Thrift Savings Plan App: Your Ultimate Retirement Management Tool

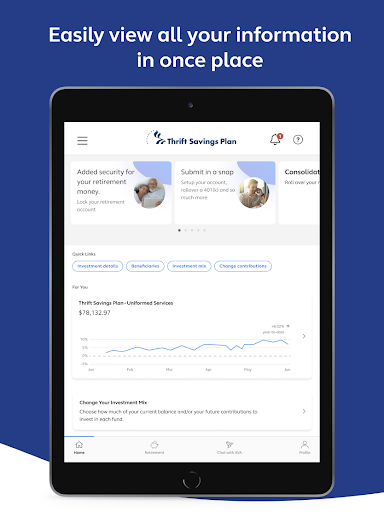

The Thrift Savings Plan (TSP) mobile application is a comprehensive tool designed exclusively for all TSP participants. Available across devices, this official TSP Mobile app empowers federal employees and members of the uniformed services to effortlessly manage, review, and optimize their retirement savings anytime and anywhere. Whether you're at home, at work, or on the go, this app ensures your financial future is always within reach.

Key Features of the TSP Mobile App

The TSP Mobile app offers a suite of powerful features tailored to streamline your federal retirement benefits management:

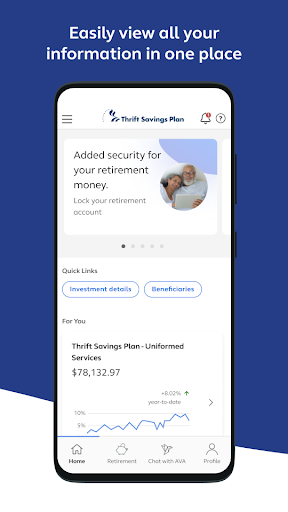

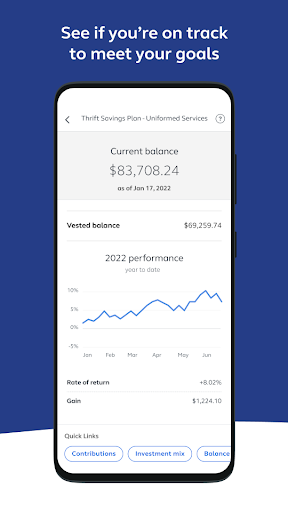

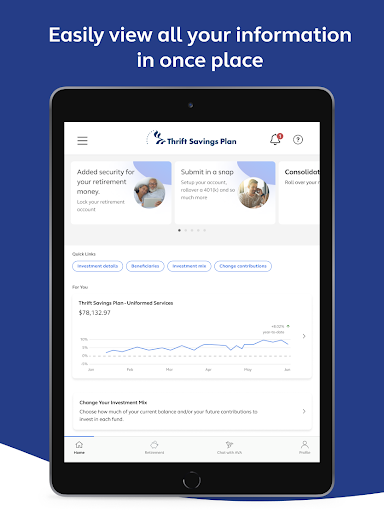

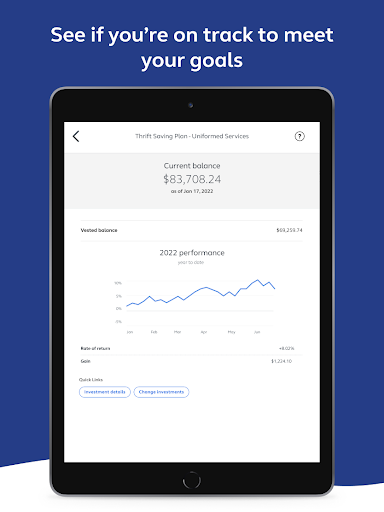

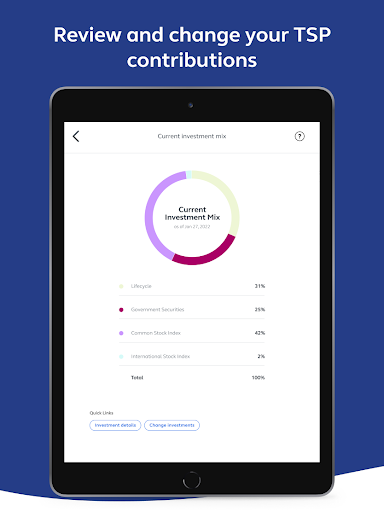

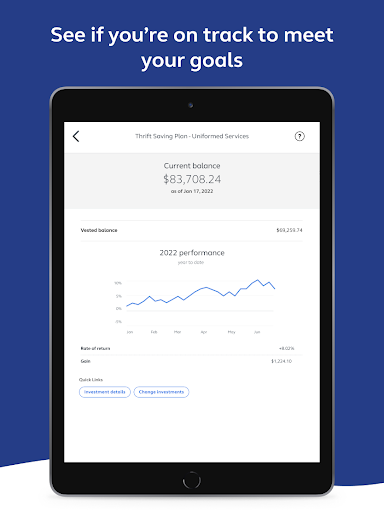

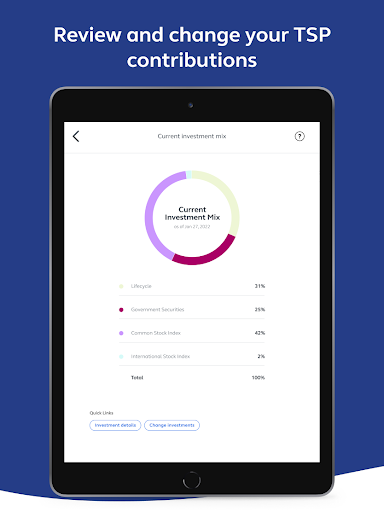

- Account Overview: Easily review your TSP account summary to keep track of your balances, contributions, and investment allocations.

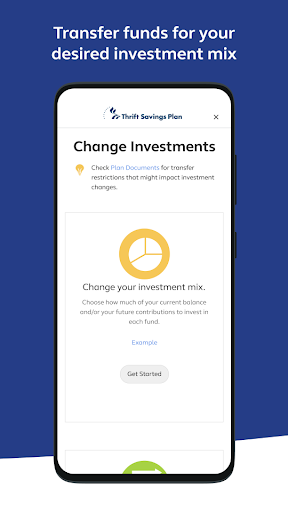

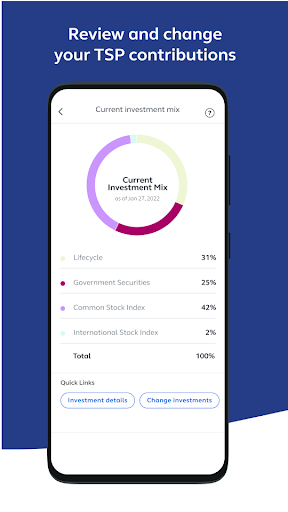

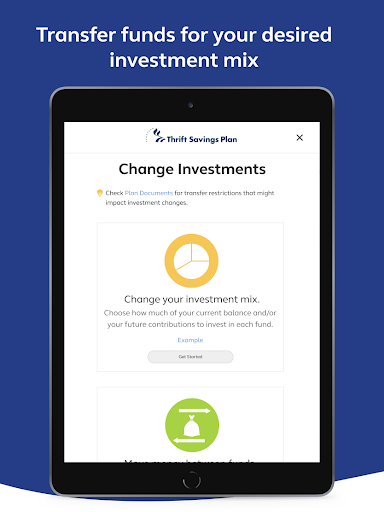

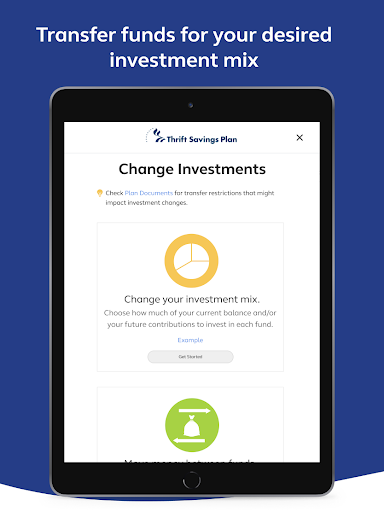

- Investment Management: Check your investment performance and adjust your investment mix as your financial goals evolve—all from your device.

