Introduction to EveryDollar: Budget Planning App

Managing personal finances can be a daunting task, especially with numerous expenses and unpredictable changes. EveryDollar emerges as a powerful yet user-friendly personal budget planner and expense tracker designed to simplify your financial journey. This comprehensive app helps users create custom budgets, track expenses, plan spending, and set financial goals to improve overall money management. Whether you are a beginner or an experienced financial planner, EveryDollar provides tools that foster responsible spending and saving habits. Its intuitive interface and versatile features make it a popular choice for managing monthly budgets, debts, savings, and more. Get started today with this free budget tracker and take control of your financial future effortlessly.

Key Features of EveryDollar

Finance & Budget Tracker

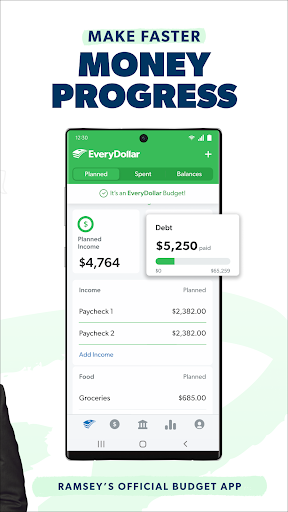

With EveryDollar, tracking money and managing budgets is effortless. You can create a budget in minutes and adjust it anytime, anywhere—whether on your smartphone or computer. The app allows you to track your spending quickly and accurately, giving you a clear overview of your remaining budget at a glance. This feature is ideal for any type of budgeter, from personal finance enthusiasts to families managing household expenses. You can set up a personal budget, home budget, family budget, or even a student budget, adapting your plan as your financial situation evolves.

All-In-One Money Management

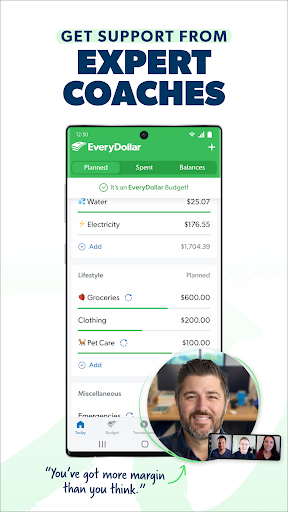

EveryDollar consolidates your finances by integrating multiple accounts into one centralized platform. Manage your checking and savings accounts, track bills, and monitor expenses seamlessly. The app aids in paying off debt and saving for future goals like retirement. Its simple interface makes it easy for beginners to get started, while providing enough depth for experienced users to formulate detailed financial plans. You can monitor your income and expenses, ensuring a comprehensive overview of your financial health.

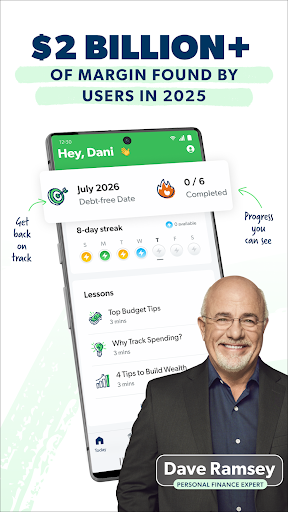

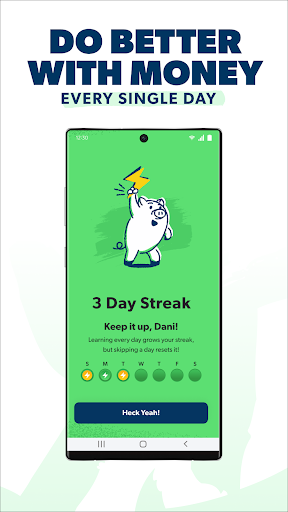

Financial Education & Tips

Beyond budgeting, EveryDollar includes a virtual financial coach that offers expert advice on saving money, managing transportation costs, and creating realistic budgets. These helpful tips empower users to improve their financial habits, making budgeting more effective and less stressful. Whether you want to learn how to track transactions or how to allocate funds for specific goals, the app provides educational content that guides you step-by-step towards better money management.

