Introduction to MyBambu

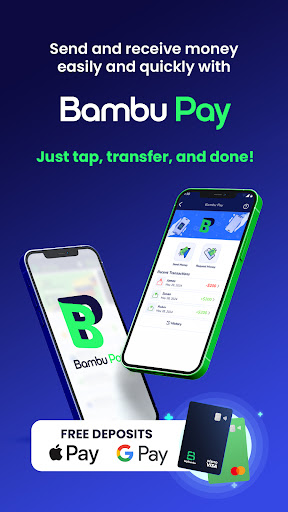

Imagine having a comprehensive financial companion right in your pocket—that's exactly what MyBambu offers. As a cutting-edge mobile banking app, MyBambu is designed to simplify your financial life, providing easy access to a range of banking services without the need for traditional brick-and-mortar branches. Whether you're managing daily expenses, sending international remittances, or seeking cashback rewards, MyBambu is here to serve your unique banking needs with convenience and security.

Key Features of MyBambu

Accessible Checking and Debit Cards

With MyBambu, opening a checking account is straightforward. You can open your account using your official ID from your home country, and immediately receive a digital Visa® debit card. A physical contactless card is also mailed to your U.S. address at no extra cost, allowing you to use it internationally and link to popular platforms like PayPal and Venmo.

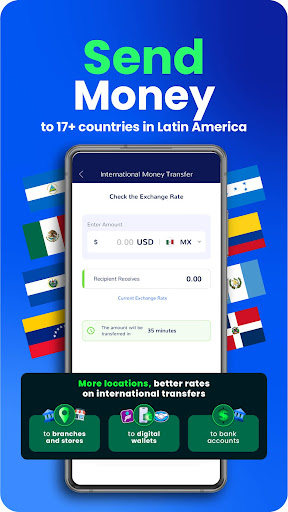

Fast and Secure Money Transfers

One of the standout features of MyBambu is its international money transfer capabilities. Send money securely to countries including Mexico, Colombia, Venezuela, Peru, Brazil, and many others, with your first four transfers being free. Funds typically arrive within 35 minutes, and transactions can be made with fees as low as $0.85, up to $1,000 per transfer. Additionally, now you can send money to Mercado Pago digital wallets, making cross-border remittance more accessible than ever.

Financial Products and Rewards

MyBambu helps you build your credit with deposits and pre-approvals for amounts ranging from $500 to $1,500. You can also enjoy cashback rewards at popular retailers such as Disney+, CVS, and Lyft, making everyday shopping more rewarding. The app's Spin & Win feature offers chances to win up to $1,000 or 50,000 tickets, adding an element of fun to your financial journey.

Additional Banking Services

The app supports mobile top-ups in the U.S. and LATAM, allows cash deposits at major retailers like CVS, Walmart, and Walgreens, and provides access to over 55,000 ATMs within the AllPoint network for free withdrawals. Users can also purchase and send gift cards to the U.S., Mexico, Cuba, and beyond, or use home deliveries for sending supplies to Cuba and Venezuela.

Security and Customer Support

Security is a top priority at MyBambu. The platform employs advanced encryption technology and biometric login options to protect your account. Funds are insured by the FDIC up to $250,000 through Community Federal Savings Bank, providing peace of mind for all users.

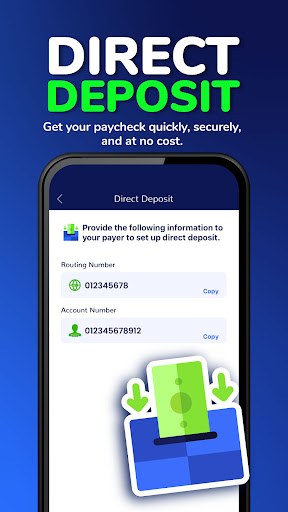

Need help? MyBambu offers customer support in both English and Spanish via phone and chat, ensuring users get timely assistance whenever needed. The platform's user-friendly interface makes managing your finances intuitive, whether you're checking your balance, setting up direct deposits, or monitoring transactions.

Benefits of Choosing MyBambu

Beyond its extensive features, MyBambu distinguishes itself with no minimum balance requirements or hidden fees, making it accessible to a broad audience. Its innovative approach promotes financial inclusion, particularly for communities that traditionally face barriers in accessing conventional banking services.

By combining seamless digital tools with robust security and rewarding incentives, MyBambu truly redefines what a mobile banking experience can be. Whether you're a seasoned digital banking user or just starting out, this app offers a smart, reliable way to manage and grow your finances efficiently.

Embrace the future of banking by downloading MyBambu today and discover the financial freedom you deserve!

Pros

- Intuitive interface for straightforward navigation.

- Secure transactions utilizing advanced encryption methods.

- Supports international money transfers.

- Lower transaction fees compared to traditional banks.

- Available in multiple languages.

Cons

- Limited options for customer support.

- Dependence on a stable internet connection.

- Not accessible in all countries.

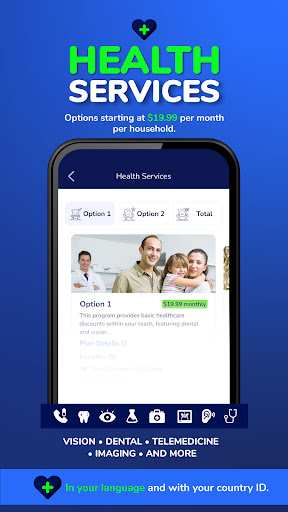

- Certain features require a paid premium subscription.

- Reports of occasional app crashes.