Kikoff - Build Credit Quickly

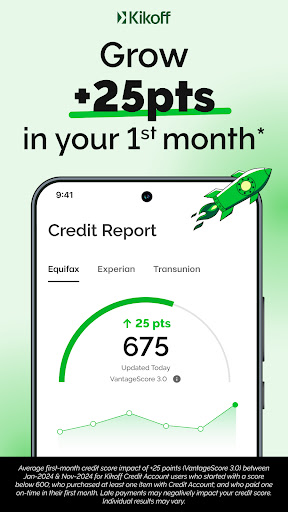

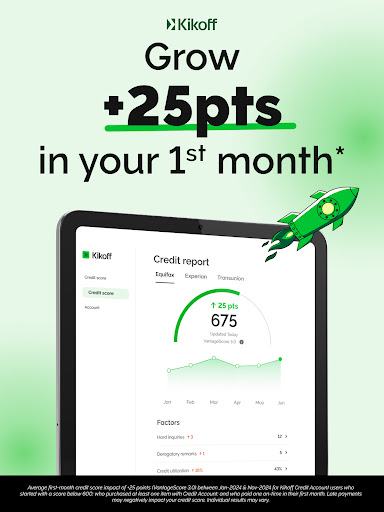

If you’re ready to build your credit, Kikoff is the fastest, smartest, and easiest way to do it. Kikoff customers who make on-time payments see improvements of their credit score by an average of 58 points.*

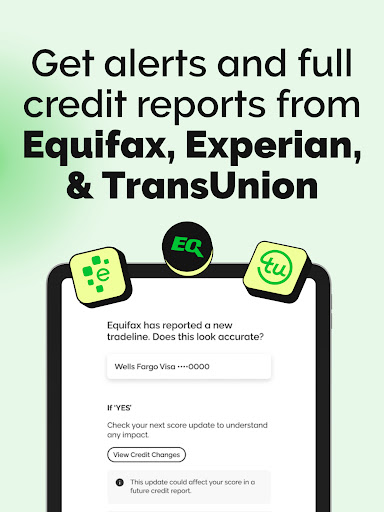

Sign up for the Kikoff Basic plan for just $5/month or the Premium plan for $20/month. You’ll receive a credit line reported to Equifax, Experian, and TransUnion** every month. Each on-time payment helps to build your payment history, which is a key factor in improving your credit!

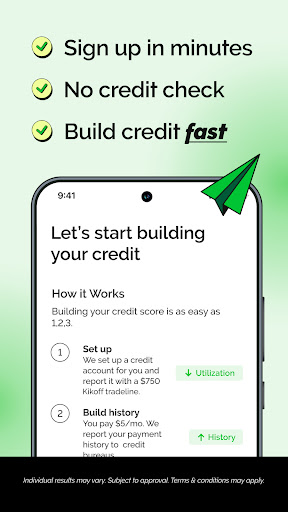

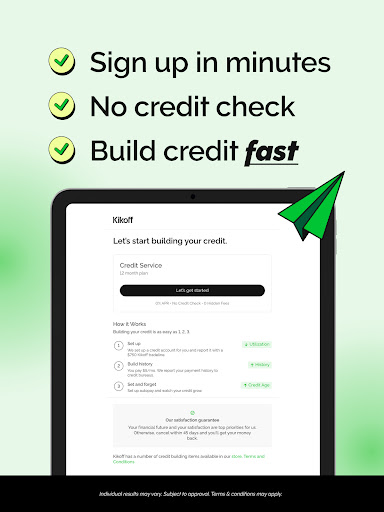

Whether you have a low credit or no credit history, Kikoff makes credit building easy and worry-free — no credit check required and it takes just a few minutes to apply.

How it Works

1. We lower your credit utilization with either a $750 or a $2,500 tradeline.

2. You make a purchase using that tradeline (limited to Kikoff), and simply pay back what you spend — our lowest and most popular payment amount is $5/month. We report these payments to Equifax, Experian, and TransUnion every month, keeping your utilization rate low.

3. You can opt to put your credit building on autopilot by turning on AutoPay — so, no heavy lifting required from you after initial setup.

