OnePay – Mobile Banking

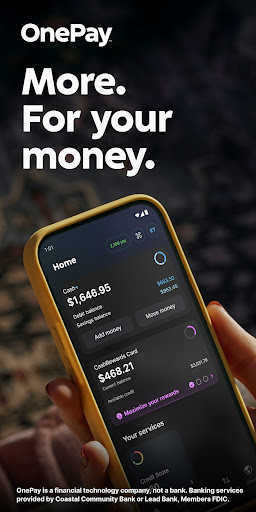

In today's fast-paced world, managing your finances shouldn't be cumbersome or complicated. OnePay – Mobile Banking offers a modern, streamlined way to handle your money directly from your smartphone, bringing the convenience of a full-service bank right into your pocket. Even though OnePay operates as a financial technology company rather than a traditional bank, it collaborates with established banking partners like Coastal Community Bank and Lead Bank to provide reliable banking services. These partnerships ensure that you enjoy the security and trustworthiness associated with federally insured institutions, as both banks are Members FDIC.

Why Choose OnePay Mobile Banking?

User-Friendly Interface

OnePay's mobile app is designed with simplicity and ease of use in mind. From the moment you open the app, you are greeted with an intuitive and clean interface that makes financial management effortless. Whether you're checking your account balance, transferring funds, or paying bills, all options are just a tap away. The app’s straightforward navigation minimizes hassle, allowing users to focus on what matters most — their finances.

Transparent and Honest Fees

Unlike many traditional banking apps that hide fees or charge unexpected costs, OnePay – Mobile Banking emphasizes transparency. Customers are provided with clear information about any applicable fees and conditions upfront. One notable feature is the ability to set up virtual pockets— personalized savings containers for specific goals like travel or emergency funds—helping users manage their money more effectively.

Robust Security Measures

Security is paramount when it comes to mobile finance. OnePay employs cutting-edge encryption technology and multi-factor authentication to safeguard user data. Real-time notifications alert you immediately to any transactions, providing ongoing oversight and a layer of protection against unauthorized activities. This security framework ensures peace of mind as you conduct your banking activities digitally.

Innovative Saving and Rewards

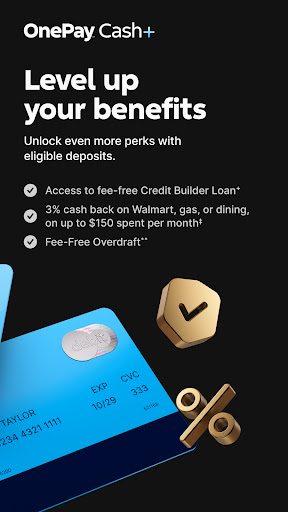

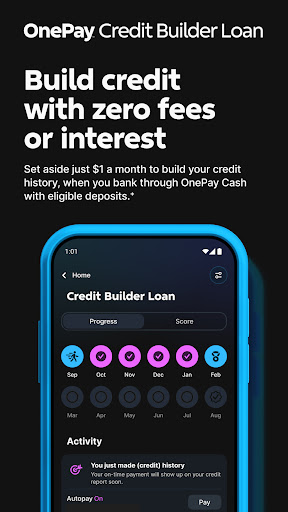

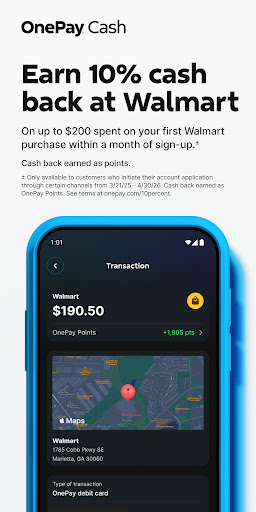

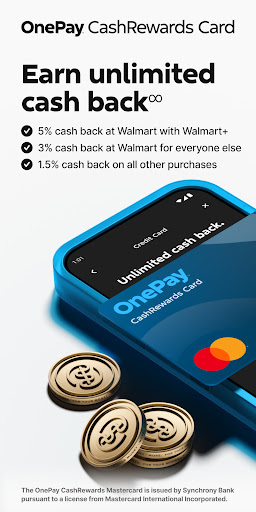

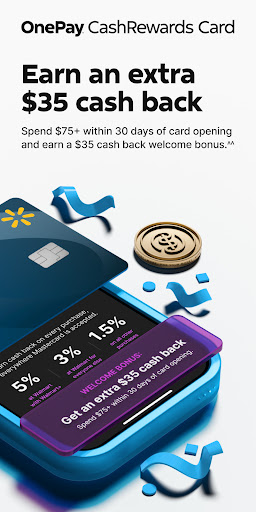

OnePay enriches your banking experience with features like OnePay Rewards, where you earn points for eligible transactions. These points can be redeemed for cash deposits into your OnePay Cash account. Additionally, the app offers interest-bearing Savings accounts with competitive annual percentage yields (APY), up to 3.75%, under certain conditions such as receiving direct deposits of $500+ or maintaining a balance of $5,000 or more. These savings tools motivate users to grow their money while enjoying the convenience of digital banking.

Features That Set OnePay Apart

Virtual Pockets for Personalized Savings

OnePay’s innovative pockets feature allows users to allocate funds for different goals seamlessly. Whether saving for a dream vacation or an unexpected emergency, these virtual piggy banks help you stay organized and motivated to reach your financial targets. The intuitive setup makes it easy to assign specific amounts to each pocket, ensuring disciplined savings habits.

Real-Time Account Insights

The app provides instant notifications for all transactions, which not only keeps you informed but also enhances account security by alerting you to suspicious activities immediately. This real-time feedback loop ensures you always know what’s happening in your financial world, giving you control and confidence.

Accredited and Trusted Banking Partners

While OnePay is a fintech company, it leverages the strength and reliability of their FDIC-insured partners—Coastal Community Bank and Lead Bank. This ensures your deposits are protected up to the federal deposit insurance limits, giving you peace of mind while enjoying the digital convenience of modern banking.

Final Thoughts

OnePay – Mobile Banking is an excellent choice for anyone seeking a hassle-free, efficient way to manage their finances on the go. Its focus on transparency, security, and user-centric features like customizable pockets and real-time alerts makes it stand out in the crowded mobile banking landscape. Whether you're looking to streamline your savings, earn rewards, or simply enjoy a secure digital banking experience, OnePay is designed to fit seamlessly into your lifestyle. Give it a try and discover how easy managing your money can really be!

Pros

- Quick account setup

- No monthly charges

- Easy-to-use interface

- Extensive ATM access

- Notifications in real-time

Cons

- Limited customer service options

- Absence of physical branches

- Only available via mobile app

- Few financial product offerings

- Needs steady internet connection