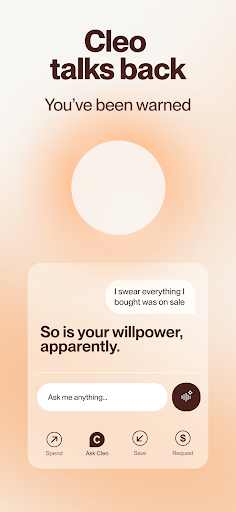

Introducing Cleo AI: Your Personal Finance Companion

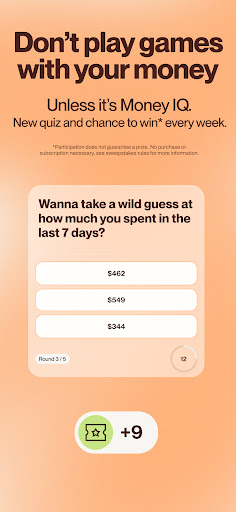

Cleo AI is a revolutionary personal finance app that acts as your friendly financial coach, available for conversations about your daily, weekly, or monthly budgeting. With over 5 million users, Cleo helps individuals manage their budgets, save smarter, build credit, and access cash advances during those low-balance moments. The app transforms the often-stressful money management experience into a simple, engaging chat where you can ask questions about your finances and learn more without feeling overwhelmed.

Wondering how much you spent on takeout last month? Just ask Cleo! It’s designed to give you quick insights into your spending habits, making financial management seamless and less boring.

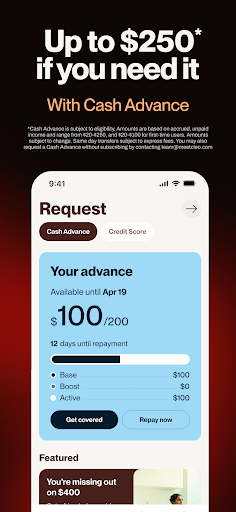

Cash Advances Made Easy

One of Cleo's standout features is its cash advance service, offering up to $250 to help you cover unexpected expenses without resorting to overdraft fees. Unlike traditional loans, Cleo’s cash advances are not personal loans. Instead, the app provides Earned Wage Access, allowing you to access your earned wages before payday.

The best part? Cleo's cash advances come with no interest, no credit checks, and no late fees. Repayment terms are flexible, with no minimum or maximum time, and you don't have to worry about direct deposit requirements. For example, requesting a $40 advance will cost exactly $40 to repay, with no hidden fees or interest—making it an affordable alternative to overdraft overdraft fees or high-interest payday loans.

Grow Your Wealth with High-Yield Savings

Cleo helps you build your savings effortlessly by offering a savings account with a 3.52% APY. This rate is almost nine times higher than the national average, enabling your money to grow through good, compound interest. Think of it as the good kind of interest that adds up over time, helping you reach your financial goals faster and smarter.

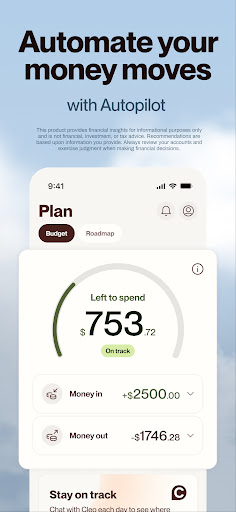

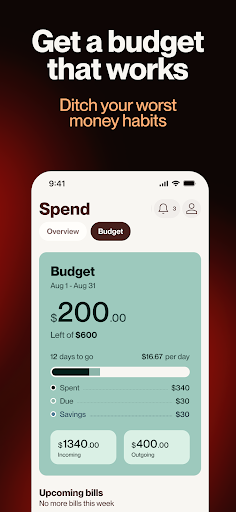

Smart Budgeting Without Restrictions

Creating a personalized budget is simple with Cleo. The app uses Plaid to securely connect to your bank accounts in a read-only mode, providing a comprehensive view of your finances. Cleo then categorizes your expenses, showcases spending breakdowns, and offers monthly bill trackers and reminders—so you can stay on top of your money without feeling restricted. Want that iced coffee? No problem! Cleo’s approach to budgeting makes room for your small pleasures while keeping your financial health intact.

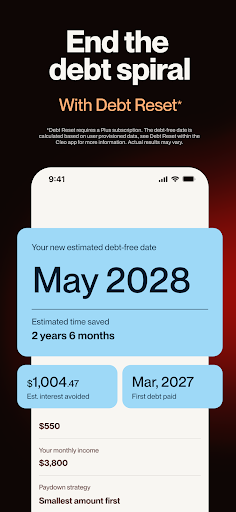

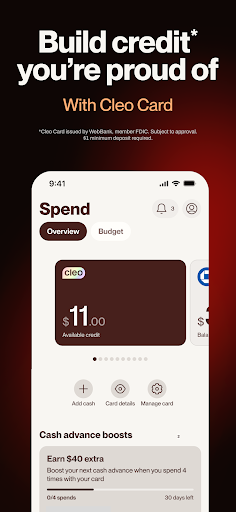

Build Credit Without a Credit Card

Looking to improve your credit score? Cleo offers ways to build credit without necessarily using a credit card. By utilizing the app’s cash advance feature, along with personalized credit score coaching, you can work toward smoother approvals, lower interest rates, and higher credit limits. You can start building your credit with a minimum deposit of just $1, making it accessible for everyone aiming to establish or improve their credit history.

Access Your Paycheck Early

Need your earnings sooner? Cleo allows you to access your paycheck up to 2 days early by setting up direct deposits. This feature helps you manage urgent expenses without waiting until your official payday, providing greater financial flexibility.

Additional Features and Important Information

Subscription Services

Cleo offers subscriptions such as Cleo Grow, which helps users set savings goals, access hacks and challenges, and earn interest on savings. The Cleo Plus subscription adds features like credit score insights and access to cash advances, while the Cleo Credit Builder subscription further enhances credit-building opportunities.

Legal and Eligibility Details

Services are available only in the US, with users selecting their state of residence during setup. The app is provided by Cleo AI, a fintech company, with banking services facilitated by Thread Bank, Member FDIC. Rates, fees, and terms are subject to change, and eligibility requirements apply for certain features.

For more on data sharing and privacy, visit meetcleo.com/page/privacy-policy.

Final Thoughts

Cleo AI is much more than a financial tool—it's a smart, intuitive buddy that helps you handle your money stress-free. Whether you need a quick cash boost, want to build credit, or simply stay on top of your budget, Cleo makes financial management approachable and straightforward. Its user-friendly interface, coupled with powerful features like high-yield savings, early paycheck access, and personalized insights, makes it an excellent choice for anyone looking to take control of their finances.

With Cleo, managing your money turns from a chore into a chat. It’s the perfect app for those who want financial empowerment without the complexity. So why not give it a try? Your smarter financial future could just be a conversation away.

Pros

- Intuitive interface for effortless navigation.

- Provides customized financial insights.

- Supports numerous banking institutions.

- Fast and straightforward cash advances.

- Aids in enhancing credit scores.

Cons

- Limited features in the free version.

- Possible fees for cash advances.

- Requires access to bank information.

- Notifications can be excessive.

- Not accessible in all regions.