Introducing СASHFLOW: The Fun and Engaging Financial Literacy App

Are you interested in mastering the art of managing your finances while enjoying a gaming experience? Look no further than СASHFLOW, an innovative app designed to turn financial education into an interactive and entertaining game. Combining elements of strategy, real-world scenarios, and social engagement, СASHFLOW makes learning about money management both accessible and enjoyable for users of all levels.

Getting Started with СASHFLOW

When you first open СASHFLOW, you are greeted with a user-friendly interface filled with vibrant colors and captivating graphics that make the world of finance feel less intimidating. The setup process is simple—just create your profile, select your language preference from options such as English, Spanish, French, Portuguese (Europe), Turkish, or Hindi, and you’re ready to embark on your financial journey. No complicated tutorials are necessary; the app is designed to get you engaged right away.

Engaging Gameplay and Educational Features

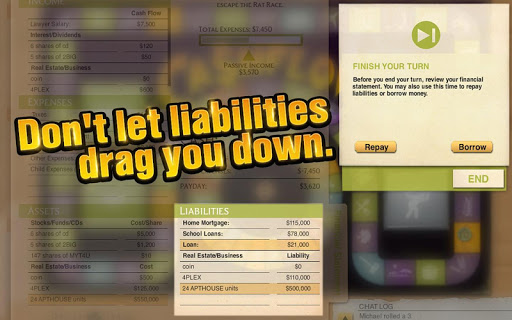

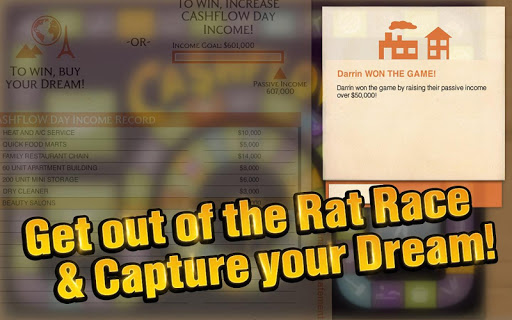

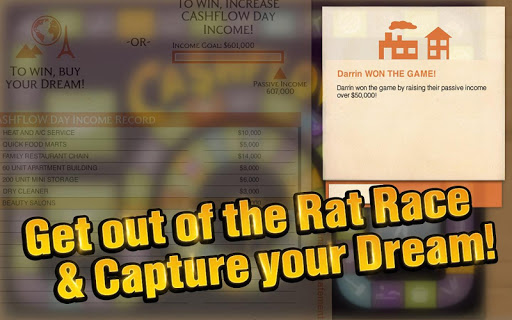

At its core, СASHFLOW is a strategic financial simulation game inspired by the famous board game by Robert Kiyosaki. Your primary goal is to escape the Rat Race and reach financial independence by investing wisely in real estate, stocks, and business ventures. The game combines realistic financial scenarios with gameplay mechanics that keep your interest high.

One of the standout features of СASHFLOW is its emphasis on financial literacy. The app doesn’t just present scenarios; it offers helpful tips, explanations, and guidance for every decision you make. Whether you're buying stocks, investing in property, or managing expenses, the in-game tutorials help you understand the consequences of each move, turning complex topics into digestible lessons.

Why СASHFLOW Is a Must-Have for Personal Finance Enthusiasts

If traditional finance education feels dry or overwhelming, СASHFLOW provides a refreshing alternative. Its game-based approach transforms learning about personal finance into an engaging experience. You can challenge yourself to beat your own high scores or compete with friends, adding a competitive edge that heightens the motivation to improve your strategies.

Additionally, the app fosters a sense of community by allowing you to connect with friends, share strategies, and learn from others’ successes and mistakes. This social aspect makes the entire financial journey more interactive and fun, creating a supportive environment for developing real-world financial skills.

Benefits and Final Thoughts

Overall, СASHFLOW is an excellent tool for anyone eager to enhance their financial literacy while having fun. It’s suitable for beginners seeking to understand the basics of money management and for seasoned investors aiming to refine their investment techniques. The app’s combination of playful gameplay and practical financial lessons makes it a unique platform for building smarter money habits.

In the end, СASHFLOW is more than just a game—it's a stepping stone toward financial independence. By simulating real-world financial decisions in a safe environment, the app empowers users to make smarter money choices in their personal lives. So, if you're ready to take control of your finances and enjoy the process, give СASHFLOW a try. Your future financially savvy self will thank you!

Pros

- Intuitive interface facilitates easy navigation.

- Provides a complete overview of financial information.

- Allows customization of categories for tracking expenses.

- Supports synchronization across multiple devices.

- Offers educational resources to enhance financial literacy.

Cons

- Free version has limited features.

- Reports of occasional synchronization problems.

- Does not support integration with certain banks.

- Lacks a manual entry option for transactions.

- Customer support response times can be slow.