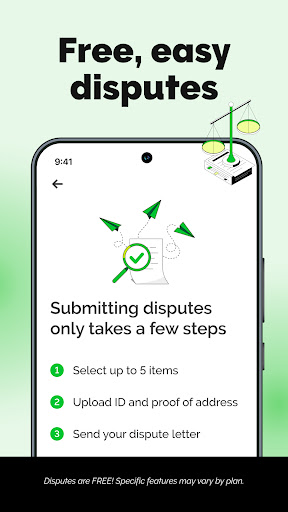

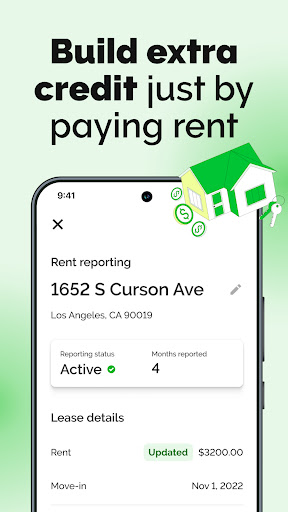

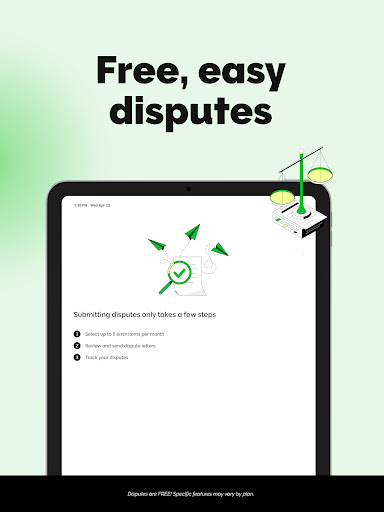

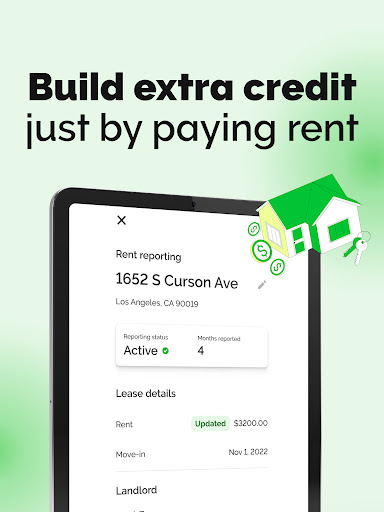

4. We flag errors on your credit report. Additionally, users with a Premium Credit Service account can sign up for Rent Reporting to have their rent payments reported.

With Kikoff, you build your credit profile by establishing a payment history and maintaining a low utilization rate, all without any unexpected fees or interest.

*Credit Score Increase: Based on Kikoff customers who start with 600 or below credit. Your payment behavior can influence your credit score, and individual results may vary. Data current as of March 2022.

**Which bureaus are reported to depends on which Kikoff products you have. Kikoff Credit Account and Secured Credit Card report to Equifax, Experian, and TransUnion.

Discovering Kikoff - Build Credit Quickly

Hey there, fellow app enthusiasts! Today, I want to introduce you to a game-changing financial app that’s transforming the way people build credit. If you’re struggling to improve or rebuild your credit score, Kikoff might just become your new best friend. Let’s dive into what makes this app so effective and why it’s worth considering for your credit-building journey.

What is Kikoff?

Kikoff is a smart, user-friendly app designed to help you boost your credit score without complex procedures. It’s like having a personal finance assistant in your pocket. The platform offers a unique credit-building service that doesn’t require a credit check, making it accessible even for those with bad credit.

Essentially, Kikoff provides you with a credit line that reports to major credit bureaus. Your role is to use this credit responsibly to see your score improve. Its straightforward approach allows you to establish a positive payment history while keeping utilization low, all with minimal effort and no unexpected fees or interest.

How Does It Work?

Once you sign up, Kikoff grants you access to a credit line usually around $500. You can use this credit line to make small purchases within the app's store, which features various digital products like e-books and online courses. The key is to pay off these purchases on time each month. This process acts like training wheels for your credit score, helping you develop a good payment history without risking debt or high interest.

Why I Recommend Kikoff

If you’re anything like me, managing finances can often feel overwhelming. What sets Kikoff apart is its simplicity. The app’s clean interface provides a clear overview of your credit line, upcoming due dates, and your payment history. Plus, there are no cryptic fees or interest rates — just pay back what you owe, on time.

Its transparency and ease of use make it ideal for anyone eager to improve their credit score without dealing with complicated financial jargon.

Features That Help Your Credit-Building Journey

Apart from offering a credit line, Kikoff includes several features to support your efforts. It tracks your progress, providing insights into how your credit score evolves over time — like having a personal credit coach cheering you on! The app also offers educational content, so you can enhance your financial literacy while you build credit.

Available on both Android and iOS, Kikoff ensures accessibility for all smartphone users. Its reporting to major credit bureaus assures that your efforts are recognized, making it a risk-free and effective tool for credit improvement.

Final Thoughts

In a world where credit scores deeply influence your financial opportunities, having a reliable tool like Kikoff — Build Credit Quickly can truly be a game-changer. It’s simple, transparent, and effective, making it an excellent choice for anyone aiming to improve their credit without unnecessary stress. Whether you're just starting out or trying to recover favorable credit, Kikoff is definitely worth exploring. Give it a try and watch your credit score soar!

Pros

- Fast registration process

- No concealed charges

- Intuitive user interface

- Complimentary credit score tracking

- Customized financial advice

Cons

- Only available for residents in the United States

- Does not offer a physical credit card

- Bank account linkage is mandatory

- Customer support options are limited

- Few options for credit building