Introduction to FloatMe: Budget & Cash Advance

Managing personal finances can often feel like a daunting task, especially when unexpected expenses arise or you need quick access to cash. Introducing FloatMe: Budget & Cash Advance, a versatile mobile application designed to help you navigate your financial needs with ease and confidence. Whether you’re seeking a short-term cash boost or tools to better understand your spending habits, FloatMe offers a comprehensive solution tailored for modern users seeking convenience and security.

What Is FloatMe?

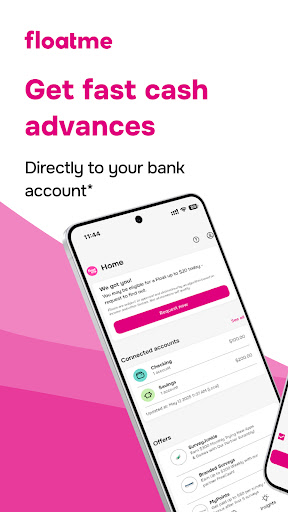

FloatMe is a cash app that enables users to access instant cash advances directly to their bank accounts with no credit checks, interest, or hidden tips. Its primary purpose is to provide financial flexibility—helping users cover unexpected expenses or manage their paycheck better. When you need quick cash advances, FloatMe allows you to borrow funds until your next paycheck arrives, making it an essential tool for those who want to avoid overdraft fees and maintain better control over their finances.

Designed for simplicity, FloatMe makes borrowing and repayment straightforward, with options to get advance credit swiftly or schedule future advances. From paying bills to managing daily expenses, this app acts as your personal financial assistant, providing support when you need it most.

Main Features of FloatMe

Cash Advances and Quick Loan Options

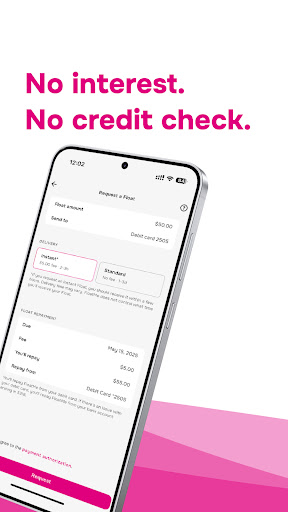

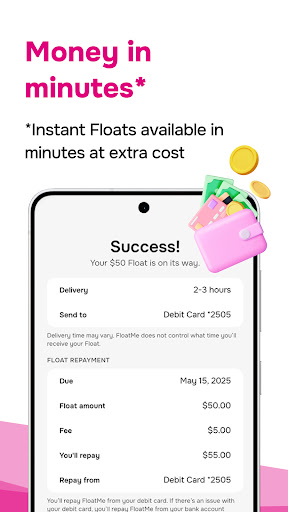

Need cash fast? FloatMe offers online cash advances that you can request directly through the app. Whether it's for paying bills, buying groceries, or filling up your gas tank, you can request a Float ranging from small amounts up to your approved limit. Many members can receive funds within minutes via instant float, with a small optional fee. This service provides a low-cost, interest-free alternative to traditional payday loans.

Membership is required to access the cash advance feature, with approval based on your bank account history. The app never charges interest or hidden fees, and you pay back when your paycheck arrives. Not everyone qualifies for the maximum amount initially, but the flexible system encourages responsible borrowing.

Banking and Security

FloatMe securely connects with your bank account through the Plaid Portal, ensuring bank-level security with 256-bit encryption. This seamless connection works with over 10,000 banking institutions across the U.S., although prepaid cards are not supported. The privacy of your financial data remains a top priority, giving you peace of mind when using the app.

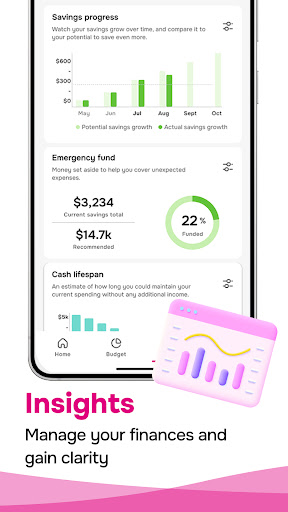

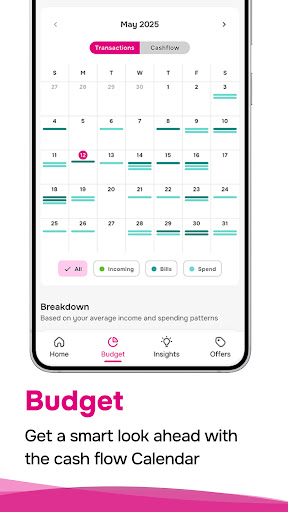

Budgeting Tools & Financial Insights

Beyond cash advances, FloatMe provides easy-to-use money management tools. The app’s cash flow calendar helps you visualize your recurring expenses and projected paydays. It calculates your likely available balance, offering a smart look ahead of your paycheck. Additionally, low balance alerts notify you when your bank balance drops below a threshold, helping you avoid overdraft fees and manage your money proactively.

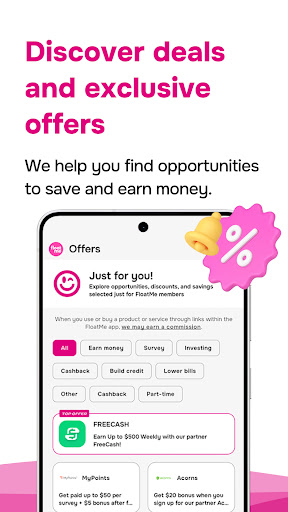

Marketplace Offers and Earning Opportunities

FloatMe encourages user engagement by presenting marketplace offers such as online surveys and deals from partner companies. This feature provides an easy way to earn extra money or access special financial products, adding value to your membership.

Membership and Costs

The app operates on a monthly subscription basis, costing $4.99/month. This fee grants access to all of FloatMe’s financial services, including cash advances and budgeting tools. Membership is automatically renewed each month but can be canceled at any time directly within the app or by contacting support.

Remember, requesting cash advances requires membership, and approval is not guaranteed. These advances are not classified as loans, have 0% interest, and do not involve any contractual obligation to repay within a specific period. Instant Float fees are optional and vary from $1 to $7 depending on the delivery method.

Usage Notes and Limitations

While FloatMe is an excellent short-term financial tool, it’s important to understand its limitations. The service is not available in Connecticut, District of Columbia, and Nevada. It is designed for temporary financial assistance, not as a long-term borrowing solution. Responsible usage ensures you avoid debt cycles and maintain good financial health.

Moreover, the app is proprietary and operates independently of other financial platforms like Credit Karma or Venmo. For safety and transparency, always review the privacy policy and terms & conditions.

Final Thoughts

FloatMe: Budget & Cash Advance stands out as a practical app for those seeking quick, interest-free cash advances combined with smart budgeting tools. Whether you’re trying to avoid overdraft fees, keep track of expenses, or earn some extra rewards, FloatMe offers a user-friendly, secure platform to help you stay financially afloat. Think of it as your financial floatie—a helpful safety device during choppy financial waters, but not a substitute for long-term financial planning. Give it a try, and see how it can support your financial well-being today!

Pros

- Easy access to cash advances.

- No credit check necessary.

- Helps prevent overdraft fees.

- User-friendly interface.

- Quick approval process.

Cons

- Limited to small advances.

- Monthly subscription fee applies.

- Requires linking a bank account.

- Not a long-term financial solution.

- Available only in the United States.