Atlas - Rewards Credit Card: Your Ultimate Rewards Partner

Are you looking to elevate your credit card experience with a solution that offers great rewards, security, and accessibility? The Atlas - Rewards Credit Card is designed to meet these needs, providing an innovative approach to earning points, managing finances, and building credit — all in one seamless platform.

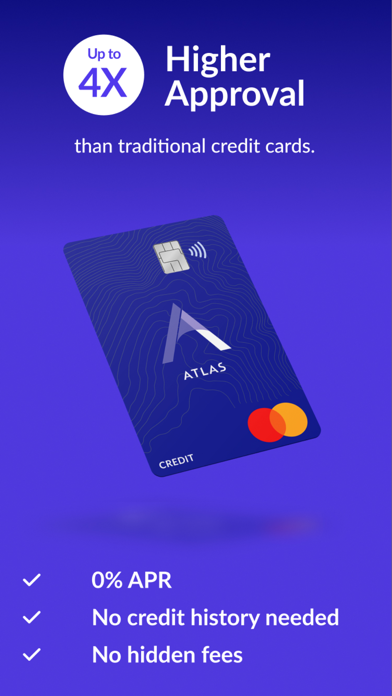

Unmatched Approval Rates and Accessibility

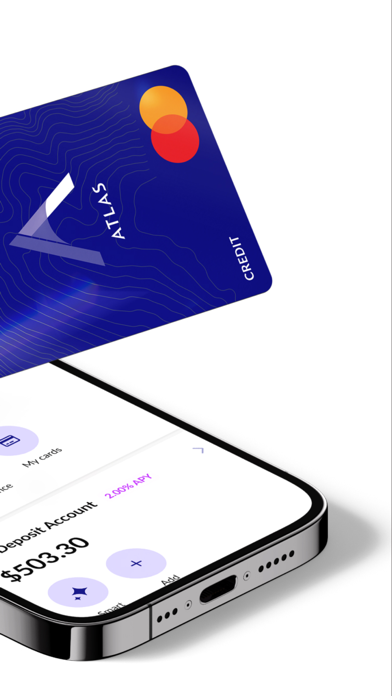

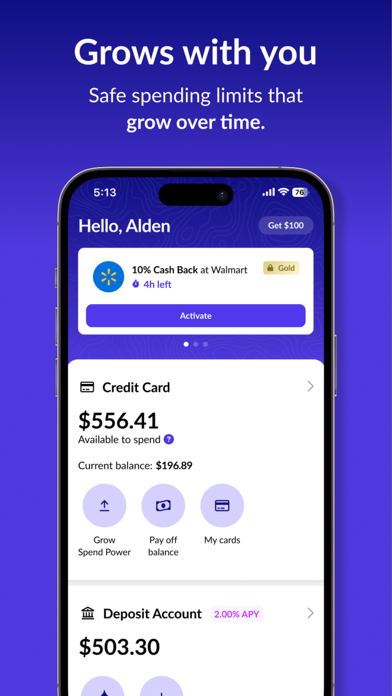

One of the standout features of the Atlas card is its 4x higher approval rates than traditional credit cards. This means more individuals, even those without an extensive credit history, can get approved quickly and easily. With instant approval available directly in the app, users can start enjoying benefits without tedious paperwork or long waiting periods. The card adapts to your financial growth, connecting with over 10,000 banks to determine a secure spending limit you can comfortably repay, helping you avoid overextending yourself.

Enjoy the advantage of 0% APR, ensuring you never pay interest as long as you manage your balance responsibly. Keep using your Atlas credit card to gradually increase your spending limits, all while maintaining a healthy credit profile.

Smart Saving and Money Management

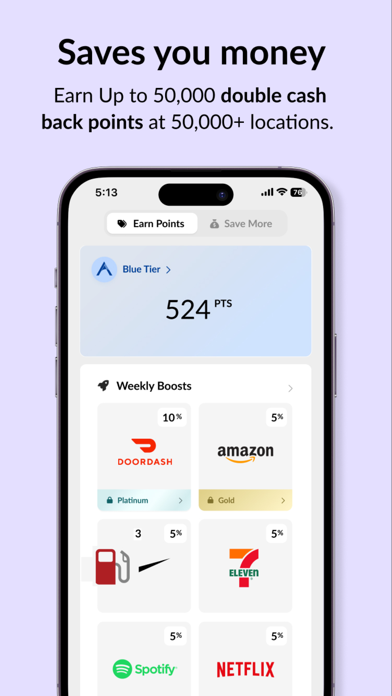

With the Atlas card, saving money becomes effortless. Automatically accumulate savings of up to 10% at more than 50,000 locations, including popular brands like Starbucks, Nike, DoorDash, Shake Shack, and Burger King. The app continually updates with new national and local offers, making it easy to maximize your savings on everyday purchases.

