Introducing the NetBenefits - Fidelity at Work App

Are you looking for a way to efficiently manage your workplace benefits and plan your financial future? The NetBenefits - Fidelity at Work app is designed to make managing your retirement savings, stock options, health insurance, HSA, and other benefits straightforward and accessible right from your mobile device. This innovative app serves as your personal financial assistant, offering a suite of features that empower you to stay on top of your financial wellness and benefits management with ease and confidence.

Comprehensive Benefits Management

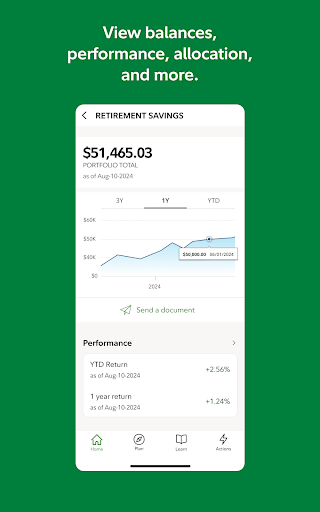

With NetBenefits - Fidelity at Work, you can effortlessly view and manage your accounts and investments. The app provides real-time account balances, recent contributions, investment performance, and track record of your savings. It’s your one-stop shop for checking retirement and benefits account details, including stock options and healthcare.

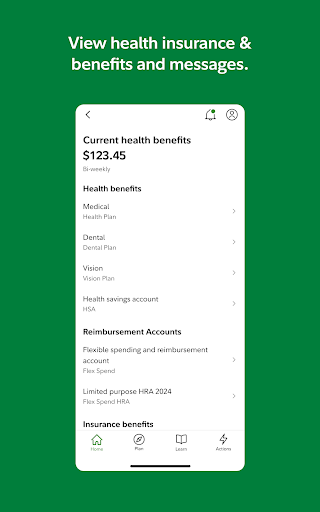

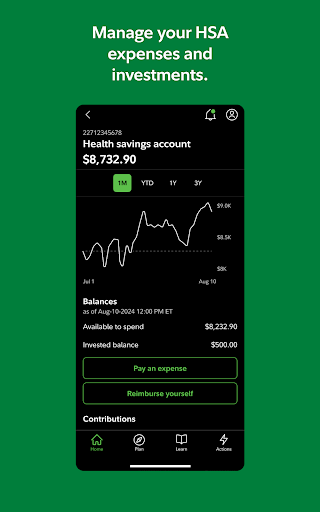

Need to stay informed about your HSA expenses, investments, or other accounts such as 529 plans or brokerage accounts? The app caters to all of those, letting you monitor and manage them seamlessly. Quickly find essential health insurance information, such as coverage details, provider contact numbers, and your group number—all within a few taps.

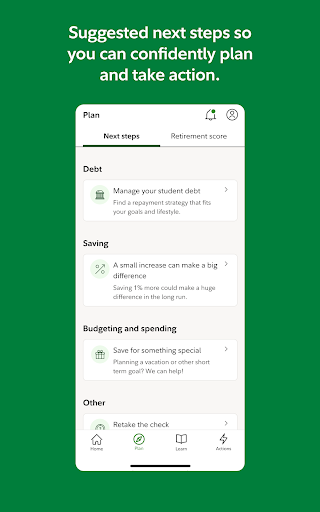

Personalized Planning and Financial Wellness

One of the standout features of the NetBenefits app is its ability to help you plan for the future. You can see estimated retirement needs, access your Fidelity Retirement Score SM, and get tailored financial wellness recommendations to guide your savings strategies. The app provides helpful tools to assist you in understanding your retirement readiness and what steps to take next, whether that involves adjusting contributions or exploring new investment options.

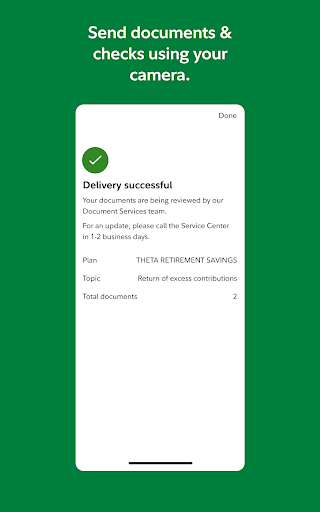

Additionally, you can change your contribution rates and investment allocations across your 401(k), 403(b), or HSA accounts directly within the app. It also enables you to submit documents or rollover checks by simply using your device’s camera, making document management hassle-free.

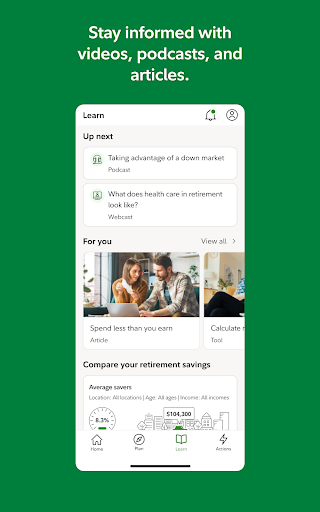

Engaging Educational Resources

Building financial confidence is easier with access to a wealth of educational content available through the NetBenefits app. Users can explore articles, videos, podcasts, and interactive tools designed to explain complex financial concepts in an accessible way. Whether you are new to investing or a seasoned investor, these resources keep you informed about the latest strategies and best practices, helping you make well-informed decisions about your financial future.

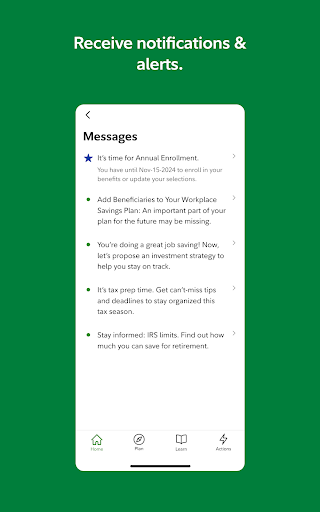

Stay Informed and Secure

The app ensures you stay updated with timely reminders for important account actions or deadlines, so nothing slips through the cracks. Your security is a top priority; Fidelity employs advanced security measures, including customer verification and biometrics, to protect your sensitive information. Rest assured, your personal and financial data are handled with the highest standards of security and privacy.

User Experience and Accessibility

The NetBenefits app is designed with user-friendliness in mind. Its clean and modern interface allows for smooth navigation, making it easy to find what you need quickly. It is compatible with devices running Android 10.0 or later, ensuring broad accessibility for users on various smartphones. While there might be occasional slight loading delays, the overall experience remains reliable and efficient.

Why Choose the NetBenefits - Fidelity at Work App?

This application is a valuable tool for anyone seeking to streamline the management of their workplace benefits and enhance their financial wellness. If you are already a Fidelity customer, integrating this app into your daily routine can offer a seamless way to stay on top of your retirement planning, benefits accounts, and investment strategies. New users will find it easy to set up and start benefiting from its comprehensive features, guiding you toward a more secure financial future. Embrace the convenience, security, and educational support it offers, and take control of your financial journey today.

Pros

- User-friendly interface for easy navigation.

- Comprehensive financial tools and resources.

- Secure multi-factor authentication.

- Real-time account updates and alerts.

- Personalized retirement planning assistance.

Cons

- Limited support for non-Fidelity accounts.

- Occasional app crashes reported by users.

- Complex features may overwhelm beginners.

- Requires frequent updates for optimal use.

- Some features need a stable internet connection.