Klover - Instant Cash Advance

Have you ever found yourself waiting impatiently for payday while expenses keep piling up? Klover - Instant Cash Advance is an innovative app designed to ease financial stress by providing quick access to cash when you need it most. With its user-friendly interface, transparent practices, and a host of features, Klover stands out as a reliable financial companion for those seeking an alternative to traditional lending options.

Overview of Klover App

Klover offers a seamless experience for users in need of cash advances that can be received in minutes. Unlike banks or payday loan providers, Klover emphasizes transparency and affordability, making it a popular choice among over 2 million users who want to manage their finances smarter and stress-free.

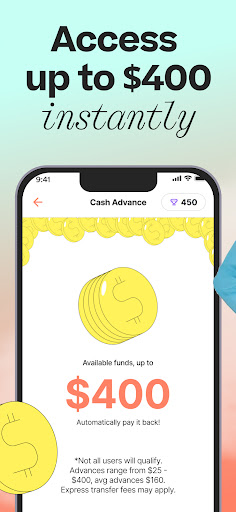

Key features include up to $250 cash advances without any late fees, credit checks, or interest charges, ensuring users can access funds with peace of mind. The process is straightforward: sign up by providing your name, email, and phone number, link your bank account securely, and receive your cash quickly — often in just minutes and up to $200 or more, depending on eligibility.

Additionally, Klover encourages users to earn points by participating in activities such as taking surveys and watching ads. These points can be redeemed for larger advances or entered into daily sweepstakes, where you have a chance to win cash prizes, including $100 daily and $20 for five lucky winners each day. This gamification element adds an engaging layer to the app, incentivizing users to interact regularly.

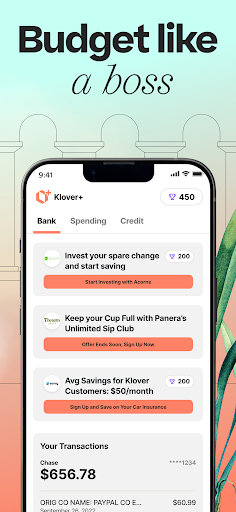

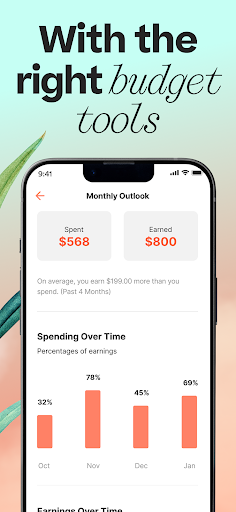

Beyond quick advances, Klover provides powerful budgeting tools through Klover+. Users can set spending goals, track their credit score, and earn extra points for reaching saving milestones, helping them budget like a boss and improve their overall financial health.

One of the standout benefits is the ability to access money from the future—borrowing from yourself without involving high-interest lenders or traditional banks. This makes Klover a practical alternative for managing unexpected expenses or bridging cash flow gaps.

Why Choose Klover?

Financial Freedom and Transparency

At its core, Klover is dedicated to helping you become financially free. Instead of charging high fees, the app leverages your approved data ethically and securely to offer low to no-cost financial tools. By doing so, it provides instant cash advances without interest or hidden charges, making it a transparent option that puts user interests first.

Secure and Private Data Handling

Your privacy is a top priority at Klover. The app ensures data security through 256-bit encryption, a military-grade standard that keeps personal information safe. Data is anonymized to prevent identification, and users must opt-in to share data, maintaining control over their information while enjoying the app’s benefits.

Responsibility and Legality

Klover is not a loan provider in the traditional sense; it offers advance services that revolve around your earned wages. Advances from $25 up to $250 are available without interest, with no fixed repayment schedule. For example, if you request a $100 advance, your repayment will be $100, unless you choose optional delivery fees for faster service. Always review the terms to understand your obligations.

It’s important to use Klover responsibly and not depend on it as a long-term financial solution. The app is intended to supplement your budget, offering quick support during unforeseen expenses or to help you manage day-to-day cash flow.

How Klover Works

Getting started with Klover is quick and easy. Download the app, provide some basic information, and securely link your bank account. No credit checks are needed, which makes it accessible even if you have a less-than-perfect credit history.

Once set up, you can request a cash advance of up to $250. The app’s non-intrusive data analysis helps determine your eligibility, and you can pocket your funds within minutes. The process is designed to be transparent, with clear explanations of any optional fees, like immediate delivery charges.

Additionally, participating in the rewards system enables users to earn points, which can improve their chances of receiving larger advances or winning daily sweepstakes. Budgeting tools help you set savings goals, track expenses, and monitor your credit score, empowering you to make smarter financial decisions.

Conclusion

Klover - Instant Cash Advance is a practical and innovative app that provides quick, interest-free cash advances without the hassle of traditional loans or credit checks. Its combination of user-friendly features, privacy safeguards, and rewards makes it a valuable tool for managing financial emergencies smoothly. Whether you’re facing unexpected expenses or simply need to bridge the gap until your paycheck, Klover offers a responsible and transparent solution to help you navigate your financial journey with confidence.

Pros

- Provides immediate access to cash without the need for a credit check.

- Features an intuitive interface that makes navigation simple.

- No concealed fees or interest charges are applied.

- Connects directly to your bank account for quick withdrawal.

- Offers useful financial insights and tips.

Cons

- Cash advances are limited to a maximum of $100 per transaction.

- Requires access to your personal bank account details.

- Fees for cash advances can add up over time.

- May not be compatible with all banks.

- Includes frequent advertisements within the application.