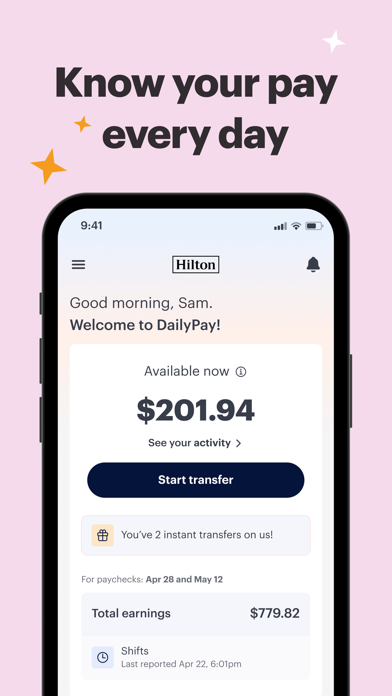

Introducing the DailyPay On-Demand Pay App

DailyPay is a revolutionary financial app designed to offer users on-demand access to earned wages. It serves as a convenient and secure solution for individuals who want greater control over their financial management by accessing their paycheck before the traditional payday. Whether it's covering unexpected expenses, paying bills on time, or avoiding late fees, DailyPay empowers users to have their money when they need it most.

How the DailyPay App Works

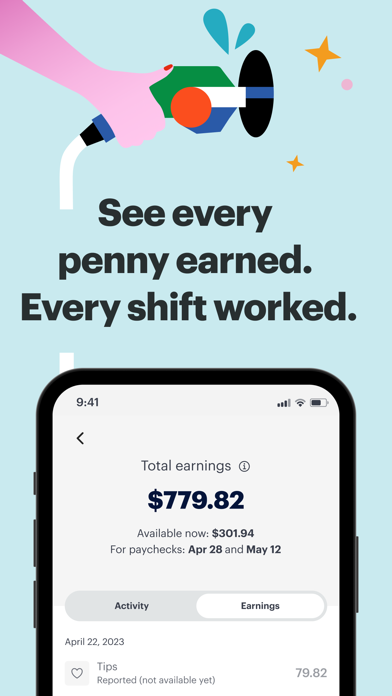

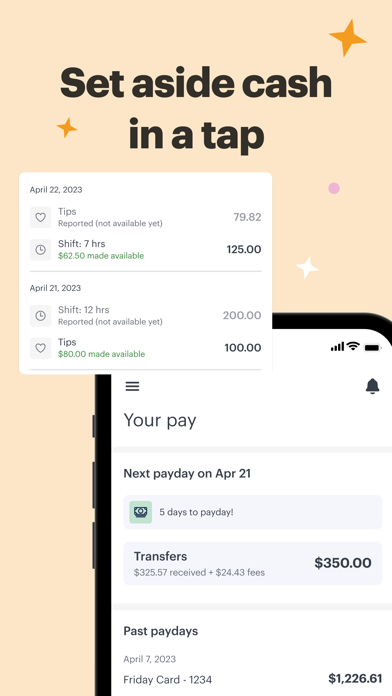

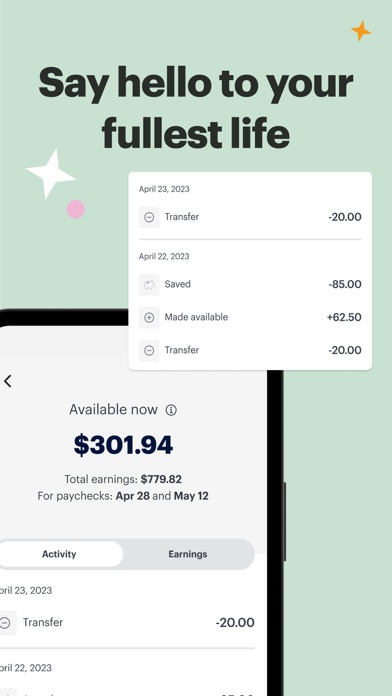

Using the DailyPay app is simple and straightforward. As you work throughout the week, you accumulate a Pay Balance which reflects your earned wages. With just a tap, you can:

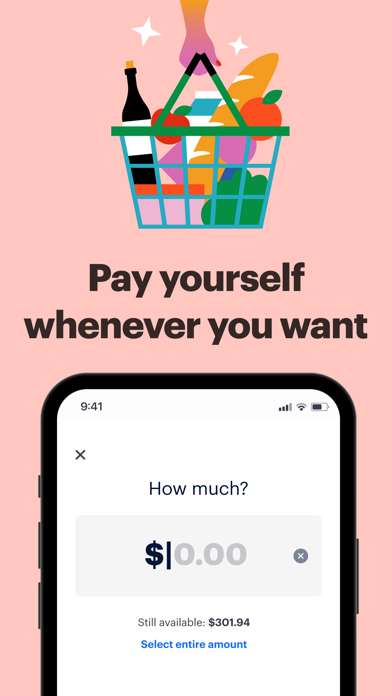

- Withdraw money from your Pay Balance at any time

- Choose to receive your funds instantly (24/7/365, including weekends and holidays) or on the next business day

- Receive your remaining pay on your scheduled payday as usual

This seamless process provides flexibility, allowing you to access your earnings whenever necessary without waiting for the standard pay cycle.

Benefits and Key Features of DailyPay

DailyPay offers numerous benefits that make managing your finances easier:

Flexible Money Access

Transfer your Pay Balance to various accounts including bank accounts, debit cards, prepaid cards, or pay cards. This versatility ensures you can use your money in the way that suits your financial habits.

Real-Time Balance Insights

Stay informed with timely notifications and insights into your Pay Balance as you work, helping you plan your finances better and avoid surprises.

Safety & Security

DailyPay prioritizes security by using 256-bit encryption. Its payment network and customer support are PCI-compliant and SOC II audited, ensuring your data and transactions are protected.

Why Choose DailyPay?

DailyPay is a benefit provided by employers, designed to enhance employee financial wellness and satisfaction. It is especially valuable for those living paycheck to paycheck or facing unexpected financial hurdles. By offering quick access to earned wages, DailyPay reduces financial stress and provides an alternative to costly payday loans or overdraft fees.

However, responsible use remains important. It’s a tool to help manage cash flow more effectively rather than an incentive for impulsive spending. Self-discipline ensures that the app serves as a complement to regular budgeting and financial planning.

Final Thoughts

Overall, DailyPay stands out as a secure, user-friendly solution for accessing your wages early. It acts like a financial friend, providing you with quick access to your earnings whenever necessary. While it doesn’t replace prudent financial planning, it’s an incredibly useful tool in your personal finance arsenal. If you’re looking to maintain greater control over your cash flow and avoid payday-related stress, the DailyPay app is definitely worth trying. Remember, using it responsibly will maximize its benefits and help improve your financial well-being.

Pros

- Immediate access to earned wages.

- Easy-to-use interface.

- Helps decrease financial stress.

- Secure transaction process.

- Works with major payroll systems.

Cons

- Requires employer involvement.

- Limited customer support options.

- May promote overspending.

- Charges fees for instant transfers.

- Not accessible in all regions.