Introducing Cash App: Your All-in-One Digital Wallet and Financial Companion

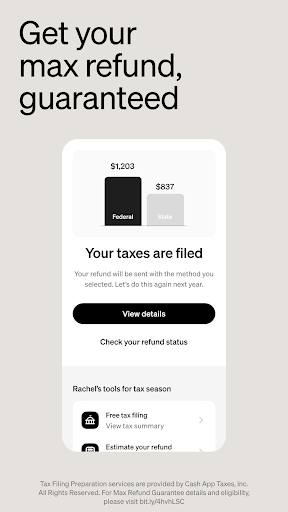

Cash App is a versatile and user-friendly platform designed to make managing your finances effortless. Whether you want to send money to friends, invest in stocks and cryptocurrencies, or access exclusive discounts, Cash App provides a seamless experience. Its innovative features combine banking, investing, and shopping in one secure app, making it an essential tool for anyone looking to simplify their financial life.

Key Features of Cash App

Instant Peer-to-Peer Payments

With Cash App, transferring money to friends or family is quick and free. You can send and receive funds instantly using a phone number, email, or a unique $Cashtag. The platform also supports sending bitcoin, allowing you to transact globally without additional fees through the Lightning Network. Rest assured, advanced security measures keep your transactions safe, making peer-to-peer payments as effortless as a tap.

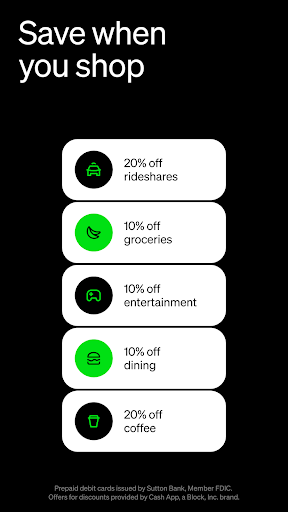

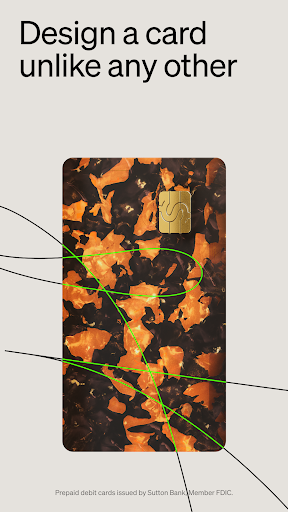

Customizable Debit Card

Upgrade your digital wallet with a personalized Cash App Card, a prepaid debit card accessible anywhere Visa is accepted. The virtual card can be customized to match your style, and real-time transaction alerts help you monitor your spending. Plus, enjoy exclusive discounts instantly with every purchase, and benefit from waived ATM fees when you deposit at least $300 each month.

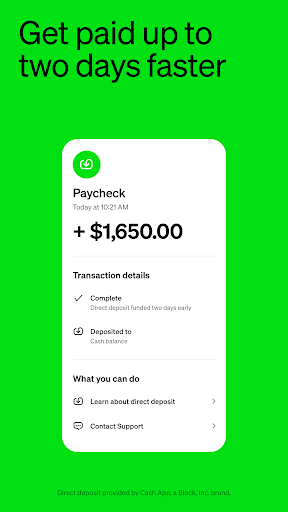

Simplified Banking Services

Set up direct deposits to receive your paycheck up to two days earlier. Cash App eliminates traditional banking hurdles by offering no monthly balance minimums or activity requirements. Additionally, users who deposit $300 or more monthly qualify for waived ATM withdrawal fees and up to $50 in overdraft protection. This makes Cash App a convenient and reliable alternative to traditional banking.

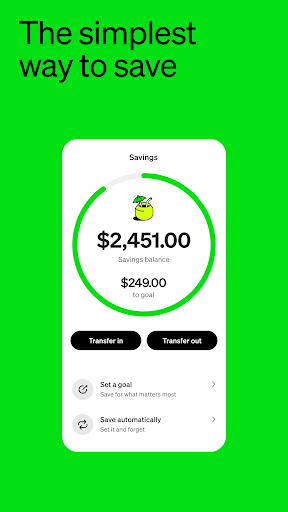

Saving & Exclusive Discounts

Grow your savings effortlessly by unlocking interest with your Cash App account—up to 1.5% APY. When you deposit $300 or more monthly via direct deposit, this rate increases to 4.5%. The app also enables round-up savings, where your spare change is invested automatically. Plus, enjoy special discounts on leading brands and popular events right through the app, helping you save money on everyday expenses.

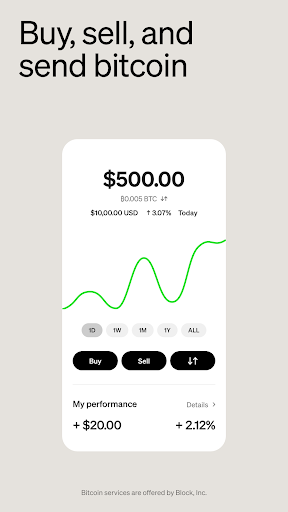

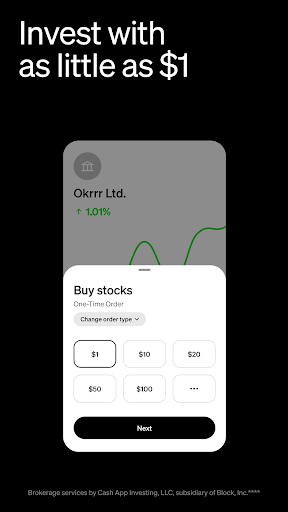

Investments in Stocks & Bitcoin

Cash App makes investing accessible for everyone aged 13 and up, with parental supervision if necessary. You can buy stocks and ETFs with no commission fees, and even use auto-invest features. For cryptocurrency enthusiasts, the app allows you to buy, sell, and receive bitcoin—even setting up direct deposits in bitcoin. Access the latest market data, analyze earnings, and stay informed with real-time updates to make smarter investment decisions.

Why Choose Cash App?

In today’s fast-paced world, Cash App offers a faster, simpler way to bank. Its intuitive interface allows users to handle multiple financial tasks within a single platform—whether you're splitting dinner bills, saving for a big purchase, or investing in the stock market. The app’s security features, including encryption and fraud monitoring, ensure your funds are protected. Plus, with features like cashback discounts and investing without commissions, Cash App helps you make the most of your money every day.

Final Thoughts

Whether you’re looking to simplify everyday spending, grow your savings, or explore investing in stocks and bitcoin, Cash App is an all-in-one financial tool designed for ease and security. Its growing popularity is a testament to its effectiveness in providing accessible financial services for users aged 13 and up. Download Cash App today and take control of your financial future—manage, invest, and save with confidence, all from the convenience of your mobile device.

Pros

- User-friendly interface

- Instant money transfers

- Free ATM withdrawals

- Cashback rewards

- Bitcoin support

Cons

- Limited international use

- No credit card option

- Customer service issues

- Transaction limits

- Security concerns