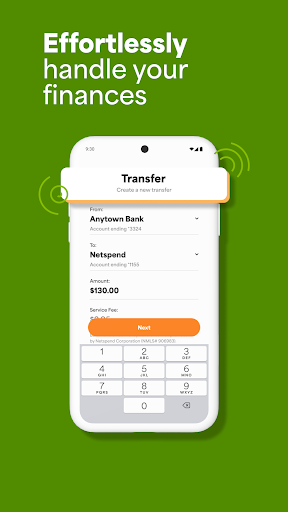

Revolutionize the way you manage your money with the Netspend Wallet. This innovative digital wallet provides a seamless financial experience whether you're at home or on the go. One of the main advantages of joining Netspend is the ability to manage your accounts effortlessly from your mobile device. With the app, you can check your balances, pay bills, and perform a variety of financial tasks anytime and anywhere, thanks to compatibility with Google Pay and Apple Pay. This mobility ensures you always stay in control of your finances without the hassle of visiting bank branches or ATMs.

Transparent Fees and Budgeting Tools

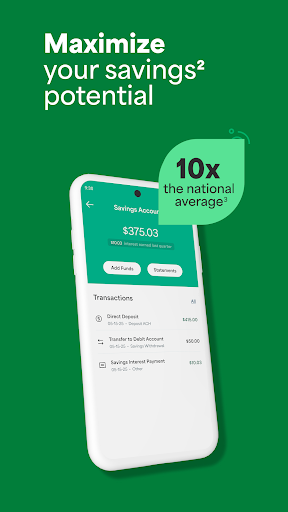

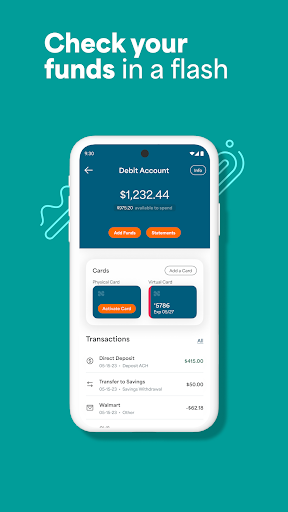

No hidden fees is a core principle of Netspend. The platform offers clear, upfront fee structures, so you're never caught off guard by surprise charges. This transparency allows you to better understand where your money is going. Additionally, the app provides smart budgeting features that make financial planning straightforward. You can track your spending in real-time, monitor pending transactions, and review your transaction history to ensure you stay within your budget. These tools empower users to take charge of their financial health with confidence.

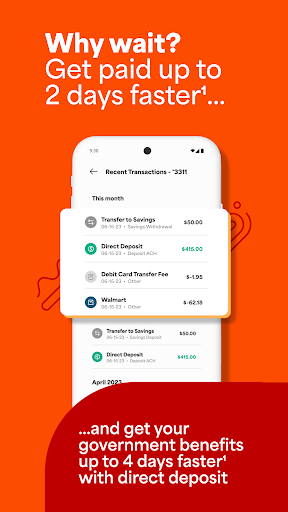

Fast & Secure Payments

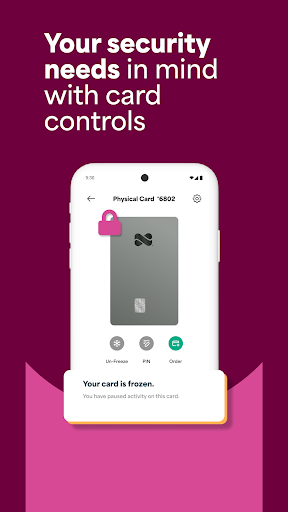

With direct deposit, you can receive your paycheck up to two days earlier, making cash flow management even more convenient. Plus, security remains a top priority—if your card is lost or stolen, you can temporarily suspend it, minimizing risk. Rest assured that Netspend utilizes advanced encryption and security measures to safeguard your data and transactions. The platform also offers real-time alerts, keeping you informed about your account activity so you can act swiftly if any suspicious activity occurs.

No Credit Check, Easy Sign-Up

Getting started with Netspend is simple and accessible—there's no need for a credit check, making it an excellent choice for unbanked or underbanked individuals, freelancers, and families seeking flexible financial solutions. Once you activate your card and complete registration, your funds are insured up to the standard maximum deposit insurance limit through Pathward, N.A.. The seamless sign-up process combined with transparent costs and security features makes Netspend Wallet a trustworthy and user-friendly digital wallet.

Why Choose Netspend Wallet? The User Experience

When I first started using the Netspend Wallet, I was impressed by how straightforward and user-friendly it is. Setting up the app was a quick process—download, register, and link your bank accounts with ease. The real-time transaction notifications keep me updated every time I make a purchase, helping me stay within my budget. The app’s neatly organized interface makes managing multiple cards and expenses simple, even for those less familiar with digital finance tools.

A Personal Finance Companion

One of my favorite features is the app’s budgeting tool, which allows categorization of expenses, giving insights into where my money goes. Plus, the cash-back rewards programs are a bonus—partnering with various merchants, the app offers deals that reward you every time you spend. These features transform managing finances from a chore into an engaging experience. The security measures, including encryption and account suspensions, add peace of mind, knowing your financial information and assets are protected against cyber threats.

Final Thoughts: Is Netspend Wallet Right for You?

In conclusion, the Netspend Wallet stands out as a comprehensive, easy-to-use, and secure digital wallet solution. It’s perfect for individuals and families seeking a smarter way to handle everyday financial tasks, freelancers needing flexible payment options, or those who prefer alternatives to traditional banking. Packed with features like real-time alerts, budgeting tools, security first policies, and seamless integrations with popular payment platforms, Netspend aims to make managing your money a hassle-free experience. If you’re looking for a reliable digital wallet to streamline your finances and boost your money management skills, Netspend Wallet might just become your new favorite app.

Pros

- Easy to monitor expenses.

- Extensive network of ATMs.

- Customizable alerts.

- Versatile budgeting features.

- Secure transaction processes.

Cons

- Limited options for cash deposits.

- Monthly subscription fee.

- No interest on funds.

- Customer service wait times.

- Fees for foreign transactions.