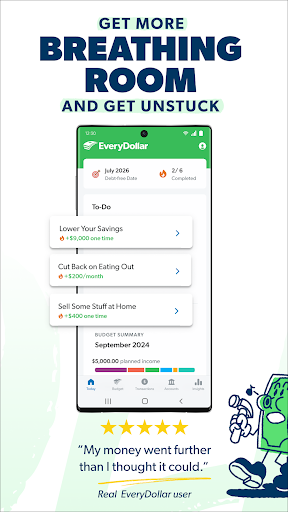

Money Saving & Spending Management

Budgeters using EveryDollar tend to save more—they report saving an average of $395 extra each month and cutting expenses by about 9% within the first month. The spending tracker feature helps you manage money guilt-free by providing an instant view of where your money goes. Track your expenses throughout the month, manage subscriptions, and eliminate unnecessary costs with easy automation—all linked directly to your bank account for quick updates. This transparency allows you to identify hidden expenses and optimize your spending habits effectively.

Expense & Income Tracking

The app makes managing expenses straightforward—manage subscriptions, categorize spending, and even track vacation or travel expenses. The expenses tracker helps uncover hidden costs and offers suggestions to cut unnecessary outlays. Additionally, the income tracker and bill app let you organize bills, monitor income, and compare earnings against expenses. This comprehensive approach keeps your finances organized and enables better allocation of resources.

Goals and Progress Monitoring

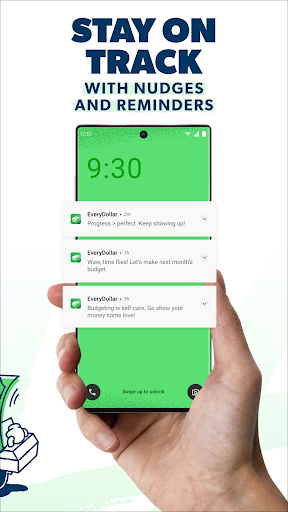

EveryDollar allows you to create specific financial goals—be it saving for a wedding, vacation, or down payment. You can set a monthly budget and allocate funds for big purchases, savings, and debt payoffs. The app supports goal tracking through detailed financial roadmaps, letting you see when you’ll achieve your targets. Features like net worth tracking, bill reminders, and paycheck planning help you stay on course and motivated, ensuring consistent progress toward your financial aspirations.

Why Choose EveryDollar?

This free budgeting app is suitable for all users—from those newly managing finances to seasoned planners. Its zero-based budgeting approach ensures that every dollar has a purpose, reducing waste and promoting mindful spending. The ability to connect financial accounts for automatic transaction imports simplifies the process further, saving time and reducing manual entry errors. Plus, with options to export data, generate expense reports, and receive personalized recommendations, EveryDollar offers a truly tailored budgeting experience. Whether you want to manage everyday expenses, plan for upcoming big goals, or eliminate debt faster, this app provides the tools and insights needed to make smarter financial choices. Take advantage of its easy setup, helpful resources, and real-time tracking to turn your financial goals into achievable milestones.

Conclusion

In summary, EveryDollar is more than just a personal budget app—it’s a full-featured financial companion designed to empower users with smarter money management skills. Its focus on simplicity, accountability, and goal achievement has made it a favorite among individuals and families alike. If you're looking for an effective way to organize your finances, track expenses accurately, cut unnecessary costs, and reach your financial goals with confidence, EveryDollar proves to be an excellent choice. Start your journey towards financial freedom today with this innovative budgeting solution.

Pros

- User-friendly interface for easy navigation.

- Customizable budget categories.

- Synchronizes with bank accounts for real-time updates.

- Provides financial insights and reports.

- Free version includes core features.

Cons

- Limited features in the free version.

- Lacks bill tracking functionality.

- Requires subscription for complete access.

- Manual input needed for cash transactions.

- Does not support investment tracking.