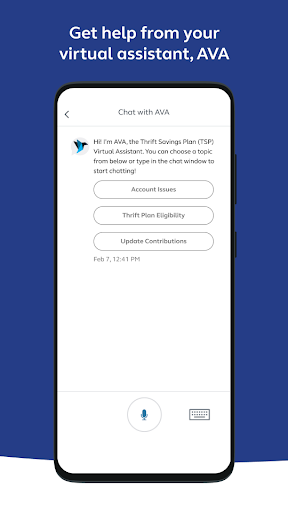

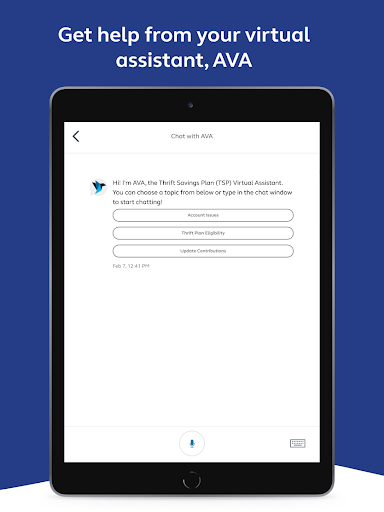

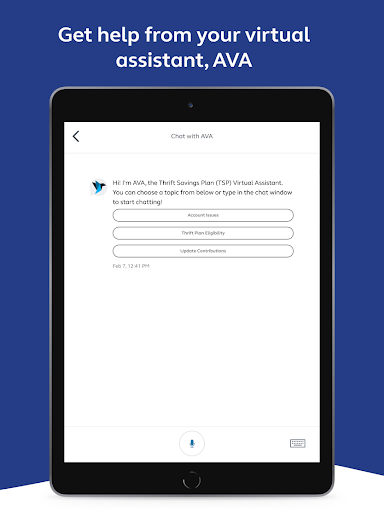

- Digital Tools: Access helpful resources like the TSP virtual assistant, AVA, which provides convenient navigation and answers to your questions.

- Secure Document Handling: Sign paperwork electronically, submit forms, and upload important documents securely within the app.

- Mobile Check Deposit: Facilitate rollovers and other transactions with quick and secure mobile check deposit functionalities.

- Mutual Fund Window: Enroll in and manage your mutual fund window account seamlessly.

Accessibility and Security

To access certain features, a tsp.gov login is required, ensuring your account remains protected. The app incorporates cutting-edge security measures, including biometric logins and two-factor authentication, so you can manage your retirement savings with confidence. Your personal and financial data are safeguarded through these layered protections, making security a top priority.

Personal Experience and Ease of Use

When I first discovered the Thrift Savings Plan app, I was genuinely intrigued by its promise to simplify federal retirement management. As a user, I found its interface exceptionally intuitive—regardless of tech proficiency, navigating through features is straightforward. It’s like having a dedicated financial advisor at your fingertips, helping you make informed decisions.

Managing Contributions & Investments On-The-Go

One of the standout benefits is the ability to manage your contributions and investment allocations on-the-fly. Want to increase your monthly contribution? Easily do so within the app. Looking to reallocate your investments? It's simple and quick. You can even request loans or make withdrawals, giving you full control over your retirement planning without the need for a visit to the office or submitting paper forms.

Educational Resources & User Support

Beyond transactional features, the TSP app acts as a mini-educational hub—offering webinars, articles, and tips to help you make smarter decisions about your savings. This knowledge-sharing capability makes planning your retirement more accessible, especially for those new to investing or unfamiliar with federal benefit programs.

Why You Should Consider the TSP Mobile App

Overall, the Thrift Savings Plan mobile app is a robust, user-friendly, and secure platform that transforms how federal employees and service members manage their retirement savings. Its comprehensive features, ease of use, and commitment to security make it an indispensable tool for anyone looking to stay on top of their financial future. Whether you’re a seasoned federal worker or just starting your savings journey, this app can be your effective partner in achieving long-term financial stability.

Pros

- Affordable investment options

- Tax benefits available

- Wide variety of funds

- Automatically contributed through payroll

- Securely backed by the government

Cons

- Limited choice of investment options

- Complicated withdrawal procedures

- Does not include individual stocks

- No options for Roth conversions

- Limited customer support hours