Managing your finances is simple with the user-friendly app interface. Keep track of your spending, monitor your savings, and view your credit score all in real time. This transparency helps you stay on top of your financial health and make informed decisions.

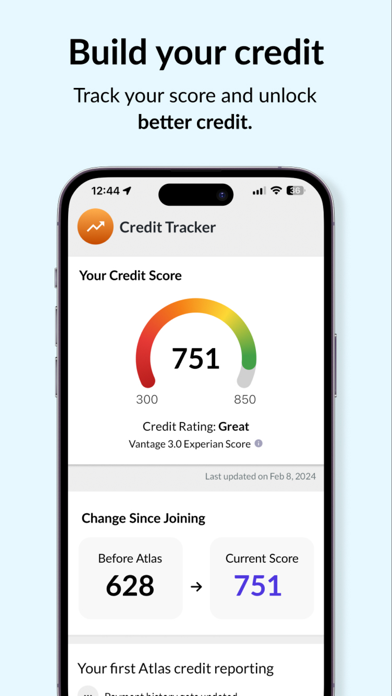

Build Your Credit with Confidence

The Atlas card is not just about rewards — it’s also about building your credit. Every transaction you make contributes to your credit history, and with built-in auto-pay, you never have to worry about missing a payment. The app's comprehensive tracking and reporting ensure that your credit score steadily improves over time.

Signature to all 3 major credit bureaus — Equifax, Experian, and TransUnion — the Atlas credit report helps you monitor your progress and optimize your financial profile for future needs.

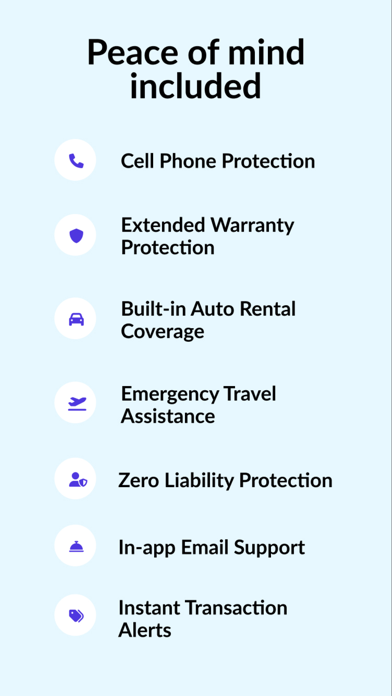

Security and Peace of Mind

Security is paramount when handling digital transactions. The Atlas card offers industry-leading security features, including the capability to block transactions or shut down your card instantly if suspicious activity is detected. With fraud protection backed by Mastercard and Patriot Bank, your financial information remains safe and protected at all times.

Affordable and Transparent Fees

Forget about hidden charges — the Atlas card operates with simple pricing at only $8.99 every four weeks or $89 annually. There are no surprise fees or charges hidden in the terms, making budgeting straightforward and stress-free.

Why Choose the Atlas Rewards Credit Card?

Whether you’re aiming to earn more rewards, improve your credit, or enjoy hassle-free management and superior security, Atlas brings it all together in a sleek, user-centric platform. With excellent customer support, a rewarding points program, and benefits tailored to fit your lifestyle, this card is an excellent choice for savvy consumers eager to maximize every dollar spent.

Take control of your financial future today with Atlas - Rewards Credit Card — your partner in smarter spending, earning, and credit building.

Pros

- No annual fee for cardholders.

- Provides cashback on all purchases.

- Offers flexible payment options.

- Provides instant transaction notifications.

- Ensures security with advanced fraud protection.

Cons

- Availability is limited to certain countries.

- High fees for foreign transactions.

- Requires a good credit score.

- No introductory APR promotions.

- Customer service response can be slow.